- Canada

- /

- Metals and Mining

- /

- TSX:AG

A Look at First Majestic Silver (TSX:AG) Valuation Following Record Results, Dividend Announcement, and Stock Rally

Reviewed by Simply Wall St

First Majestic Silver (TSX:AG) has been on a roll lately, extending its rally as investors respond to record third-quarter results, a return to profitability, and a newly announced dividend. The stock’s momentum has also benefited from surging silver prices and optimistic sentiment around potential interest rate cuts.

See our latest analysis for First Majestic Silver.

First Majestic Silver’s share price has soared alongside surging silver prices and a wave of upbeat news, with a 145.6% year-to-date return. Momentum is gathering speed thanks to record production and renewed profitability. Options activity and sector-wide rallies suggest growing investor confidence in the company’s long-term prospects. Its impressive 143.8% total shareholder return over the past year is also notable.

If this kind of market rally has you wondering where the next big growth story might come from, now’s a great time to explore fast growing stocks with high insider ownership.

After such a dramatic run fueled by record results and rising silver prices, the key question is whether First Majestic Silver’s share price still offers room for upside, or if the market has already factored in future growth.

Most Popular Narrative: 5.2% Undervalued

First Majestic Silver’s narrative fair value stands at $22.25, slightly above the last close price of $21.10. The stage is set for ambitious growth, supported by major production gains and aggressive exploration spending.

Substantial ongoing investment in exploration (for example, 255,000 meters drilled, the addition of drilling rigs, and development of large new ore bodies like Navidad and Santo Niño) is expected to extend reserve life, increase production capacity, and drive long-term revenue and cash flow growth. Operational synergies and cost savings from the successful integration of Cerro Los Gatos (including procurement consolidation and efficiency improvements through best practices and technology transfer) are likely to lower all-in sustaining costs and improve net margins and earnings over time.

Want to know the growth blueprint behind this high valuation? The narrative is focused on a bold ramp-up in production and a sharp increase in profitability. Curious which aggressive financial leaps are fueling this price target? Discover what’s really driving the numbers behind this valuation.

Result: Fair Value of $22.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued cost pressures or setbacks at key development projects could quickly reverse optimism around First Majestic Silver’s rapid growth outlook.

Find out about the key risks to this First Majestic Silver narrative.

Another View: Multiples Tell a Different Story

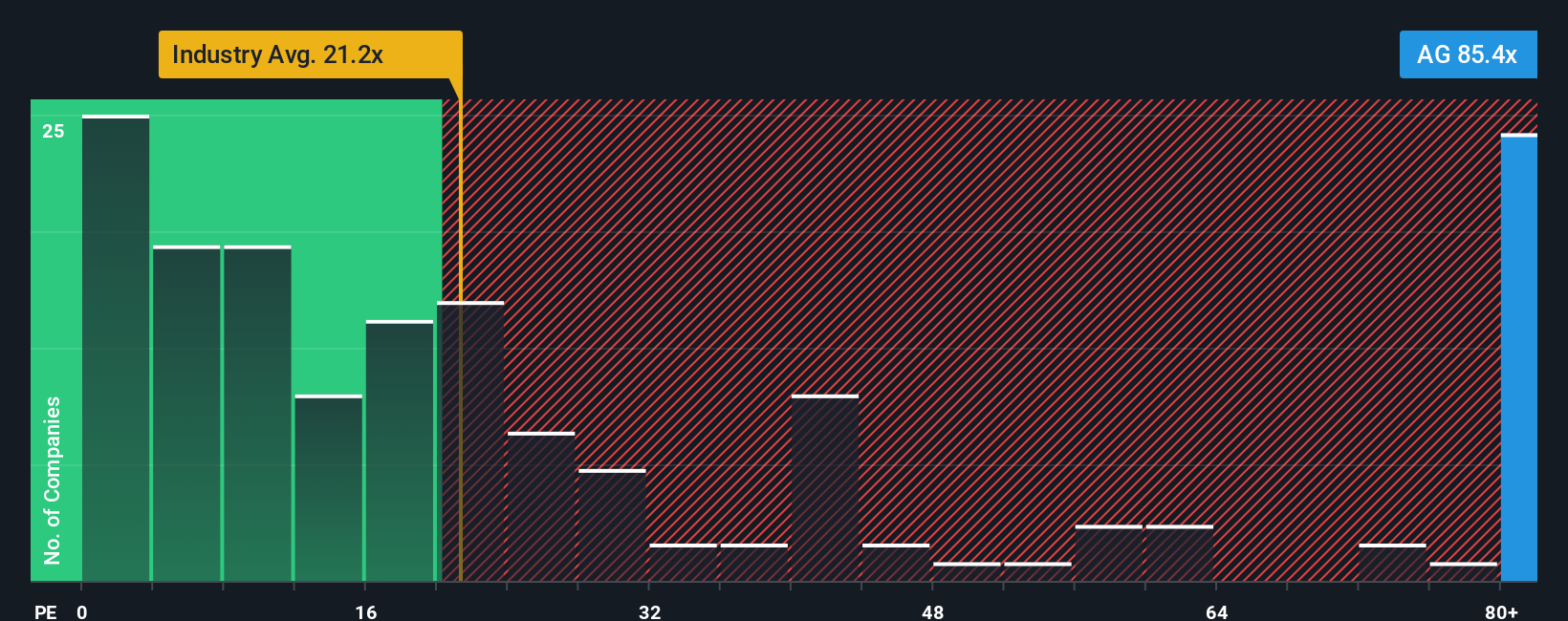

While the narrative-based fair value points to upside, a look at price-to-earnings ratios signals caution. First Majestic Silver trades at 108.6x, far above its peer average of 41.8x, the industry average of 20.6x, and the fair ratio of 27.3x that the market could return to. This wide gap suggests significant valuation risk if market sentiment shifts. Will strong growth be enough to justify such a premium, or could reality catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Majestic Silver Narrative

If you'd rather chart your own course or dig into the numbers yourself, you can build your own data-driven narrative in just minutes. Do it your way.

A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let today’s momentum pass you by. Seize the opportunity to boost your portfolio by targeting high-potential trends and robust financials. Check out these handpicked opportunities to stay ahead of the curve:

- Unlock growth by researching these 921 undervalued stocks based on cash flows that stand out for their compelling cash flow potential and market mispricing.

- Catch the yield advantage with these 15 dividend stocks with yields > 3% offering strong income streams and stable returns above 3%, giving your investments a steady boost.

- Ride the intelligence wave as you uncover these 25 AI penny stocks set to transform our daily lives with breakthroughs in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.