- Canada

- /

- Metals and Mining

- /

- TSX:AG

A Look at First Majestic Silver (TSX:AG) Valuation Following Cerro Los Gatos Integration and Raised Production Guidance

Reviewed by Kshitija Bhandaru

First Majestic Silver (TSX:AG) released third quarter 2025 operating results, highlighting a sharp jump in silver production as a result of the integration of the Cerro Los Gatos Silver Mine. The company also updated its production guidance upward for the year.

See our latest analysis for First Majestic Silver.

After integrating the Cerro Los Gatos Silver Mine and lifting its production guidance, First Majestic Silver’s momentum has been hard to miss. The stock’s 1-month share price return of 50.84%, and a dramatic 150.76% rally so far this year, show investors are responding to renewed confidence in growth. Over the past year, total shareholder return hit 147.23%, setting a strong pace. In addition, multiyear gains continue to reflect long-term conviction in the company’s strategy and assets.

If you want to see where else strong momentum and management conviction are shaping returns, now is the perfect moment to discover fast growing stocks with high insider ownership

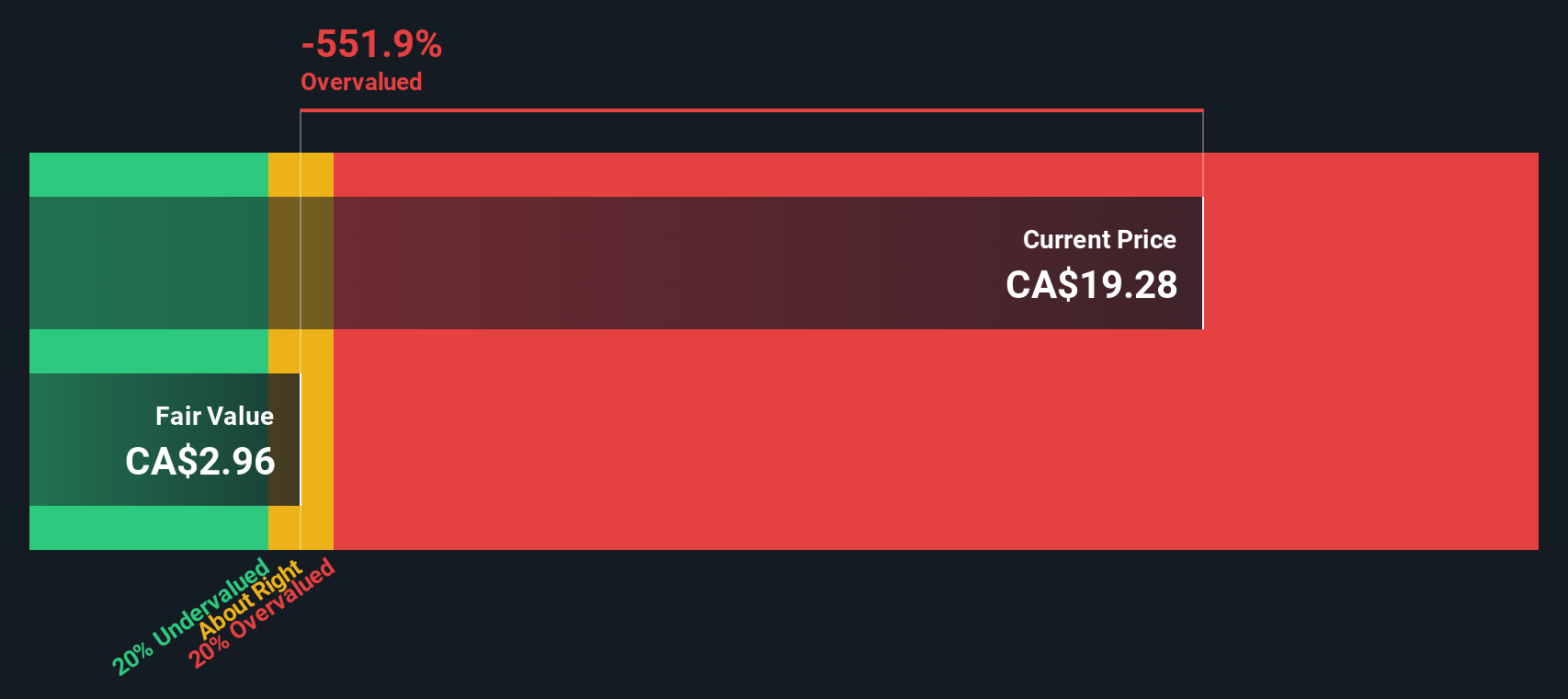

With such a strong surge in output and share price, the question now is whether First Majestic Silver is still trading at a compelling value, or if the stock is already factoring in all of its future growth potential.

Most Popular Narrative: 2% Overvalued

First Majestic Silver’s most widely followed valuation narrative sets a fair value just under the company’s latest closing price, suggesting the market has already priced in elevated growth expectations. The debate now centers on whether upbeat projections accurately reflect future realities in silver production and investment flows.

"Robust year-over-year growth in silver production (up 76%) and record revenue (up 94%), combined with expanded exploration and accelerated mine development, position the company to capture higher sales volumes and benefit from potential increases in industrial and investment demand for silver, directly supporting future revenue growth."

Curious which sky-high growth assumptions are powering this fair value? This narrative pulls together bold revenue forecasts, margin upgrades, and a future profit multiple that rivals some tech giants. Uncover the make-or-break numbers and see what really underpins this price target. These shocks may surprise even the most seasoned mining investor.

Result: Fair Value of $21.13 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated costs and concentrated exposure in Mexico could weigh on margins if silver prices or production volumes do not increase as expected.

Find out about the key risks to this First Majestic Silver narrative.

Another View: Discounted Cash Flow Suggests Undervaluation

While most analysts see First Majestic Silver as slightly overvalued at its current share price, the SWS DCF model presents a very different perspective. By projecting all future cash flows, this method suggests the stock could be trading well below its intrinsic value, highlighting a potential opportunity the market may be overlooking. Is there more to the story than meets the eye?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Majestic Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Majestic Silver Narrative

If you see things differently or want to dig into the numbers firsthand, you can shape your own story in a matter of minutes, and Do it your way

A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Why limit your search to just one company? Make the most of your next move by analyzing other fast-moving themes and market opportunities tailored to your goals.

- Capitalize on tech’s biggest disruptors by checking out these 24 AI penny stocks, which are driving innovation in artificial intelligence and automation worldwide.

- Boost your portfolio’s income potential and discover companies offering consistent yields through these 20 dividend stocks with yields > 3%, proven to deliver attractive returns over time.

- Position yourself ahead of the curve with these 79 cryptocurrency and blockchain stocks, which are pioneering advancements in blockchain applications and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives