Sun Life (TSX:SLF) Valuation After $1 Billion Subordinated Debenture Move for Future Growth

Reviewed by Simply Wall St

Sun Life Financial (TSX:SLF) just moved to raise CA$1 billion through subordinated unsecured debentures, a financing step that strengthens its Tier 2 capital and signals confidence in funding future growth and acquisitions.

See our latest analysis for Sun Life Financial.

The timing of this CA$1 billion issue lines up with a stock that has cooled off in the short term, with a 30 day share price return of minus 5.88 percent and a year to date share price return of minus 4.97 percent, but still has a three year total shareholder return of 46.03 percent, suggesting that longer term momentum remains intact even as the market reassesses near term risks and M&A ambitions.

If this kind of balance between stability and growth appeals to you, it could be worth scanning other established insurers and asset managers via our healthcare stocks discovery tool.

With Sun Life trading below consensus targets yet boasting robust multi year returns and fresh firepower for acquisitions, are investors overlooking a compelling entry point, or has the market already baked in the next leg of growth?

Most Popular Narrative Narrative: 11.2% Undervalued

With the narrative assigning a higher fair value than Sun Life Financial's last close of CA$80.70, the gap centers on how durable future growth really is.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$49.3 billion, earnings will come to CA$4.5 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 6.0%.

Curious what powers that revenue climb, profit step up, and lower future multiple all at once? The narrative hides a precise earnings roadmap behind this fair value.

Result: Fair Value of $90.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if U.S. Dental headwinds persist or MFS outflows deepen, earnings could undershoot expectations and force a reconsideration of the undervalued narrative.

Find out about the key risks to this Sun Life Financial narrative.

Another Angle on Valuation

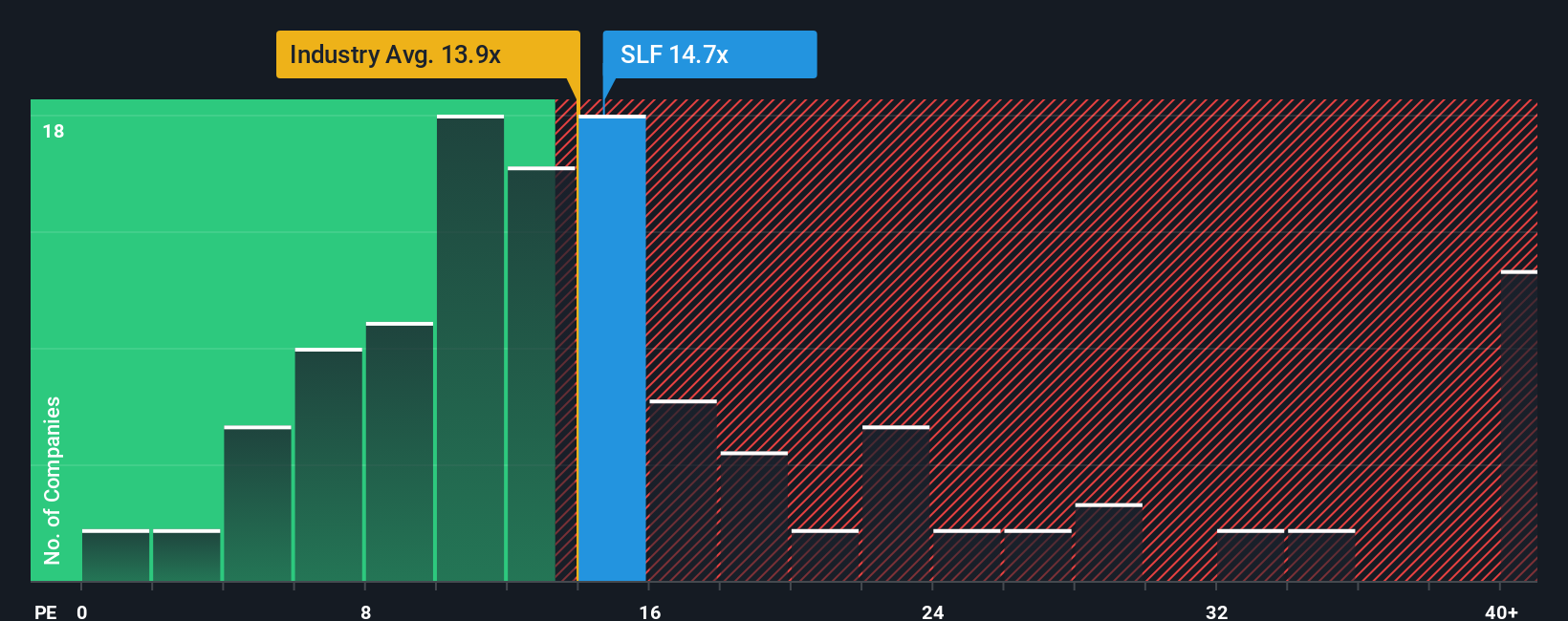

On simple earnings yardsticks, Sun Life does not look cheap. Its price to earnings ratio of about 15 times sits above both peers at 14.5 times and a fair ratio of 14.6 times, implying limited margin of safety if growth or sentiment cool from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sun Life Financial Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes at Do it your way.

A great starting point for your Sun Life Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing move?

Before the market’s next upswing leaves you watching from the sidelines, put Simply Wall Street’s screener to work and line up your next round of ideas today.

- Capture potential mispricings early by scanning these 927 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Target income you can count on by focusing on these 14 dividend stocks with yields > 3% that balance solid yields with sustainable payout profiles.

- Position yourself at the frontier of digital finance by tracking these 81 cryptocurrency and blockchain stocks shaping payments, blockchain infrastructure, and tokenization trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026