- Canada

- /

- Metals and Mining

- /

- TSX:ALS

Altius Minerals (TSX:ALS) Valuation in Focus Following Leadership Reshuffle and CEO Contract Extension

Reviewed by Kshitija Bhandaru

Altius Minerals (TSX:ALS) just announced a wave of executive and board shifts, including a new CFO, changes to several key leadership roles, and a five-year contract extension for its CEO. Investors are watching for signals about the future direction and company strategy.

See our latest analysis for Altius Minerals.

Following the leadership shake-up, Altius Minerals’ share price has seen only modest shifts. The company’s one-year total shareholder return is up 0.35 percent, reflecting steady performance despite little recent momentum. Longer-term returns suggest the company has delivered consistent value to patient investors.

If company transitions like this have you thinking bigger, why not broaden your horizon and check out fast growing stocks with high insider ownership?

With leadership changes underway and shares drifting only modestly higher this year, the real question for investors is whether Altius Minerals is trading at a bargain or if the market has already factored in expectations of future growth.

Price-to-Earnings of 15.8x: Is it justified?

Altius Minerals is trading at a price-to-earnings (P/E) ratio of 15.8x, notably below both its peer group and the broader Canadian Metals and Mining industry averages. At last close, shares stood at CA$33.86, suggesting the market is valuing the company conservatively versus competitors.

The price-to-earnings multiple tells investors how much they are paying per dollar of current earnings, and it is especially relevant in capital-heavy, cyclical sectors like mining. A lower P/E here can indicate skepticism about future profit stability or valuation upside.

This discount is not minor: the Canadian Metals and Mining industry trades around 23.1x earnings, while Altius' peer group sits at 19.2x. In both cases, Altius looks inexpensive. However, compared to its estimated fair price-to-earnings ratio of 5.7x, the current multiple is much higher. This indicates that if the market moves towards ‘fair’ value, there could be downside.

Explore the SWS fair ratio for Altius Minerals

Result: Price-to-Earnings of 15.8x (ABOUT RIGHT)

However, investors should note that slowing net income growth and a potential price target discount could shift sentiment if performance weakens further.

Find out about the key risks to this Altius Minerals narrative.

Another View: What Does the DCF Model Say?

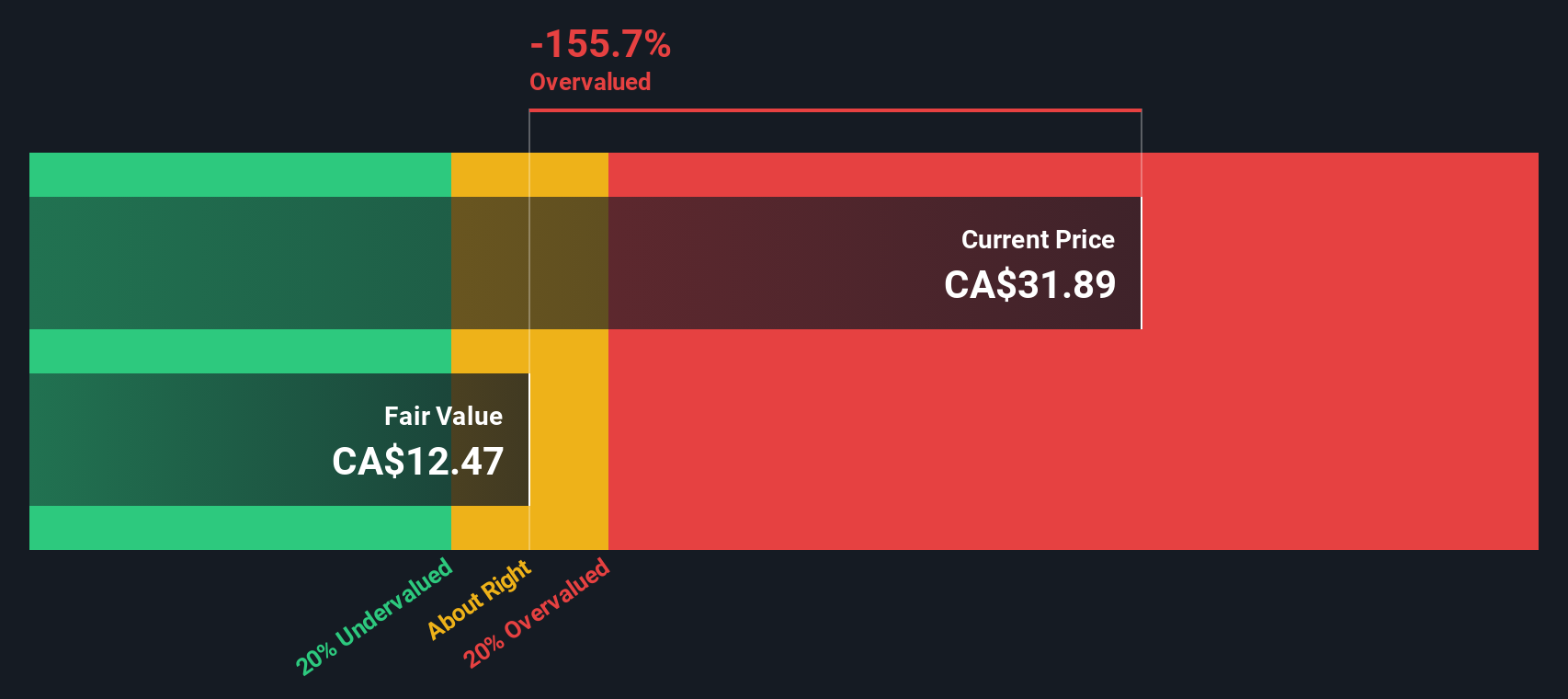

Looking at Altius Minerals through the lens of our SWS DCF model, the outlook is strikingly different. The model estimates a fair value of CA$12.27 per share, which is well below the current price of CA$33.86. This suggests shares may be overvalued using this approach and raises the question: are market expectations already running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Altius Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Altius Minerals Narrative

If you'd like to dig into the details and shape your own perspective, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Altius Minerals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let potential opportunities pass you by. Level up your strategy with new stock ideas tailored to different growth drivers, industries, and trends using our screeners below.

- Boost your income by targeting companies with strong yields among these 19 dividend stocks with yields > 3% for reliable dividend potential and historic payout growth.

- Catalyze your portfolio with frontline innovators in artificial intelligence through these 24 AI penny stocks, where market-changing technology and smart automation create fresh upside.

- Capitalize on tomorrow’s breakthroughs from the rapidly advancing world of quantum computing by accessing these 26 quantum computing stocks, showcasing high-conviction industry leaders and hidden gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALS

Altius Minerals

Engages in the mineral and renewable royalties and project generation businesses in Canada, Brazil, and the United States.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives