- Canada

- /

- Metals and Mining

- /

- TSX:AGI

Alamos Gold (TSX:AGI): Assessing Valuation After Strong Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Alamos Gold (TSX:AGI) stock has moved over 7% higher this month and surged almost 29% over the past 3 months. The steady climb likely caught the attention of investors tracking momentum in the gold sector recently.

See our latest analysis for Alamos Gold.

Alamos Gold’s share price has steadily built momentum this year, with a notably strong run in the last quarter reflecting renewed optimism around gold stocks and resilient investor appetite. Including dividends, the company’s one-year total shareholder return of nearly 79% stands out as one of the sector’s more robust performances recently.

If recent gains in gold stocks have you looking for your next opportunity, consider broadening your search and discover fast growing stocks with high insider ownership

Yet with such a rapid run-up and the stock now trading just below analyst price targets, it is worth asking whether Alamos Gold remains undervalued or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 9.4% Undervalued

Alamos Gold's most followed narrative suggests a fair value moderately above the current share price, hinting at untapped potential yet to be priced in. The stage is set for a discussion centered on ambitious growth and integration plans.

Integration of high-grade underground ore from Island Gold into the larger and more efficient Magino mill is expected to deliver substantial processing cost synergies and increase throughput, driving both higher revenues and better net margins. Significant organic production growth is underway, with ongoing ramp-up at Magino and the Island Gold Phase 3+ expansion projected to raise consolidated output towards 900,000 to 1,000,000 ounces per year over the next several years, supporting strong top-line growth and free cash flow.

Want to uncover the logic behind this premium valuation? The projections behind this estimate hinge on major output expansion, higher future margins, and a bold improvement in profit multiples. Find out which growth drivers are key to the case that Alamos Gold’s upside is only beginning.

Result: Fair Value of $52.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and any delays in expansion projects could quickly threaten both profit margins and the ambitious growth targets of Alamos Gold.

Find out about the key risks to this Alamos Gold narrative.

Another View: Market-Based Risks Emerge

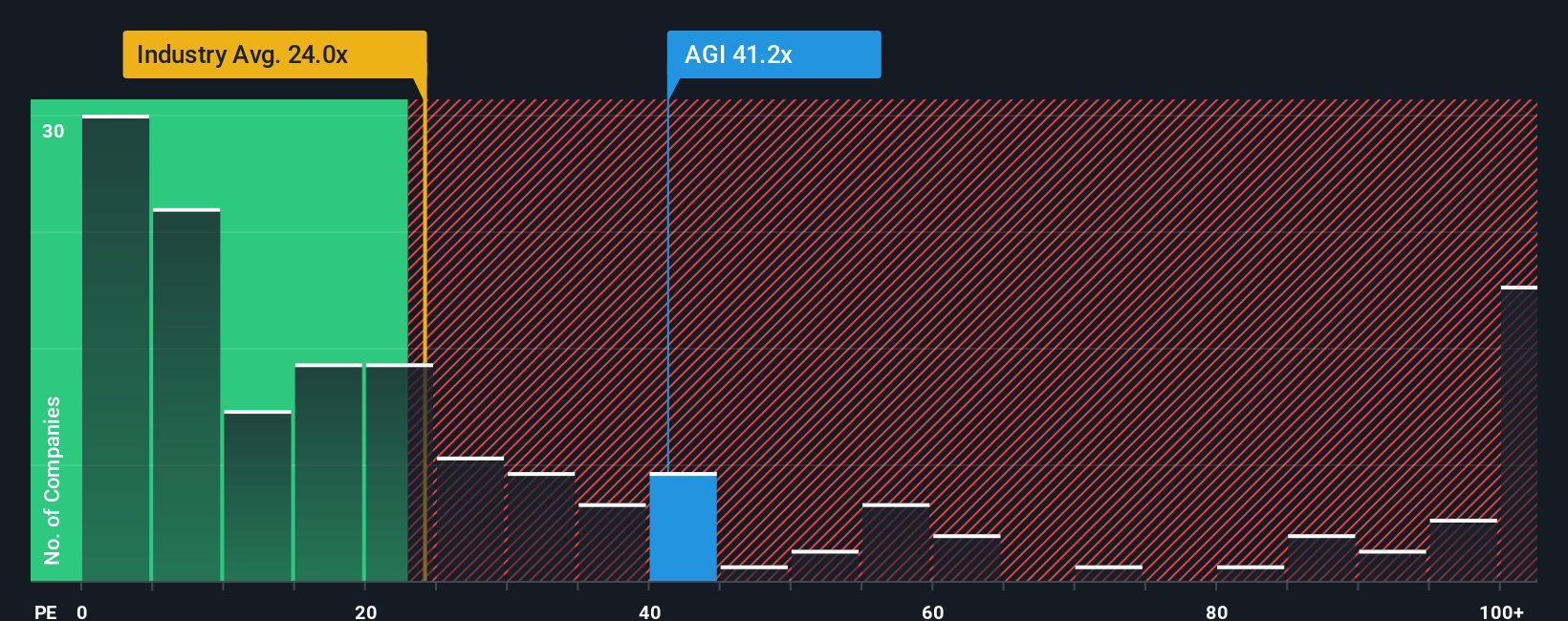

Valuing Alamos Gold based on its price-to-earnings ratio tells a different story. Trading at 41.2 times earnings, the stock is priced considerably higher than the industry average of 24 times and above its fair ratio of 24.8 times. This suggests investors are paying a premium for future growth, which adds valuation risk if expectations are not met. This raises the question of whether the market is already fully accounting for the company’s strengths.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alamos Gold Narrative

If you see the numbers differently or enjoy diving into data to form your own view, you can create a personalized narrative in just minutes. Do it your way

A great starting point for your Alamos Gold research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means going beyond the obvious. Give yourself a real edge by tapping into fresh growth stories, long-term winners, and emerging trends with these standout opportunities today.

- Tap into the explosive potential of breakthrough technology by scanning these 24 AI penny stocks which are changing the AI landscape and redefining what is possible for tomorrow’s businesses.

- Capture sustainable yields and reliable income by checking out these 19 dividend stocks with yields > 3% which consistently reward shareholders even through uncertain markets.

- Step ahead with undervalued opportunities rooted in strong cash flow by reviewing these 896 undervalued stocks based on cash flows before these stocks grab wider attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AGI

Alamos Gold

Operates as a gold producer in Canada, Mexico, and the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives