Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Altius Minerals Corporation (TSE:ALS) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Altius Minerals

What Is Altius Minerals's Net Debt?

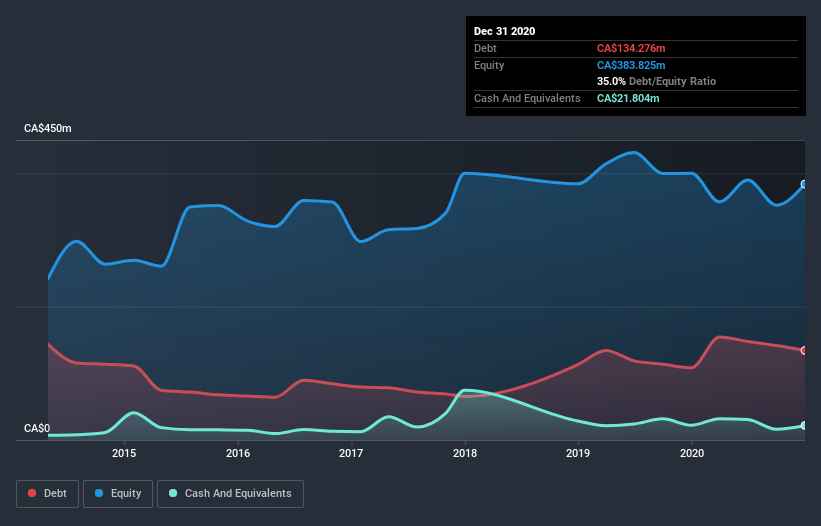

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Altius Minerals had CA$134.3m of debt, an increase on CA$108.4m, over one year. On the flip side, it has CA$21.8m in cash leading to net debt of about CA$112.5m.

A Look At Altius Minerals' Liabilities

The latest balance sheet data shows that Altius Minerals had liabilities of CA$31.5m due within a year, and liabilities of CA$174.3m falling due after that. Offsetting this, it had CA$21.8m in cash and CA$13.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$170.1m.

This deficit isn't so bad because Altius Minerals is worth CA$656.6m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Altius Minerals has a debt to EBITDA ratio of 2.7 and its EBIT covered its interest expense 2.9 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. On the other hand, Altius Minerals grew its EBIT by 24% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Altius Minerals can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Altius Minerals generated free cash flow amounting to a very robust 87% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Happily, Altius Minerals's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But the stark truth is that we are concerned by its interest cover. When we consider the range of factors above, it looks like Altius Minerals is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Altius Minerals insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Altius Minerals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Altius Minerals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ALS

Altius Minerals

Operates as a diversified mining royalty and streaming company in Canada, the United States, and Brazil.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives