- Canada

- /

- Metals and Mining

- /

- TSX:AG

Earnings Beat and Gatos Silver Acquisition Could Be a Game Changer For First Majestic Silver (TSX:AG)

Reviewed by Simply Wall St

- First Majestic Silver Corp. recently achieved a 52-week high after reporting a Q2 turnaround with adjusted earnings surpassing analyst expectations, alongside announcing the acquisition of Gatos Silver and strong exploration results at the Los Gatos Silver Mine.

- These developments have strengthened market confidence in the company's operational improvements and potential resource growth, highlighting its enhanced positioning within the evolving silver sector.

- We’ll examine how the improved earnings and Gatos Silver acquisition impact First Majestic Silver’s investment story and outlook.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

First Majestic Silver Investment Narrative Recap

To be a shareholder in First Majestic Silver, you need to believe that higher silver prices and expanded production can outpace rising operating costs, especially as the company works to integrate recent acquisitions. The recent Q2 earnings beat and Los Gatos exploration results materially boost confidence in near-term production growth, which is widely viewed as the most important short-term catalyst; however, the biggest risk still centers on whether ongoing cost pressures from mine expansion and regional exposure can be contained. Among recent announcements, the positive drilling results at San Dimas stand out, confirming new mineralization that could extend reserve life and strengthen production, directly supporting the company’s growth catalysts at a key asset. Yet, despite these positives, investors should also weigh the risk that persistently high operating and capital costs could challenge earnings if...

Read the full narrative on First Majestic Silver (it's free!)

First Majestic Silver's outlook anticipates $1.2 billion in revenue and $94.0 million in earnings by 2028. This projection is based on a 12.2% annual revenue growth rate and a $79.3 million increase in earnings from the current $14.7 million.

Uncover how First Majestic Silver's forecasts yield a CA$14.75 fair value, a 13% upside to its current price.

Exploring Other Perspectives

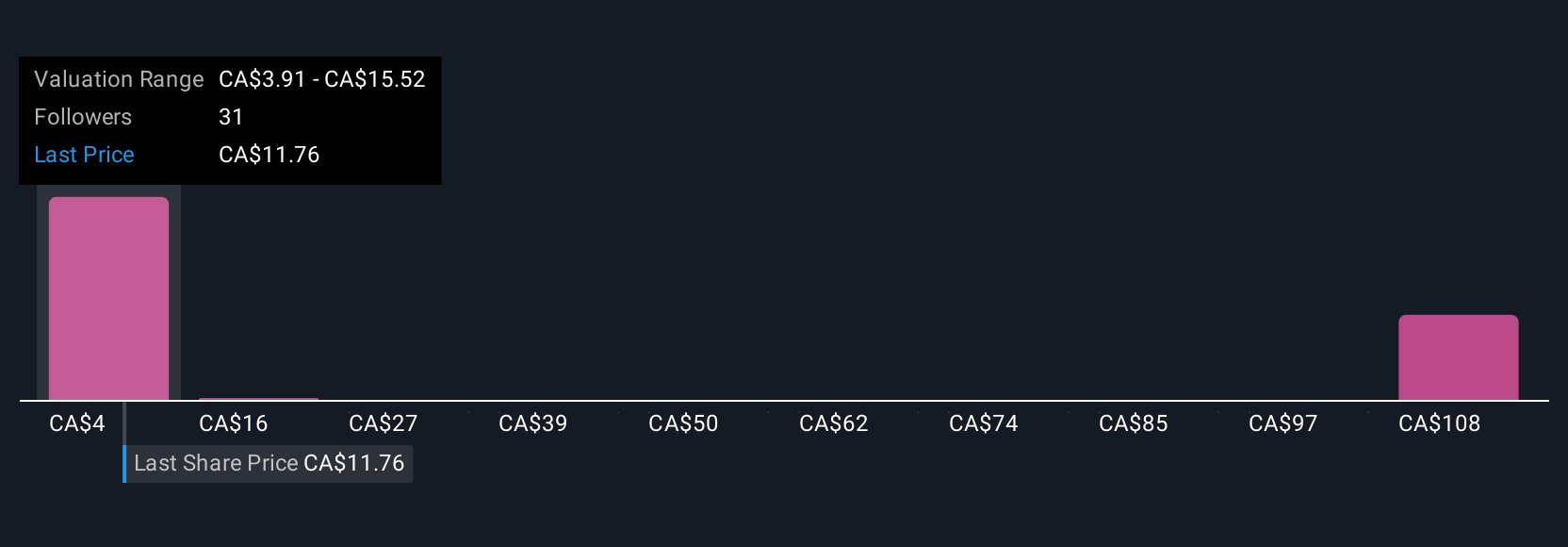

Fair value estimates from eight Simply Wall St Community members range widely from US$3.91 to a high of US$120. With such divergent views, especially in light of recent operational gains and ongoing cost risks, you can compare these perspectives to see how varied outlooks may impact expectations and future performance.

Explore 8 other fair value estimates on First Majestic Silver - why the stock might be worth over 9x more than the current price!

Build Your Own First Majestic Silver Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First Majestic Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Majestic Silver's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives