- Canada

- /

- Metals and Mining

- /

- TSX:ABX

Is There Still Value in Barrick Gold After Its 100% Rally in 2025?

Reviewed by Bailey Pemberton

Deciding what to do with Barrick Mining stock right now might feel like a bigger call than ever. If you have been watching the ticker, you have seen the numbers come in hard and fast, with the stock jumping 3.0% in the past week alone and climbing more than 20% in just the last 30 days. Year-to-date, Barrick has surged a whopping 106.4%. The momentum over the past year and even the last five years is impressive, with the stock up 78.2% and 48.0% respectively. Longer-term investors have been well rewarded, with a solid 139.0% gain over three years. These figures reflect not only continued confidence in gold producers, but also investor reactions to global market developments and shifting appetite for defensive, resource-focused plays.

What really matters now, though, is whether Barrick’s stock is still a buy at these levels, especially for investors who care about getting value for their money. According to our valuation framework, Barrick scores a 4 out of 6. This means the company checks the box for being undervalued on four key measures. That is an encouraging score, but the story does not end there. Next, we will break down the specific valuation methods used and what they show about Barrick’s price relative to its business. Later, we will reveal an even more powerful way to gauge whether Barrick Mining is the right fit for your portfolio.

Why Barrick Mining is lagging behind its peers

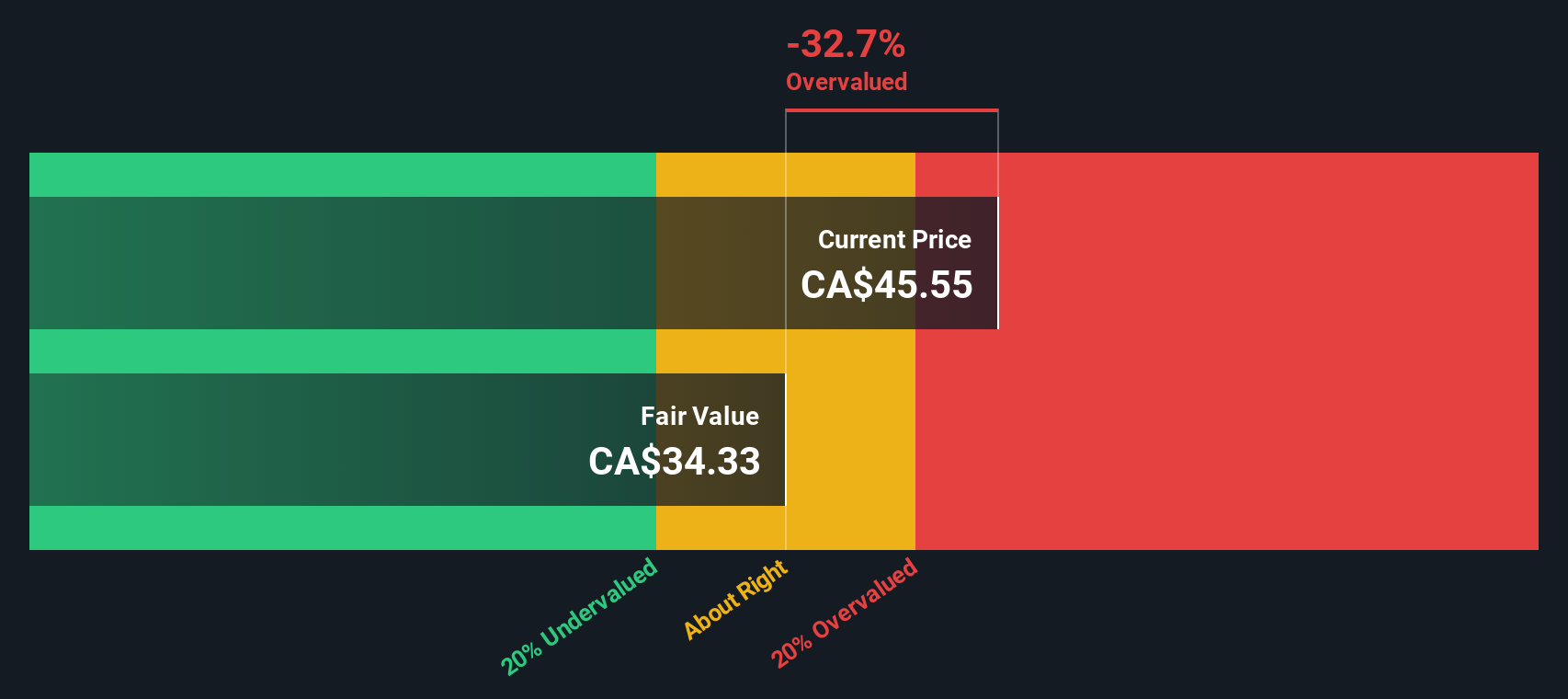

Approach 1: Barrick Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth today based on its future cash flow. It projects those cash flows and discounts them back to the present. This approach attempts to capture the long-term earnings power of Barrick Mining by forecasting how much cash the business will generate and translating those figures into today’s dollars.

For Barrick Mining, the most recent Free Cash Flow (FCF) is $1.43 Billion. Analysts expect annual free cash flow to grow, projecting a rise to $3.36 Billion by 2029. Over the next ten years, further projections extrapolate this growth, factoring in a range of analyst and in-house estimates.

Based on this model, the estimated intrinsic value per share is $53.19. This is 10.7% higher than the current price and implies that the stock is undervalued according to DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Barrick Mining is undervalued by 10.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

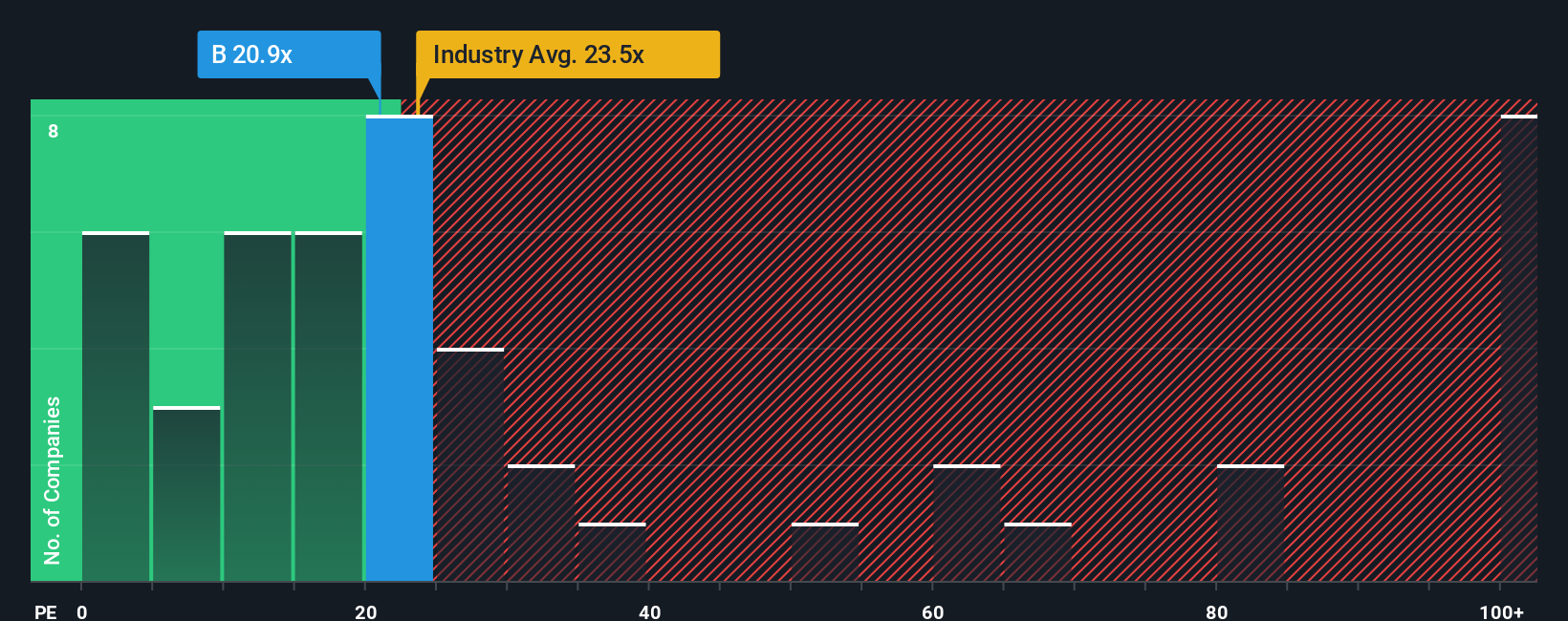

Approach 2: Barrick Mining Price vs Earnings

The Price-to-Earnings (PE) ratio is often considered the go-to valuation tool for profitable companies like Barrick Mining. It gives investors a snapshot of how much they are paying for each dollar of the company's earnings. A lower PE can indicate a stock is undervalued, but the context is important. Companies with stronger growth prospects or lower risk often justify higher PEs, while more mature or riskier companies tend to trade at lower multiples.

Barrick Mining currently trades at a PE ratio of 21x. For context, the average PE across the Metals and Mining industry is 23x, while a group of close peers is trading at a significantly higher average of 41x. This places Barrick below both its direct competitors and the industry as a whole, suggesting the market is not pricing in especially high expectations.

However, a more tailored approach is needed. The “Fair Ratio,” a proprietary measure developed by Simply Wall St, blends Barrick’s growth outlook, earnings quality, profit margin, industry dynamics, and market cap to create a benchmark specific to the company. Unlike a simple peer or industry comparison, the Fair Ratio gives a truer picture by considering what multiple Barrick deserves given its risks, profitability, and future prospects. For Barrick, the Fair Ratio sits at 26x, above its current PE.

With the stock trading at 21x versus its Fair Ratio of 26x, Barrick Mining appears attractively valued on this metric alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Barrick Mining Narrative

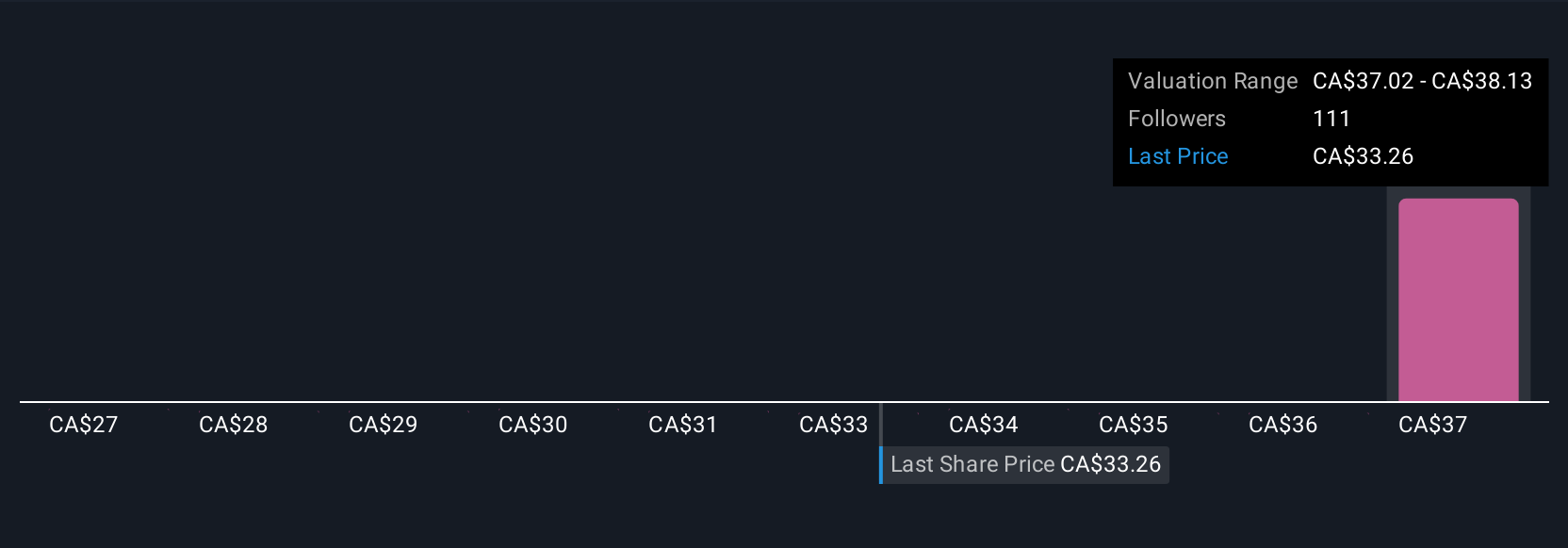

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just a number; it is your story about Barrick Mining, combining your outlook on its future revenue, earnings, and margins with broader company and industry themes, and turning this perspective into a financial forecast and fair value estimation.

Narratives make investing more accessible by letting anyone, regardless of expertise, connect what they believe about a company with the numbers that drive its valuation. On Simply Wall St’s Community page, millions of investors build and update their Narratives, comparing fair values to the current price, and getting dynamic updates as new news or earnings emerge.

This approach helps you decide when to buy or sell and to see how your assumptions compare against other investors’. For instance, some Barrick Mining Narratives are highly optimistic, projecting robust earnings growth from gold and copper expansion and setting price targets as high as CA$50.15. Others are more cautious, highlighting risks around declining ore grades and regulatory hurdles, resulting in targets closer to CA$31.15. The takeaway is that Narratives give you a simple, powerful framework to ground your investment decisions in real, evolving company stories.

Do you think there's more to the story for Barrick Mining? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives