What Sun Life Financial (TSX:SLF)'s Asset Management Leadership Reshuffle Means For Shareholders

Reviewed by Sasha Jovanovic

- Sun Life Financial recently named Tom Murphy as President of its newly unified asset management division, which now consolidates MFS, SLC Management, Aditya Birla Sun Life Asset Management, and the pension risk transfer business as part of an organizational restructure to accelerate growth and collaboration across its global asset management operations.

- This move signals Sun Life's intent to streamline leadership and unlock synergies within its asset management platform, with financial results transitioning to the new structure in 2026.

- We'll explore how consolidating asset management leadership under Tom Murphy may influence Sun Life's long-term earnings and expansion narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sun Life Financial Investment Narrative Recap

Sun Life's investment case centers on its ability to drive consistent growth through diversified global operations, including asset management, insurance, and wealth solutions. The recent unification of its asset management businesses under Tom Murphy is a structural shift aimed at building scale and accelerating collaboration, yet is unlikely to meaningfully impact near-term catalysts, such as margin improvements from Asian market growth or immediate headwinds in U.S. Dental. The main risk remains persistent pressure on MFS net flows and U.S. Dental earnings, which could temper earnings momentum.

Among recent announcements, David Healy's promotion to President of Sun Life U.S. is most relevant, as leadership continuity in the U.S. Dental and Benefits business could have implications for margin stabilization over the next year. With U.S. operations facing pressure from regulatory and Medicaid funding changes, operational consistency is critical for supporting recovery in challenged segments.

Yet, against these leadership changes, the continued risk of slower-than-expected U.S. Dental repricing is a key concern that investors should be aware of...

Read the full narrative on Sun Life Financial (it's free!)

Sun Life Financial's outlook anticipates CA$49.3 billion in revenue and CA$4.5 billion in earnings by 2028. This forecast is based on a 13.0% annual revenue growth rate and an increase in earnings of CA$1.3 billion from the current CA$3.2 billion.

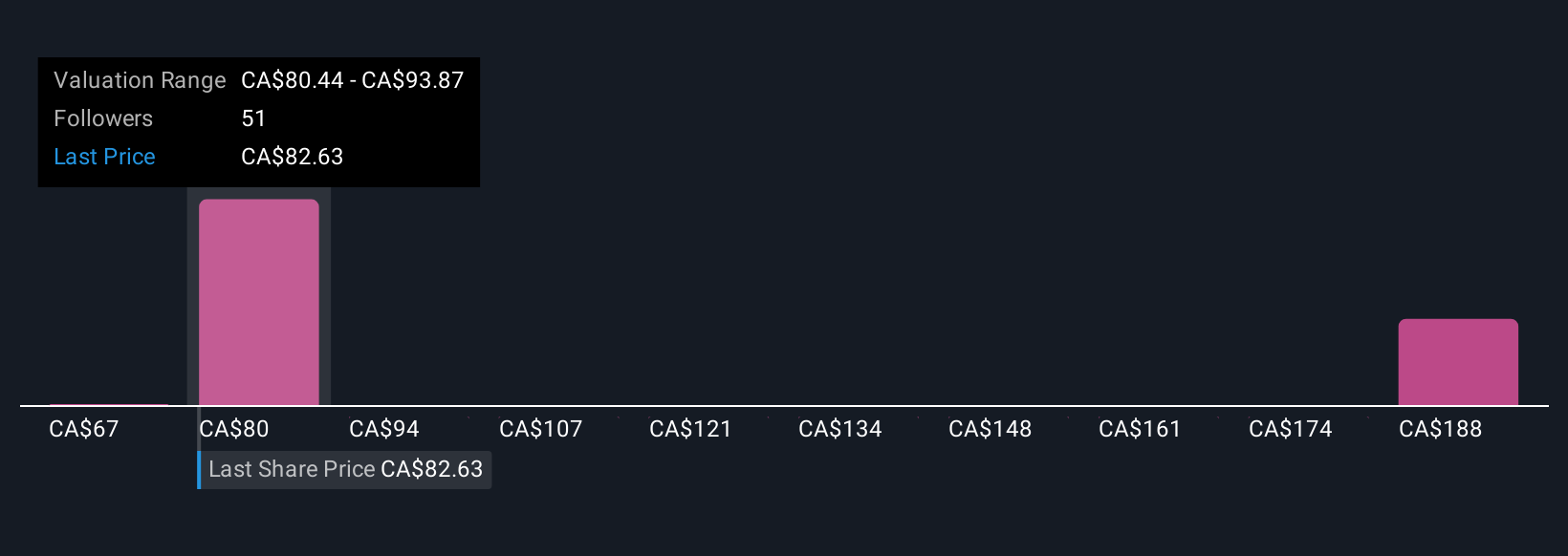

Uncover how Sun Life Financial's forecasts yield a CA$87.17 fair value, in line with its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from CA$76.91 to CA$203.87, showing broad disagreement on Sun Life’s future. Opinions are just as split regarding the risk of further earnings weakness in U.S. operations, so it pays to examine several viewpoints.

Explore 5 other fair value estimates on Sun Life Financial - why the stock might be worth over 2x more than the current price!

Build Your Own Sun Life Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Life Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sun Life Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Life Financial's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives