- Canada

- /

- Metals and Mining

- /

- TSXV:TSG

Discovering Fathom Nickel And 2 Other Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As the Canadian market navigates through economic uncertainties, including potential impacts from U.S. tariffs and inflationary pressures, investors are increasingly looking for opportunities that balance risk with potential growth. Penny stocks, while an outdated term, continue to represent a compelling investment area by highlighting smaller or less-established companies that can offer significant value. By identifying those with strong financial health and promising growth trajectories, investors may find hidden gems within this niche sector on the TSX.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.55 | CA$65.34M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$1.02B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.79 | CA$407.32M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.70 | CA$280.75M | ✅ 2 ⚠️ 2 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$181.35M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.58 | CA$531.27M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.75 | CA$74.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.55 | CA$15.76M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.00 | CA$36.92M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Fathom Nickel (CNSX:FNI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fathom Nickel Inc. is an exploration stage company focused on identifying, acquiring, and exploring base and precious metals for the electric vehicle and battery markets, with a market cap of CA$5.28 million.

Operations: Fathom Nickel Inc. has not reported any revenue segments as it is currently in the exploration stage, focusing on base and precious metals for the electric vehicle and battery markets.

Market Cap: CA$5.28M

Fathom Nickel Inc., with a market cap of CA$5.28 million, is in the exploration stage and remains pre-revenue as it focuses on metals for electric vehicle and battery markets. The company has reduced losses at 4.7% annually over five years, although it remains unprofitable with negative return on equity. Its board is experienced, averaging 4.3 years in tenure, and there's been no significant shareholder dilution recently. Fathom Nickel is debt-free but has limited cash runway despite raising CA$705,000 through a private placement in March 2025 to support operations amidst high share price volatility and increased weekly volatility from 23% to 30%.

- Dive into the specifics of Fathom Nickel here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Fathom Nickel's track record.

Spearmint Resources (CNSX:SPMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Spearmint Resources Inc. is an exploration stage company focused on the identification, acquisition, and exploration of mineral properties, with a market cap of CA$5.76 million.

Operations: Spearmint Resources Inc. has not reported any revenue segments.

Market Cap: CA$5.76M

Spearmint Resources Inc., with a market cap of CA$5.76 million, is pre-revenue and focuses on mineral exploration, recently acquiring the Sisson North Tungsten Project in New Brunswick. This acquisition comes amid heightened global demand for tungsten due to China's export controls, positioning Spearmint strategically within this critical minerals market. Despite being debt-free, the company faces financial challenges with short-term assets not covering liabilities and a limited cash runway of three months. The management and board are experienced, averaging 7.5 years and 5.4 years in tenure respectively, while share price volatility remains high at 41%.

- Click to explore a detailed breakdown of our findings in Spearmint Resources' financial health report.

- Assess Spearmint Resources' previous results with our detailed historical performance reports.

TriStar Gold (TSXV:TSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TriStar Gold, Inc. is involved in the acquisition, exploration, and development of precious metal prospects in the Americas with a market cap of CA$50.58 million.

Operations: TriStar Gold does not report any revenue segments.

Market Cap: CA$50.58M

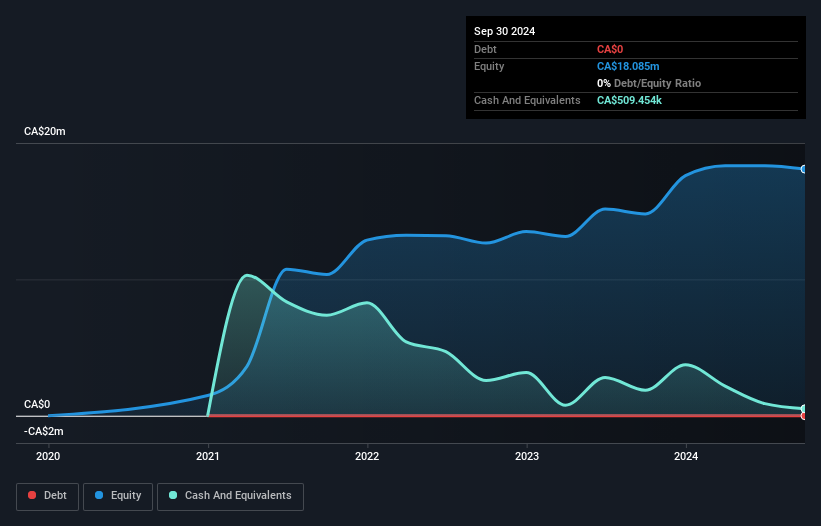

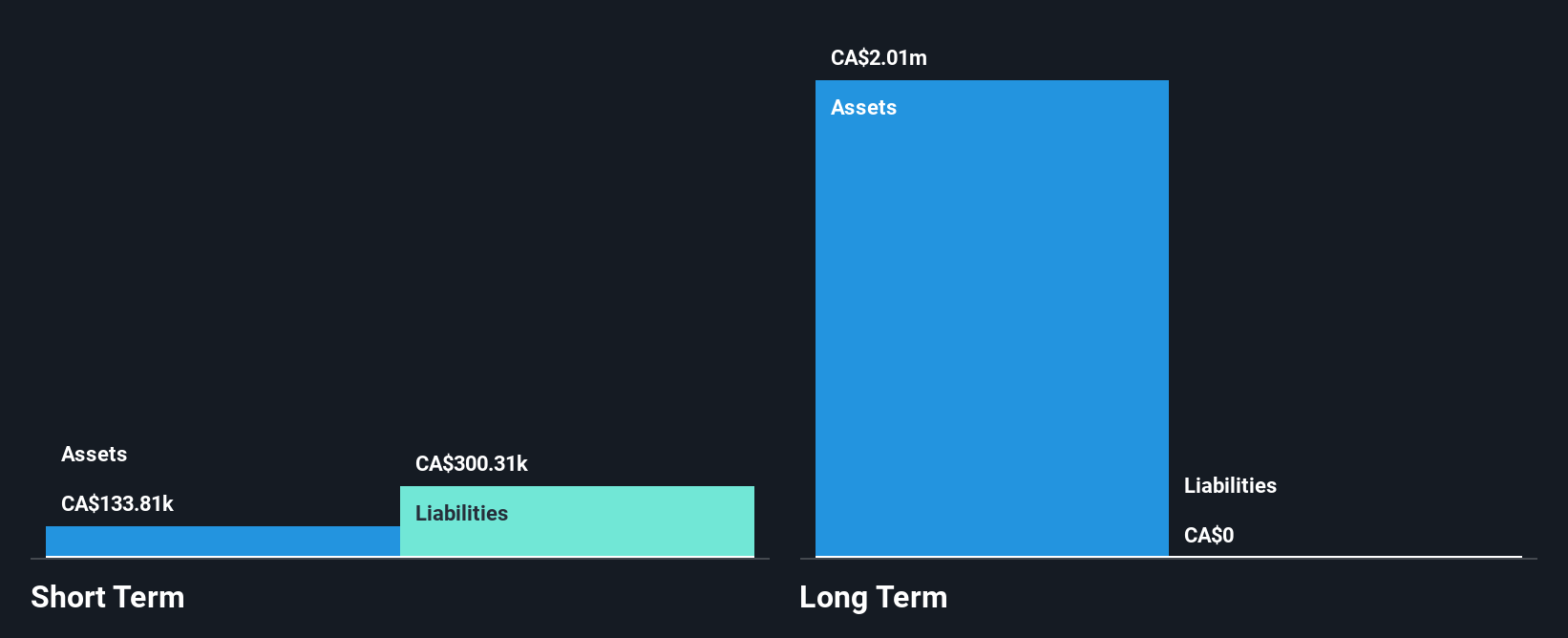

TriStar Gold, with a market cap of CA$50.58 million, is a pre-revenue company focused on precious metal exploration in the Americas. Despite being debt-free, its short-term assets of US$596.9K fall short of covering long-term liabilities of US$668K. Recent private placements raised over CA$1 million, extending its cash runway beyond two months as previously estimated. The company's share price remains highly volatile and it reported an increased net loss of US$1.93 million for 2024 compared to the previous year. Management changes include CFO Scott Brunsdon assuming additional duties as Corporate Secretary following a retirement announcement.

- Click here to discover the nuances of TriStar Gold with our detailed analytical financial health report.

- Gain insights into TriStar Gold's historical outcomes by reviewing our past performance report.

Key Takeaways

- Click this link to deep-dive into the 936 companies within our TSX Penny Stocks screener.

- Searching for a Fresh Perspective? The end of cancer? These 22 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriStar Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TSG

TriStar Gold

Engages in the acquisition, exploration, and development of precious metal prospects in the Americas.

Excellent balance sheet slight.

Market Insights

Community Narratives