- Canada

- /

- Metals and Mining

- /

- TSX:ARA

A Look at Aclara Resources (TSX:ARA) Valuation Following Major Carina Resource Upgrade

Reviewed by Kshitija Bhandaru

Aclara Resources (TSX:ARA) just announced a major upgrade to the mineral resource estimate for its Carina Project in Brazil. With a significant portion of resources moving from inferred to indicated status, this development is supported by new drilling and geological data.

See our latest analysis for Aclara Resources.

Momentum has been building fast for Aclara Resources, with the 1-day share price return jumping 14% and the 30-day share price return reaching an eye-catching 108%. Investors have clearly responded to this resource upgrade and growing confidence in the Carina Project. Looking at the bigger picture, the stock’s 1-year total shareholder return sits just under 600%, highlighting a dramatic turnaround that puts Aclara in a much brighter spotlight.

If news like this has you on the lookout for companies gaining steam, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares soaring, the big question now is whether Aclara Resources is still undervalued after this run, or if the market has already factored in all future gains. Could this be a new buying opportunity, or is caution warranted?

Price-to-Book of 3.5x: Is it justified?

Compared to the last close price of CA$3.42, Aclara Resources trades at a price-to-book ratio of 3.5x. This makes it appear undervalued relative to peer averages but more expensive than its broader industry group.

The price-to-book multiple measures how much investors are willing to pay for each dollar of net assets on the balance sheet. This ratio is a popular metric for mining and exploration companies, where tangible assets often play a key role in valuing early-stage businesses without meaningful revenue or profits.

Aclara’s price-to-book ratio sits far below the peer average of 8.7x. This suggests the market might be discounting its assets less aggressively than similar companies. However, it does trade higher than the Canadian Metals and Mining industry average of 2.7x, which could reflect investor optimism about its project pipeline or potential future growth catalysts.

Without a fair ratio to anchor to, it is difficult to know if this valuation is likely to be sustainable, or if it could revert closer to industry levels as sentiment or circumstances change.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.5x (UNDERVALUED)

However, significant risks remain, including the lack of current revenues and the possibility that analyst price targets signal limited further upside ahead.

Find out about the key risks to this Aclara Resources narrative.

Another View: DCF Model Paints a Different Picture

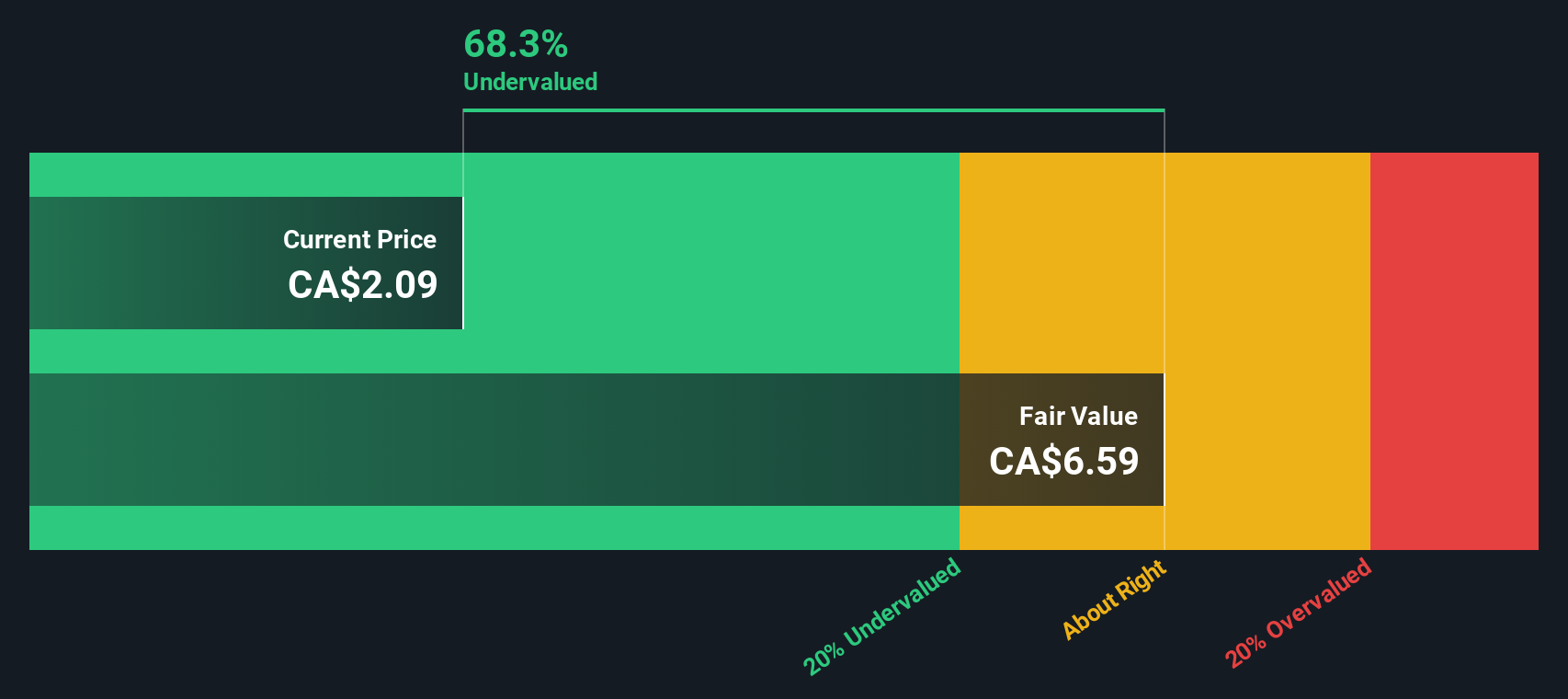

While the price-to-book ratio makes Aclara Resources appear undervalued compared to peers, our SWS DCF model presents a notably different perspective. Based on discounted cash flow analysis, the current share price is trading about 81% below its estimated fair value. This suggests deep undervaluation by this method. Could the crowd be missing something, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aclara Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aclara Resources Narrative

If these results don’t quite match your outlook, or you want to dig into the data and shape your own story, you can dive in and Do it your way.

A great starting point for your Aclara Resources research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next smart investing move with confidence. The Simply Wall Street Screener puts unique opportunities at your fingertips, so you never miss out on market-shaping trends.

- Catch the wave of next-generation healthcare innovation by jumping into these 33 healthcare AI stocks that are transforming the future of medicine.

- Unlock potential in high-yielding stocks and enjoy reliable income streams by checking out these 19 dividend stocks with yields > 3% with yields above 3%.

- Fuel your portfolio with emerging tech by tracking these 24 AI penny stocks driving artificial intelligence breakthroughs across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARA

Aclara Resources

A mining company, engages in the exploration and development of rare-earth mineral resources in Chile, Brazil and Peru.

Medium-low risk and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026