Canadian Imperial Bank of Commerce And 2 Other TSX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has risen by 1.4%, contributing to a remarkable 28% climb over the past year, with earnings forecasted to grow by 16% annually. In this thriving environment, dividend stocks like Canadian Imperial Bank of Commerce offer potential for portfolio enhancement through steady income and long-term growth prospects.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.08% | ★★★★★★ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.12% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 7.31% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.07% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.31% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.12% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.49% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.28% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.11% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.26% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients across Canada, the United States, and internationally, with a market cap of approximately CA$81.68 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue through segments including Canadian Personal and Business Banking (CA$8.80 billion), Capital Markets and Direct Financial Services (CA$5.61 billion), U.S. Commercial Banking and Wealth Management (CA$2.02 billion), and Canadian Commercial Banking and Wealth Management (CA$5.46 billion).

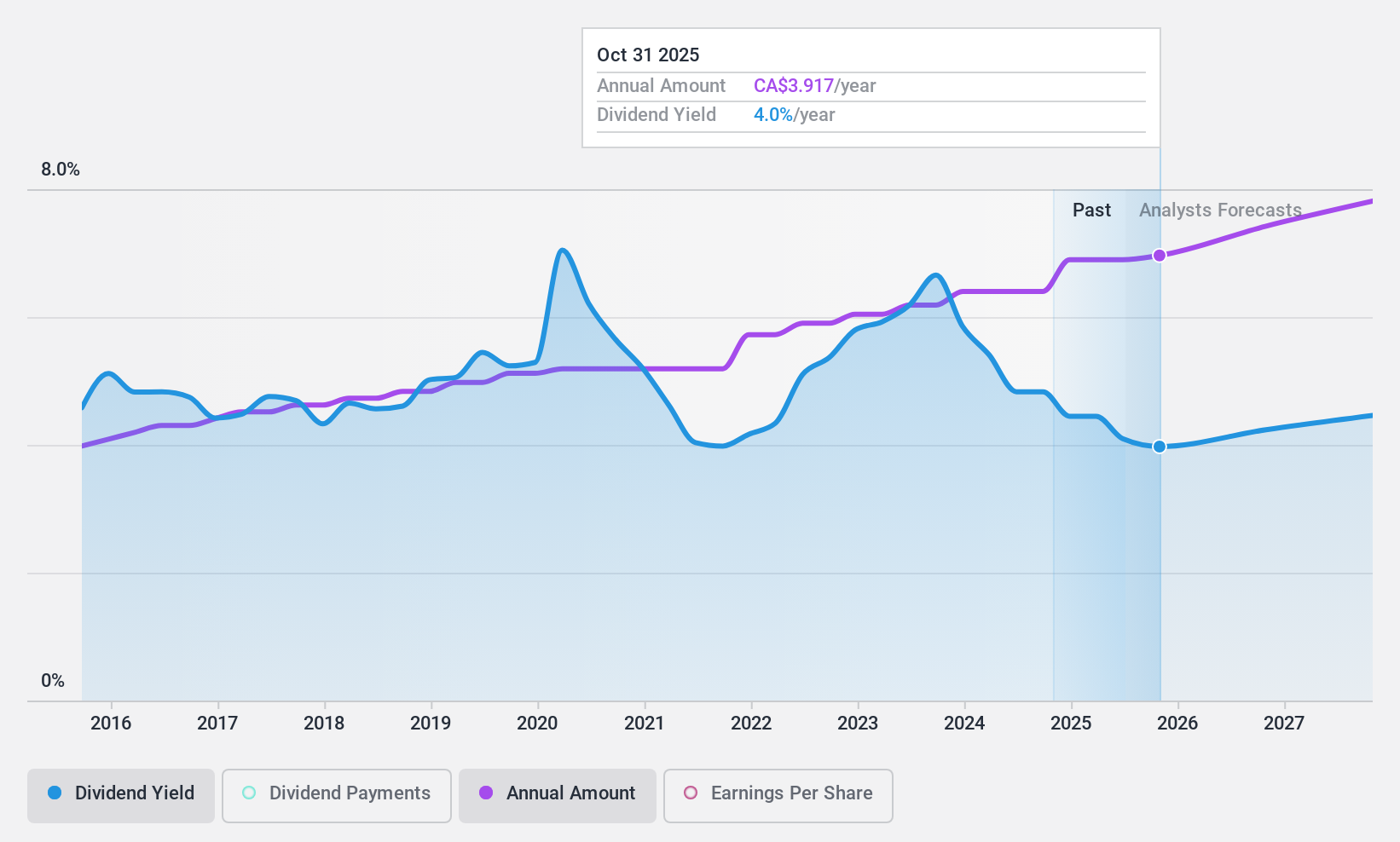

Dividend Yield: 4.2%

Canadian Imperial Bank of Commerce offers a stable dividend with a payout ratio of 51.7%, indicating sustainability, and has consistently increased dividends over the past decade. However, its dividend yield of 4.16% is lower than the top Canadian payers. Recent insider selling could be a concern for investors. The bank's strategic initiatives, including new product offerings and leadership changes, aim to enhance growth and shareholder value amidst ongoing fixed-income activities and share repurchase plans.

- Click to explore a detailed breakdown of our findings in Canadian Imperial Bank of Commerce's dividend report.

- The analysis detailed in our Canadian Imperial Bank of Commerce valuation report hints at an deflated share price compared to its estimated value.

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company operating in Canada and the United States with a market cap of CA$2.34 billion.

Operations: Russel Metals Inc.'s revenue is primarily derived from its Metals Service Centers segment at CA$2.84 billion, followed by the Energy Field Stores at CA$984 million and Steel Distributors at CA$413.80 million.

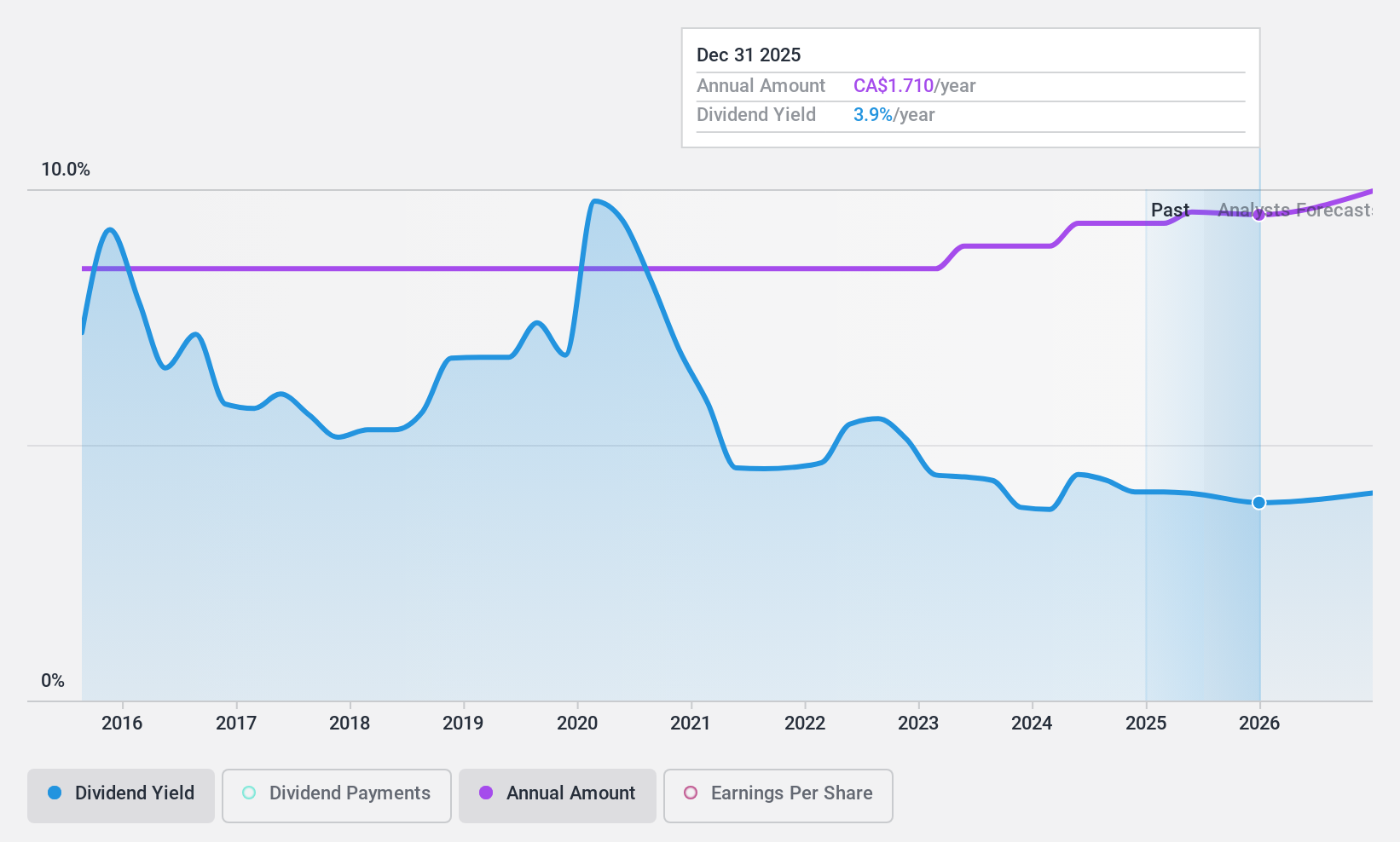

Dividend Yield: 4.1%

Russel Metals Inc. maintains a stable dividend, supported by a low cash payout ratio of 39.6%, ensuring coverage by both earnings and cash flows. Despite its dividend yield of 4.12% being lower than top Canadian payers, the company has consistently increased dividends over the past decade with minimal volatility. Recent actions include redeeming $150 million in senior notes and announcing a share repurchase program, reflecting proactive capital management to sustain shareholder returns amidst fluctuating earnings performance.

- Unlock comprehensive insights into our analysis of Russel Metals stock in this dividend report.

- According our valuation report, there's an indication that Russel Metals' share price might be on the cheaper side.

Sun Life Financial (TSX:SLF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a financial services company offering savings, retirement, and pension products globally, with a market cap of CA$45.49 billion.

Operations: Sun Life Financial Inc. generates revenue through its segments in Asia (CA$4.20 billion), Canada (CA$17.81 billion), Corporate (CA$420 million), Asset Management (CA$6.39 billion), and the United States (U.S.) (CA$13.72 billion).

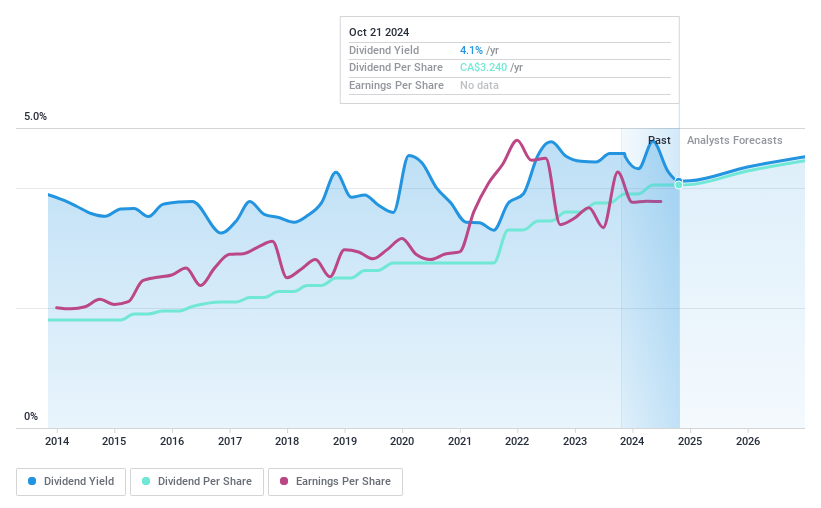

Dividend Yield: 4.1%

Sun Life Financial offers a stable dividend, supported by a reasonable payout ratio of 59% and a cash payout ratio of 48.5%, ensuring coverage by earnings and cash flows. Despite its 4.11% yield being below top Canadian payers, dividends have grown steadily over the past decade with little volatility. Recent leadership changes aim to enhance digital innovation and strategic growth, potentially strengthening Sun Life's long-term financial health and dividend sustainability.

- Get an in-depth perspective on Sun Life Financial's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Sun Life Financial's share price might be too pessimistic.

Make It Happen

- Access the full spectrum of 29 Top TSX Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sun Life Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives