- Canada

- /

- Metals and Mining

- /

- TSXV:PJX

TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape of economic trends and evolving investor strategies, as experts like Angelo Kourkafas continue to provide insights into long-term financial goals. In this context, penny stocks—though an outdated term—remain relevant for investors seeking opportunities in smaller or newer companies that may offer value and growth potential. By focusing on those with strong financials, investors can uncover promising candidates among these under-the-radar stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.96 | CA$184.25M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$113.98M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$538.09M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.37 | CA$939.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.87 | CA$182.38M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.85 | CA$118.19M | ★★★★☆☆ |

Click here to see the full list of 942 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cruz Battery Metals (CNSX:CRUZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cruz Battery Metals Corp. is an exploration stage company focused on identifying, acquiring, and exploring mineral properties, with a market cap of CA$5.04 million.

Operations: Cruz Battery Metals Corp. does not have any reported revenue segments as it is currently in the exploration stage.

Market Cap: CA$5.04M

Cruz Battery Metals Corp., with a market cap of CA$5.04 million, is a pre-revenue exploration stage company facing significant challenges typical of penny stocks. The company's financials reveal a net loss of CA$1.31 million for the year ended July 31, 2024, and an auditor's report expressing doubts about its ability to continue as a going concern. Despite having sufficient cash runway for over a year and no debt, Cruz has experienced shareholder dilution and high share price volatility recently. An upcoming extraordinary shareholders meeting could impact its strategic direction through proposed structural changes involving Makenita Resources Inc.

- Jump into the full analysis health report here for a deeper understanding of Cruz Battery Metals.

- Learn about Cruz Battery Metals' historical performance here.

PJX Resources (TSXV:PJX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PJX Resources Inc. is involved in the acquisition, exploration, and development of mineral resource properties in Canada, with a market cap of CA$17.45 million.

Operations: PJX Resources Inc. currently does not report any revenue segments.

Market Cap: CA$17.45M

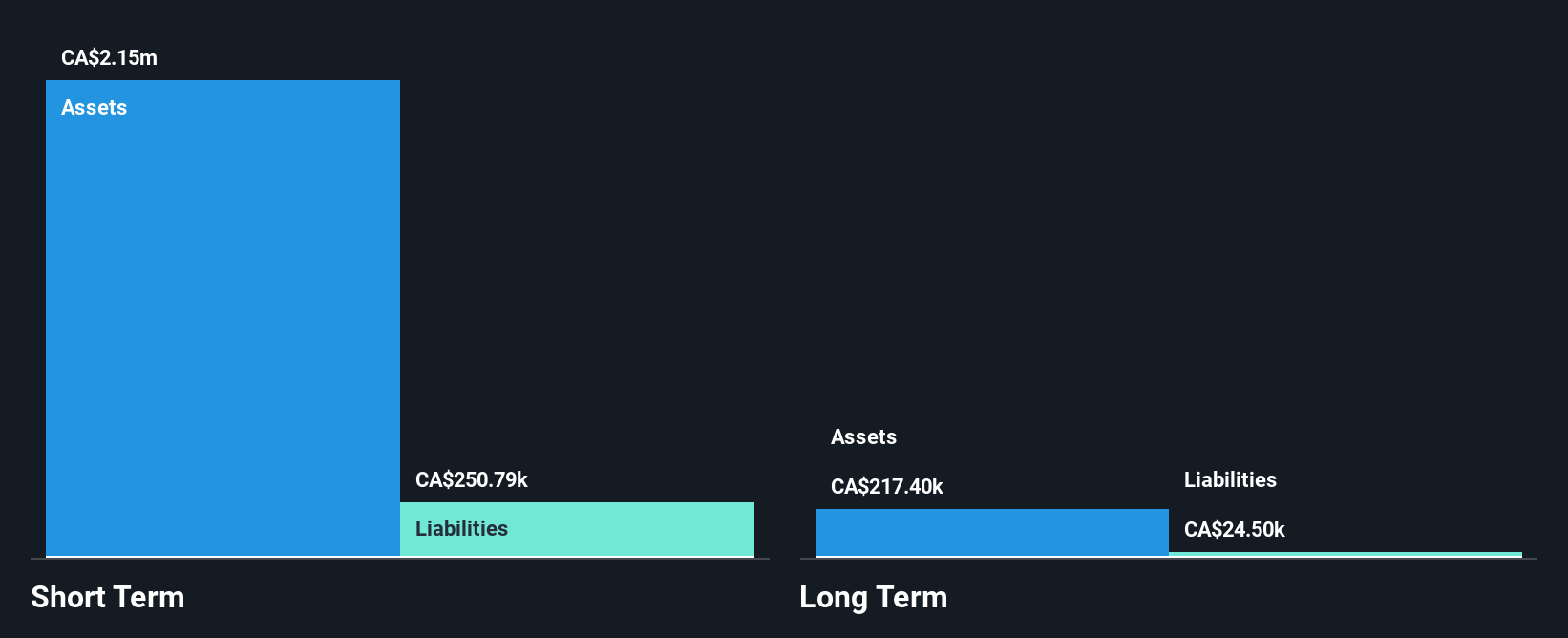

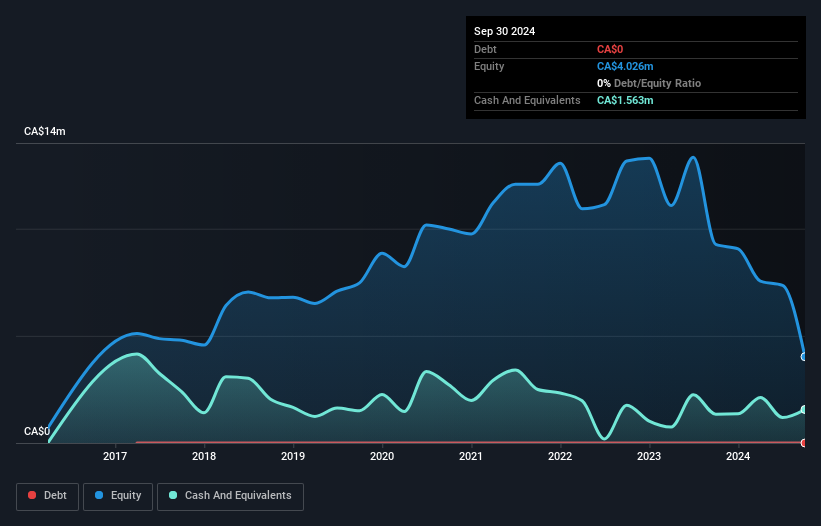

PJX Resources Inc., with a market cap of CA$17.45 million, is a pre-revenue company engaged in mineral exploration, typical of many penny stocks. The company has no debt and sufficient cash runway for over a year, but it faces challenges such as increased shareholder dilution and high share price volatility. Recent drilling at its Dewdney Trail Property suggests potential for discovering Sedex-type deposits, with findings including iron-rich minerals and copper in a geological environment indicative of significant mineralization. Despite reporting an increased net loss recently, the company's exploration activities continue to show promise in uncovering valuable resources.

- Navigate through the intricacies of PJX Resources with our comprehensive balance sheet health report here.

- Understand PJX Resources' track record by examining our performance history report.

VR Resources (TSXV:VRR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VR Resources Ltd. is a junior exploration company focused on acquiring, evaluating, and exploring mineral properties in the United States and Canada, with a market cap of CA$6.88 million.

Operations: VR Resources Ltd. does not report any revenue segments.

Market Cap: CA$6.88M

VR Resources Ltd., with a market cap of CA$6.88 million, is a pre-revenue junior exploration company focused on mineral properties in Canada and the U.S. The company has no long-term liabilities and remains debt-free, but it has experienced shareholder dilution over the past year. Recent drilling at its Empire Project in Ontario has confirmed a large mafic-ultramafic complex with magmatic sulfide segregations, suggesting potential for copper-gold-PGE mineralization. However, VR Resources faces challenges such as high share price volatility and limited cash runway, necessitating ongoing capital raises to support its exploration activities.

- Get an in-depth perspective on VR Resources' performance by reading our balance sheet health report here.

- Gain insights into VR Resources' past trends and performance with our report on the company's historical track record.

Make It Happen

- Navigate through the entire inventory of 942 TSX Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PJX

PJX Resources

Engages in the acquisition, exploration, and development of mineral resource properties in Canada.

Flawless balance sheet slight.