- Canada

- /

- Metals and Mining

- /

- TSX:AGI

Is Now the Right Moment for Alamos Gold After Shares Jumped 87% This Year?

Reviewed by Bailey Pemberton

- Thinking about Alamos Gold and whether it could be undervalued? You are not alone; plenty of investors want to know if now is the right moment to take a closer look at this fast-moving gold stock.

- Shares have surged, jumping 13.7% in the past week and rising 86.6% year-to-date, with a 100.1% gain over the past twelve months.

- Much of this buzz stems from recent announcements about new mine developments and record gold production, sparking excitement about operational growth and future cash flow. Investors have also noted positive changes in global gold prices, which often play a major role in sentiment shifts for gold producers like Alamos Gold.

- If you are wondering whether this momentum means the stock is already priced for perfection, Alamos Gold scores a 4 out of 6 on valuation checks for being potentially undervalued. We will dig into those valuation methods in a moment but stick around; there is a simple yet powerful approach to valuation that might reshape how you see Alamos Gold by the end of this article.

Approach 1: Alamos Gold Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This method helps investors see what a business could be worth today, based on expected performance in the years ahead.

For Alamos Gold, the latest reported Free Cash Flow (FCF) is $223 million. Analysts provide FCF growth estimates for several years, with projections reaching $2.19 billion by the end of 2029. The longer-term growth beyond analyst forecasts is extrapolated to 2035, where discounted projections remain strong.

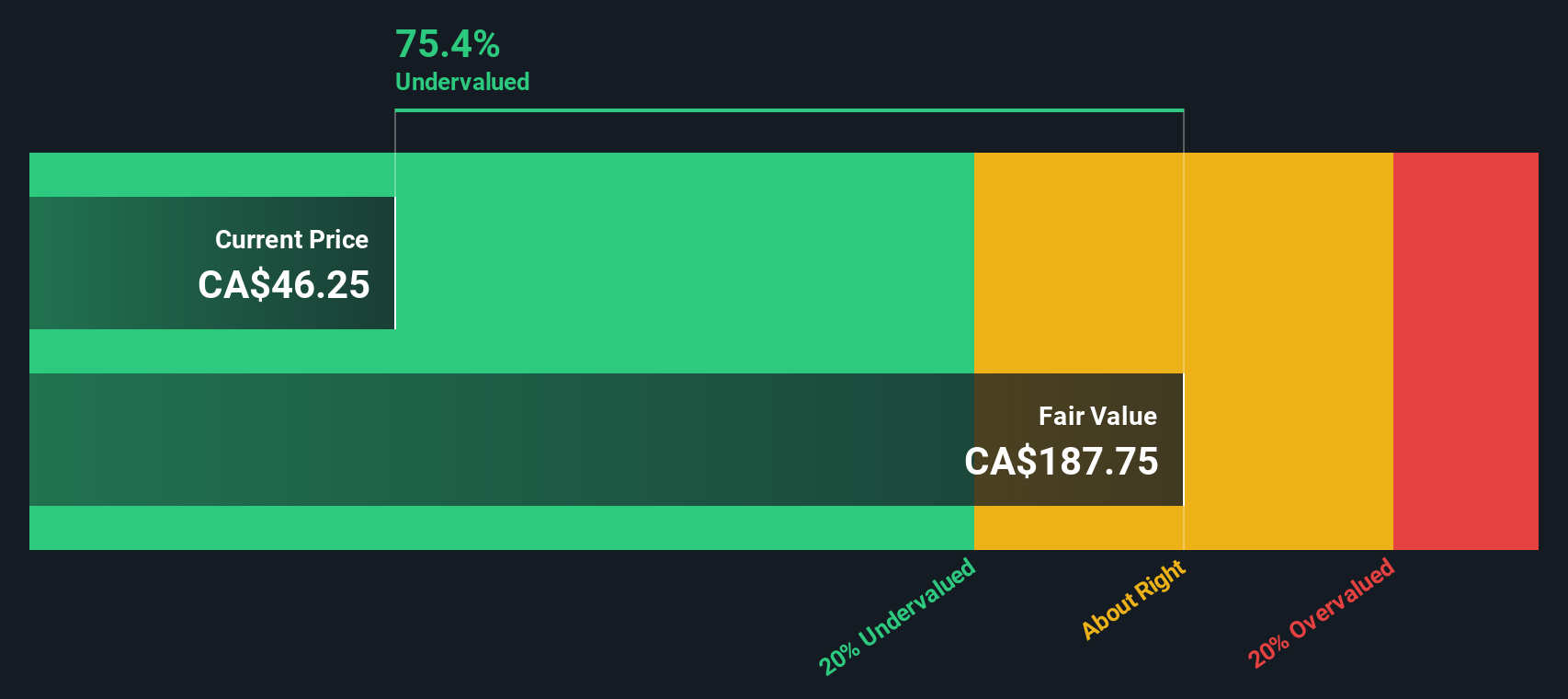

When running these figures through the DCF model (specifically, the 2 Stage Free Cash Flow to Equity method), the estimated intrinsic value per share is $216.22. Compared to the current share price, this calculation suggests that Alamos Gold is trading at a 76.1% discount to its fair value.

This DCF analysis indicates that, based on projected cash flow growth and current market pricing, Alamos Gold appears to be significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alamos Gold is undervalued by 76.1%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Alamos Gold Price vs Earnings

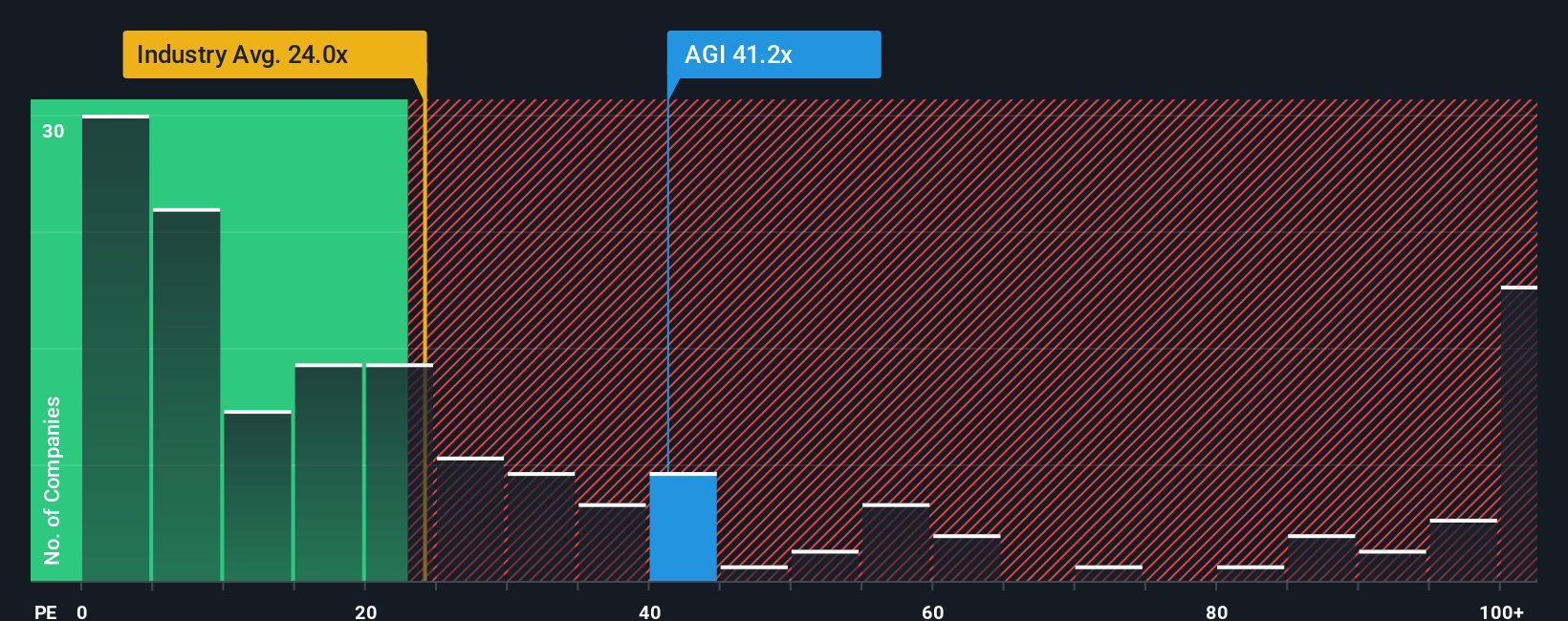

For profitable companies like Alamos Gold, the Price-to-Earnings (PE) ratio is a widely used valuation metric. It allows investors to gauge how much they are paying for each dollar of the company’s earnings, which is meaningful when the business has steady profits. The PE ratio is especially useful here because it reflects both current performance and expectations for future growth.

Typically, a “normal” or “fair” PE ratio is not static. It shifts depending on how quickly a company is expected to grow, its risk profile, and how it compares to other businesses in the same industry. Companies with better growth prospects or lower perceived risk often justify higher PE ratios, while more mature or riskier firms might trade at lower multiples.

Alamos Gold’s current PE ratio stands at 28.8x. That is above the Metals and Mining industry average of 19.3x, but well below the peer group average of 63.1x. Instead of relying solely on these benchmarks, Simply Wall St’s proprietary “Fair Ratio” takes a more holistic view, considering factors like Alamos Gold’s earnings growth, profit margin, industry, market cap, and associated risks. For Alamos Gold, the Fair Ratio is assessed at 26.0x, representing where the stock’s valuation should naturally sit given its overall outlook.

Comparing the Fair Ratio of 26.0x to the actual PE of 28.8x suggests that Alamos Gold may be trading at a slightly higher valuation than warranted, but not dramatically so. This nuanced view is more actionable than a straightforward industry comparison, as it reflects what investors might reasonably expect given the company’s specific profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alamos Gold Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personalized story about a company, where you combine your expectations for its future (like revenue, earnings, and profit margins) with your own fair value estimate. This approach builds a view that is both data-driven and true to your perspective. Narratives link a company’s story with a financial forecast and a fair value, turning raw numbers into a meaningful outlook that can guide smarter investment choices.

This process is made easy on Simply Wall St’s platform, where millions of investors use the Community page to create, share, and compare Narratives. These tools help you decide if Alamos Gold aligns with your strategy by directly comparing your fair value to today’s price. Narratives automatically update as new information, including news, production results, or earnings, is released, helping ensure your viewpoint always reflects the latest company developments.

For example, while some investors may see Alamos Gold’s expanding margins and production as a reason for a fair value above CA$64, others might focus on recent production guidance and cost risks, setting their fair value closer to CA$44. This highlights how Narratives empower you to invest according to your own convictions and evolving insights.

Do you think there's more to the story for Alamos Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AGI

Alamos Gold

Operates as a gold producer in Canada, Mexico, and the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.