July 2024 Insight Into Three TSX Stocks Estimated Below Value Projections

Reviewed by Simply Wall St

Amidst a robust first half of 2024, where the TSX index saw solid gains albeit with less exposure to the high-flying technology sector, investors might find potential in exploring areas that have not mirrored these broader market trends. In this context, identifying stocks that are estimated to be undervalued could offer interesting opportunities for those looking to diversify or adjust their portfolios in line with current economic conditions and market movements.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$184.70 | CA$313.90 | 41.2% |

| Trisura Group (TSX:TSU) | CA$41.55 | CA$80.18 | 48.2% |

| Calibre Mining (TSX:CXB) | CA$1.94 | CA$3.61 | 46.2% |

| Kinaxis (TSX:KXS) | CA$160.99 | CA$263.93 | 39% |

| Kraken Robotics (TSXV:PNG) | CA$1.13 | CA$2.21 | 48.9% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Endeavour Mining (TSX:EDV) | CA$30.41 | CA$52.49 | 42.1% |

| Green Thumb Industries (CNSX:GTII) | CA$15.79 | CA$28.00 | 43.6% |

| Kits Eyecare (TSX:KITS) | CA$8.92 | CA$15.46 | 42.3% |

| Capstone Copper (TSX:CS) | CA$10.40 | CA$17.54 | 40.7% |

Let's review some notable picks from our screened stocks

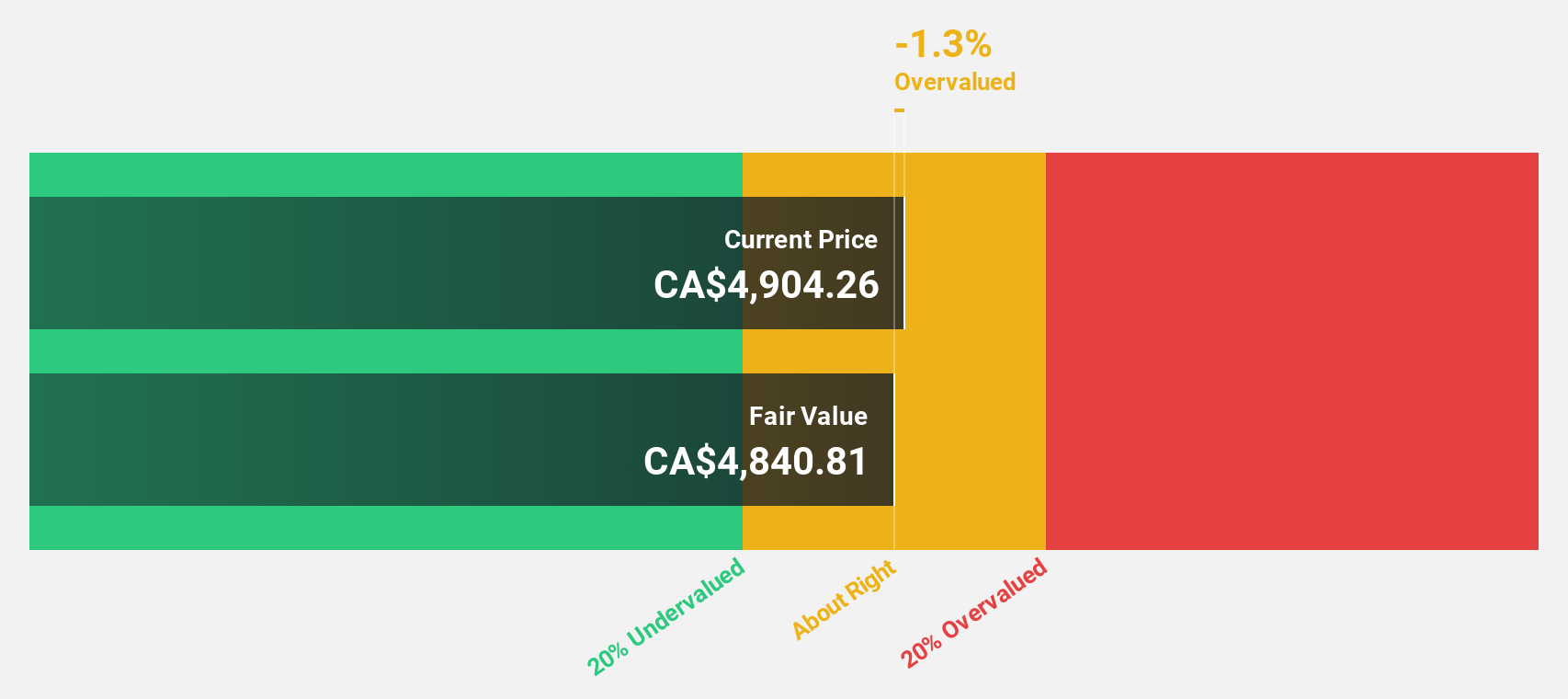

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. operates globally, acquiring, building, and managing vertical market software businesses primarily in Canada, the United States, and Europe with a market capitalization of approximately CA$85.68 billion.

Operations: The company's revenue from its software and programming segment amounts to CA$8.84 billion.

Estimated Discount To Fair Value: 27.9%

Constellation Software, trading at CA$4036.72, is 27.9% below its estimated fair value of CA$5596.48, suggesting undervaluation based on cash flows. Despite a high debt level, it's poised for robust growth with earnings expected to increase significantly over the next three years and forecasted to outpace the Canadian market's average. Recent strategic executive changes and the launch of Omegro indicate a strengthening focus on global software solutions expansion and operational efficiency. However, there has been significant insider selling in the past quarter, which could raise concerns among investors.

- Our earnings growth report unveils the potential for significant increases in Constellation Software's future results.

- Unlock comprehensive insights into our analysis of Constellation Software stock in this financial health report.

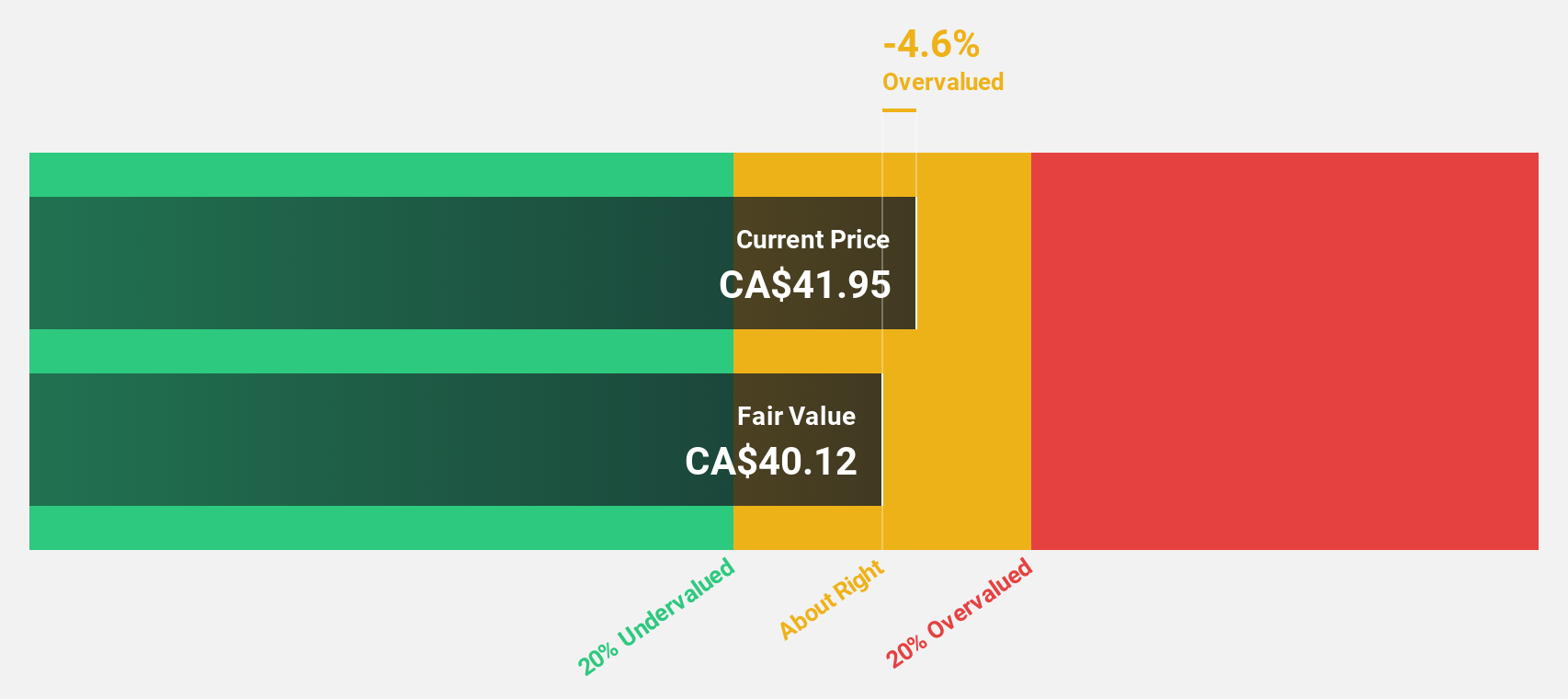

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc operates as a gold mining company in West Africa, with a market capitalization of approximately CA$7.38 billion.

Operations: The company's primary revenue is generated from four mines in West Africa: Ity Mine (CA$653.70 million), Mana Mine (CA$292.70 million), Houndé Mine (CA$611.30 million), and Sabodala Massawa Mine (CA$548.40 million).

Estimated Discount To Fair Value: 42.1%

Endeavour Mining, priced at CA$30.41, is significantly undervalued by over 20%, with a fair value estimated at CA$52.48. Despite recent operational challenges reflected in a net loss of US$20.2 million for Q1 2024, the company is on track to meet its annual production guidance and has promising growth prospects with expected revenue growth outpacing the Canadian market average. However, its dividend coverage by earnings and cash flows remains weak, raising sustainability concerns.

- Our comprehensive growth report raises the possibility that Endeavour Mining is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Endeavour Mining.

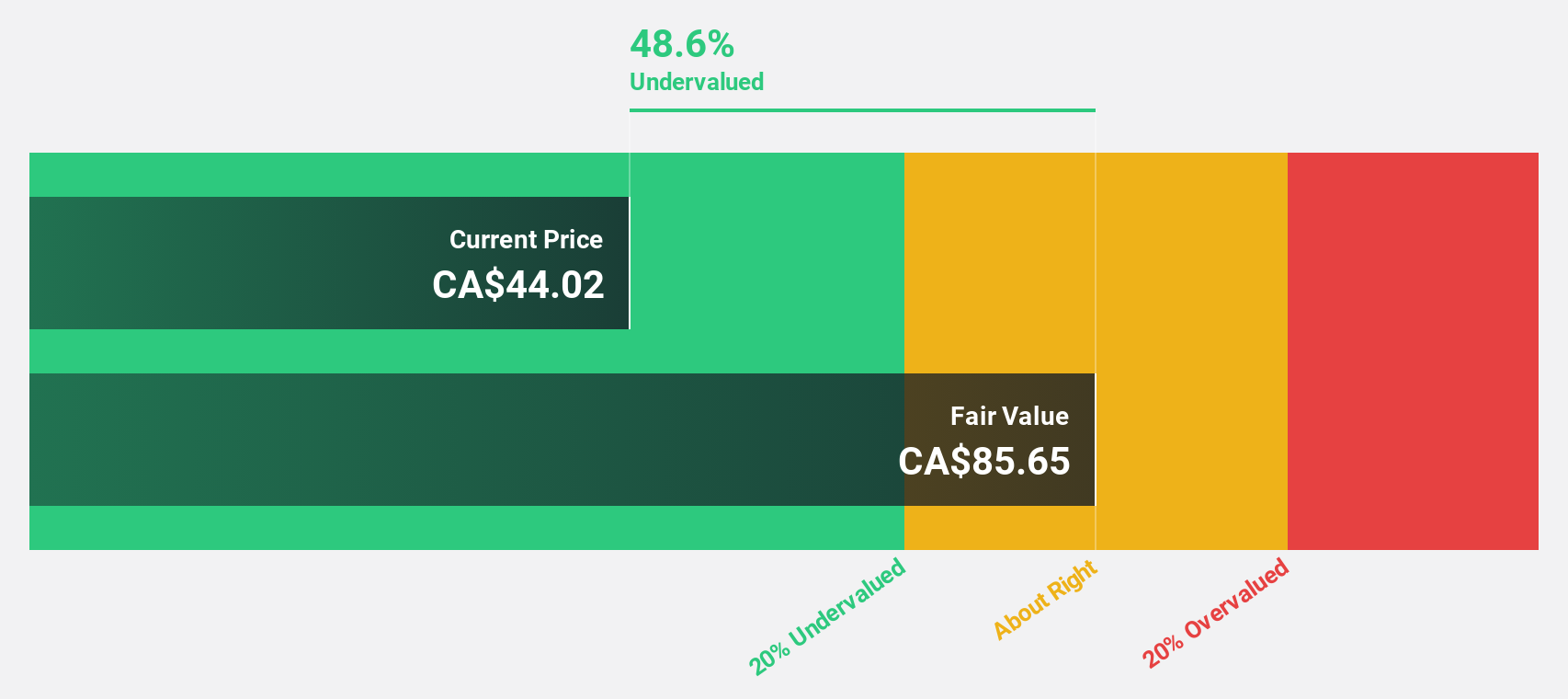

Trisura Group (TSX:TSU)

Overview: Trisura Group Ltd. is a specialty insurance provider with operations in surety, risk solutions, corporate insurance, and reinsurance across Canada, the United States, and internationally, boasting a market capitalization of approximately CA$1.98 billion.

Operations: The company generates revenue through its operations in the U.S. and Canada, with CA$2.04 billion from the U.S. and CA$900.81 million from Canada.

Estimated Discount To Fair Value: 48.2%

Trisura Group, valued at CA$41.55, trades below its estimated fair value of CA$80.18, indicating a potential undervaluation by over 20%. Despite significant insider selling and shareholder dilution in the past year, Trisura's earnings have grown by 385% over the previous year and are expected to continue growing significantly. Recent executive changes aim to strengthen its North American operations, suggesting strategic positioning for sustained growth amidst these financial dynamics.

- Our growth report here indicates Trisura Group may be poised for an improving outlook.

- Navigate through the intricacies of Trisura Group with our comprehensive financial health report here.

Turning Ideas Into Actions

- Gain an insight into the universe of 24 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trisura Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TSU

Trisura Group

A specialty insurance company, operates in the surety, risk solutions, corporate insurance, and reinsurance businesses in Canada, the United States, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives