- Canada

- /

- Metals and Mining

- /

- CNSX:FOX

Discover 3 Canadian Penny Stocks On TSX With Market Caps Over CA$10M

Reviewed by Simply Wall St

In the last week, the Canadian market has stayed flat, but it is up 22% over the past year with earnings forecast to grow by 16% annually. Penny stocks, though an outdated term, continue to attract attention when they are backed by strong financials and growth potential. This article will explore three Canadian penny stocks on the TSX that stand out for their financial strength and potential as under-the-radar opportunities in a growing market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.64 | CA$173.17M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$286.83M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$116.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$584.01M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.38 | CA$325.16M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.75M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.10 | CA$207.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 967 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Fox River Resources (CNSX:FOX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fox River Resources Corporation focuses on the acquisition, exploration, evaluation, and development of mineral and natural resources properties with a market cap of CA$27.29 million.

Operations: Fox River Resources Corporation does not report any revenue segments.

Market Cap: CA$27.29M

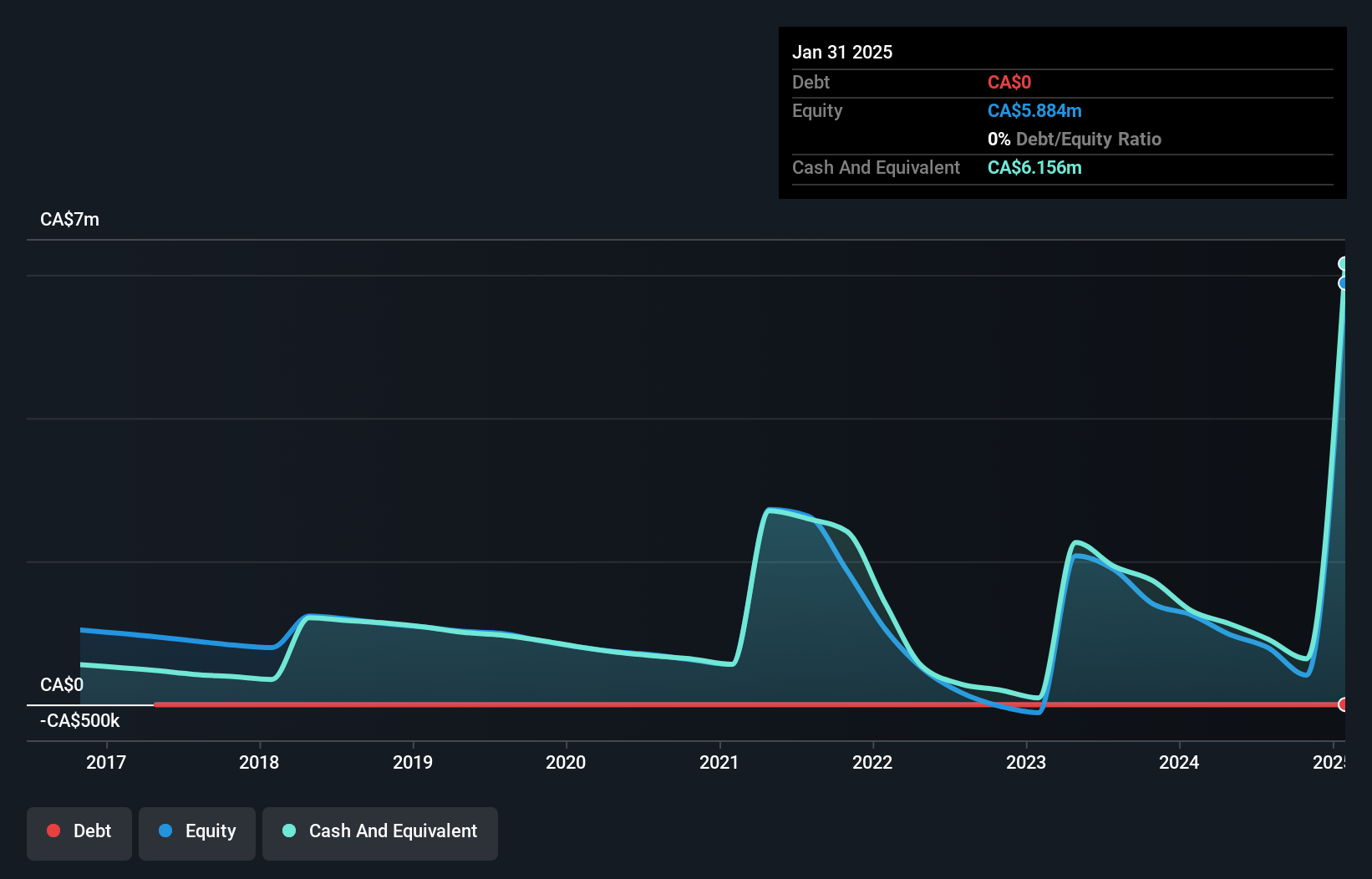

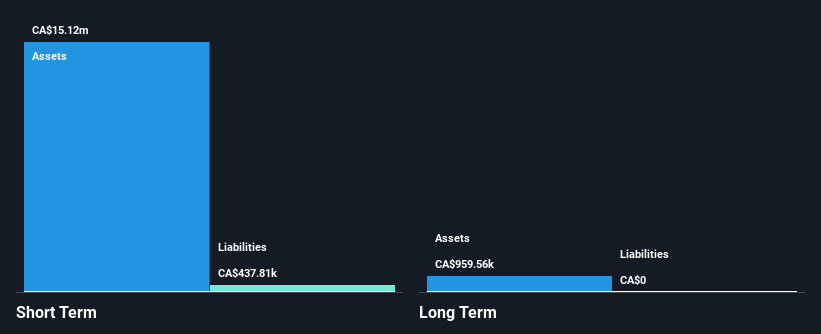

Fox River Resources, with a market cap of CA$27.29 million, is pre-revenue and unprofitable, reporting consistent net losses over recent periods. Despite its financial challenges, the company maintains a debt-free status and has short-term assets exceeding both short-term and long-term liabilities. However, it faces high share price volatility and limited cash runway under current conditions. Recent developments include a non-brokered private placement expected to raise CA$2.88 million from strategic investors, potentially providing some financial relief but subjecting new shares to trading restrictions for four months post-issuance.

- Unlock comprehensive insights into our analysis of Fox River Resources stock in this financial health report.

- Examine Fox River Resources' past performance report to understand how it has performed in prior years.

Li-Metal (CNSX:LIM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Li-Metal Corp. focuses on the development, production, and sale of metallic lithium metal and anode materials, with a market cap of CA$11.51 million.

Operations: The company generates revenue from its Batteries / Battery Systems segment, amounting to CA$0.16 million.

Market Cap: CA$11.51M

Li-Metal Corp., with a market cap of CA$11.51 million, is pre-revenue and unprofitable, reporting declining sales of CA$0.033 million in the latest quarter and a net loss of CA$1.37 million. The company recently appointed Keshav Kochhar as CEO, bringing experience from the battery and automotive sectors. Li-Metal remains debt-free with short-term assets exceeding liabilities but faces less than a year of cash runway if current cash flow trends persist. Shareholders have experienced dilution over the past year amidst high share price volatility, reflecting ongoing financial challenges despite strategic leadership changes.

- Take a closer look at Li-Metal's potential here in our financial health report.

- Understand Li-Metal's track record by examining our performance history report.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, and operation of mineral properties in Latin America, with a market cap of CA$104.09 million.

Operations: The company's revenue is derived from its operations at Porco ($31.21 million), Bolivar ($75.81 million), Zimapan ($67.26 million), SAN Lucas ($76.09 million), and the Caballo Blanco Group ($62.69 million).

Market Cap: CA$104.09M

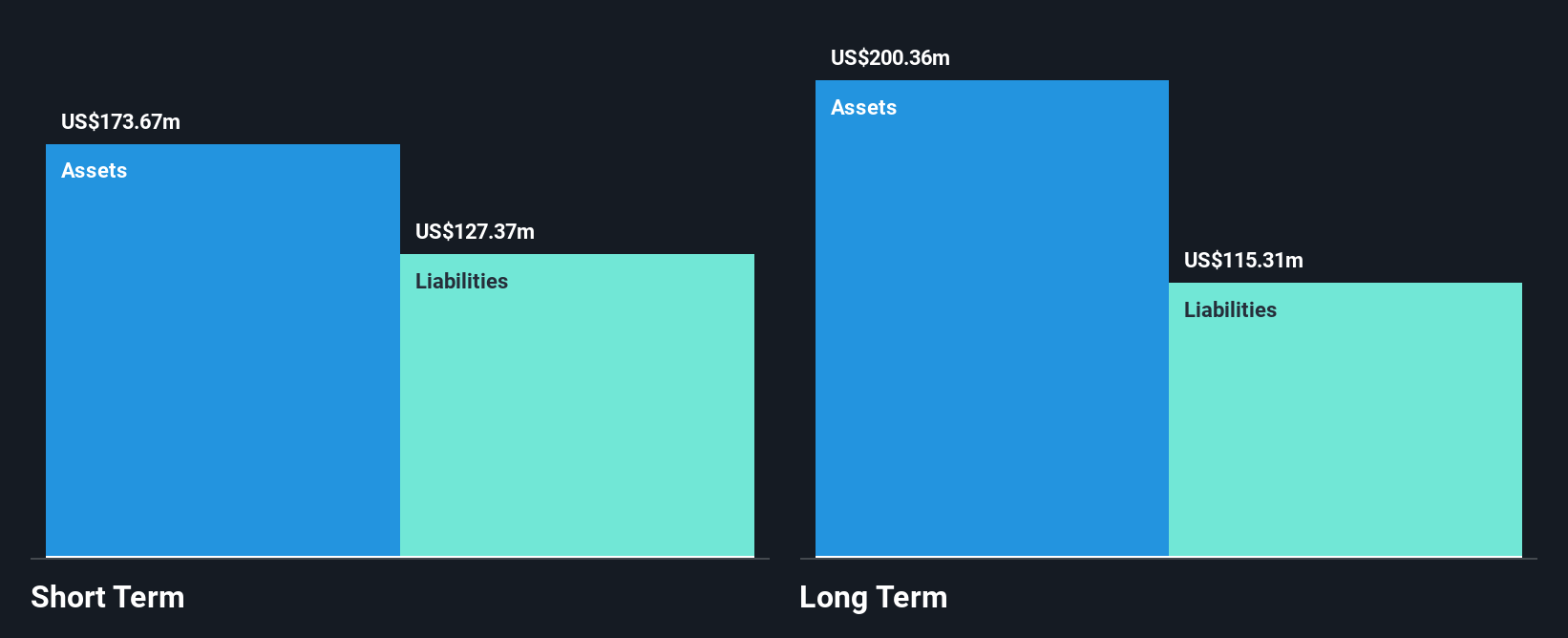

Santacruz Silver Mining Ltd., with a market cap of CA$104.09 million, has recently achieved profitability, marking significant progress in its financial performance. The company's operations across several sites contribute to substantial revenue streams, including Porco (CA$31.21 million) and Bolivar (CA$75.81 million). Despite high volatility and a recent CFO change, Santacruz maintains robust financial health with short-term assets exceeding liabilities and well-covered debt by operating cash flow. The board is experienced; however, the management team is relatively new. Its stock trades below estimated fair value, offering potential investment interest amidst ongoing strategic developments.

- Dive into the specifics of Santacruz Silver Mining here with our thorough balance sheet health report.

- Evaluate Santacruz Silver Mining's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 967 TSX Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:FOX

Fox River Resources

Engages in the acquisition, exploration, evaluation, and development of mineral and natural resources properties.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026