Altius Minerals Corporation's (TSE:ALS) dividend will be increasing to CA$0.07 on 15th of September. Even though the dividend went up, the yield is still quite low at only 1.2%.

See our latest analysis for Altius Minerals

Altius Minerals Might Find It Hard To Continue The Dividend

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Even though Altius Minerals isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Assuming the trend of the last few years continues, EPS will grow by 41.2% over the next 12 months. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. However, the positive cash flow ratio gives us some comfort about the sustainability of the dividend.

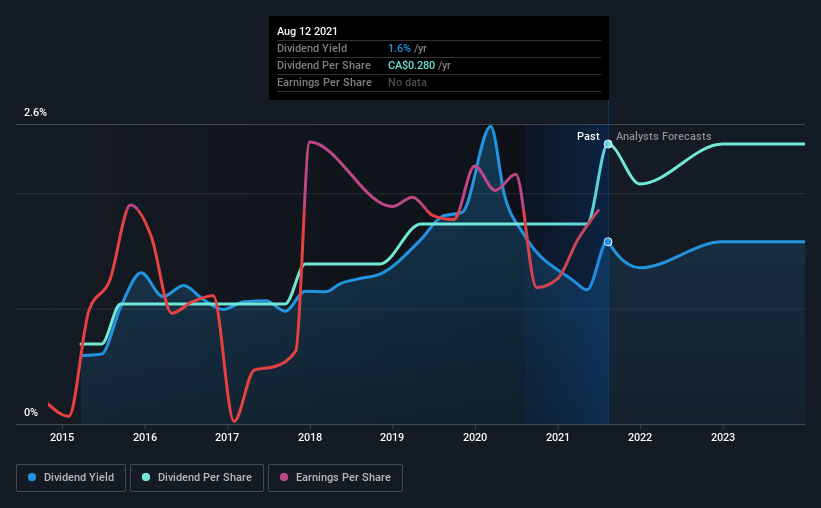

Altius Minerals Is Still Building Its Track Record

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. The first annual payment during the last 6 years was CA$0.08 in 2015, and the most recent fiscal year payment was CA$0.28. This means that it has been growing its distributions at 23% per annum over that time. Altius Minerals has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Altius Minerals has impressed us by growing EPS at 41% per year over the past five years. Even though the company is not profitable, it is growing at a solid clip. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Altius Minerals will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Altius Minerals that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ALS

Altius Minerals

Operates as a diversified mining royalty and streaming company in Canada, the United States, and Brazil.

Proven track record with adequate balance sheet and pays a dividend.