- Canada

- /

- Trade Distributors

- /

- TSX:WJX

TSX Dividend Stocks Including Canadian Imperial Bank of Commerce Lead Income Opportunities

Reviewed by Simply Wall St

As the global economy navigates through a period of moderated growth and geopolitical uncertainties, the Canadian market remains a focal point for investors seeking stability and income. In this environment, dividend stocks on the Toronto Stock Exchange (TSX), such as those from established financial institutions like Canadian Imperial Bank of Commerce, present appealing opportunities for generating steady income amidst fluctuating interest rates and economic conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 3.95% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.05% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.51% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 8.97% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.54% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.43% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.19% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.03% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.45% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.50% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

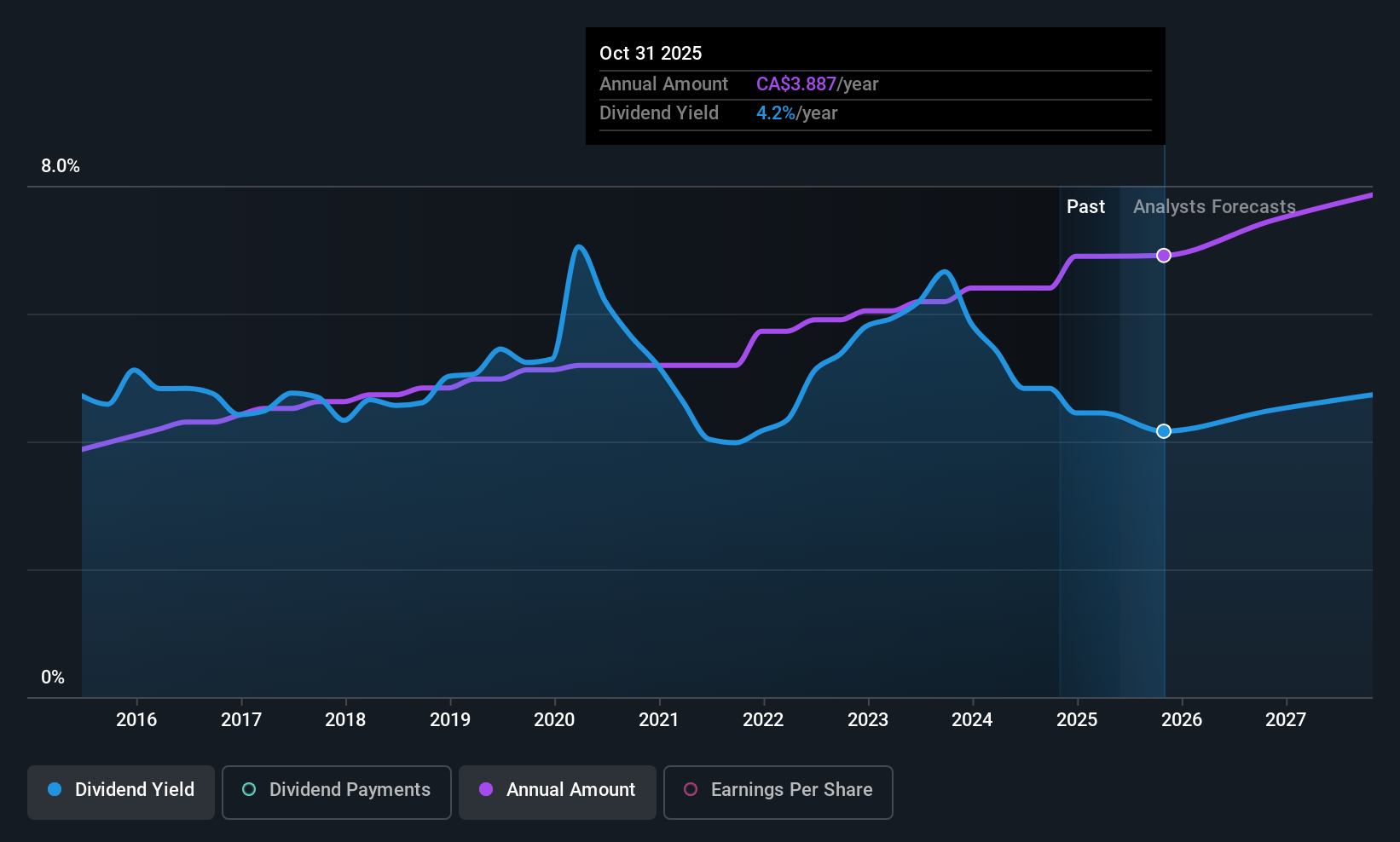

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally with a market cap of CA$90.07 billion.

Operations: Canadian Imperial Bank of Commerce's revenue is primarily derived from Canadian Personal and Business Banking (CA$9.29 billion), Capital Markets (CA$6.21 billion), Canadian Commercial Banking and Wealth Management (CA$6.02 billion), and U.S. Commercial Banking and Wealth Management (CA$2.74 billion).

Dividend Yield: 4%

Canadian Imperial Bank of Commerce's recent financials show strong earnings growth, with net income reaching C$1.99 billion in Q2 2025. The bank maintains a stable dividend, recently declaring C$0.97 per share for the upcoming quarter, supported by a sustainable payout ratio of 46.9%. Despite trading below estimated fair value, its dividend yield is lower than top Canadian payers. Recent fixed-income offerings and preferred stock buybacks indicate strategic capital management efforts to support ongoing dividend stability and shareholder returns.

- Get an in-depth perspective on Canadian Imperial Bank of Commerce's performance by reading our dividend report here.

- Our valuation report unveils the possibility Canadian Imperial Bank of Commerce's shares may be trading at a discount.

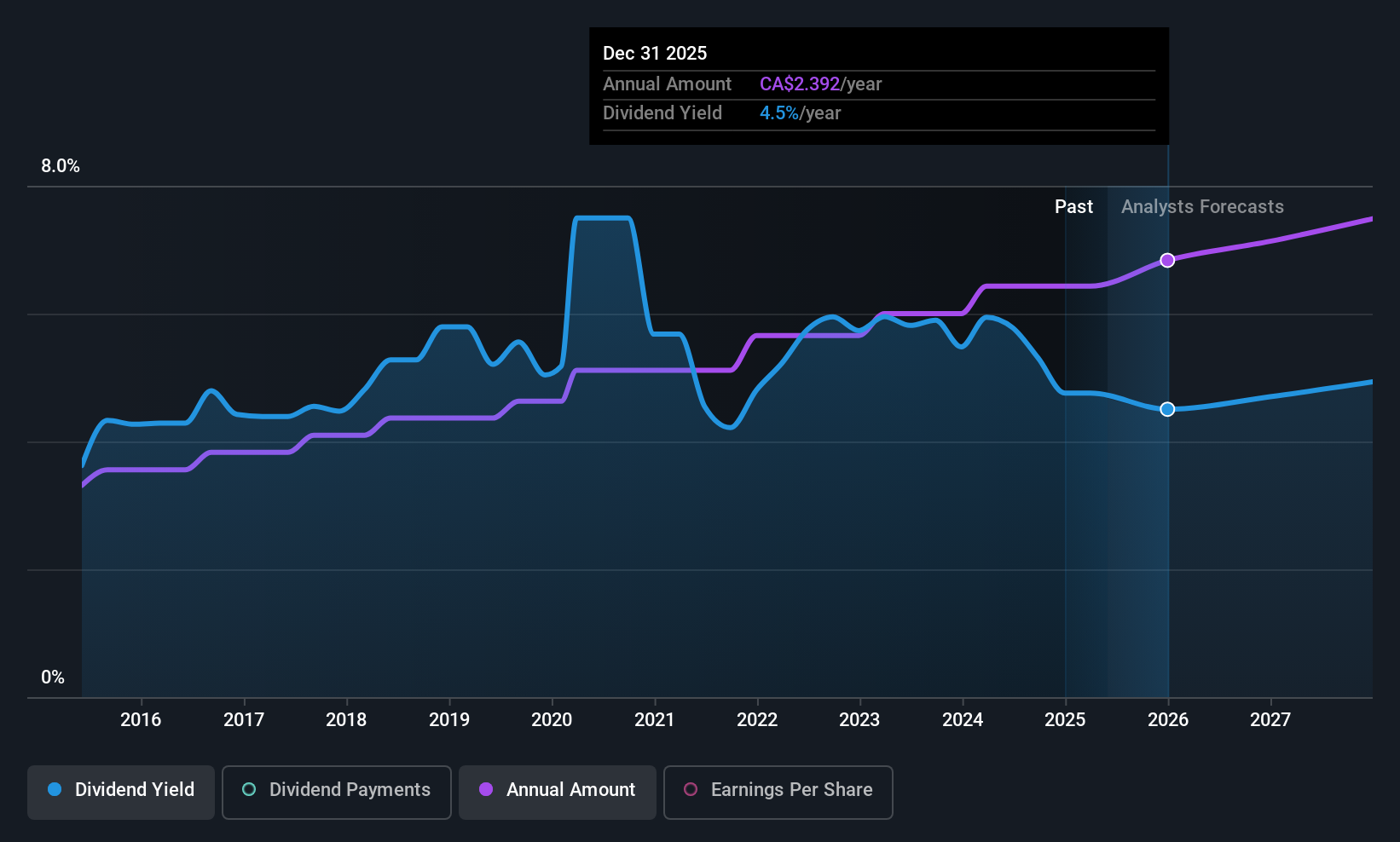

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada is an international management and holding company offering financial services across North America, Europe, and Asia with a market cap of CA$34.38 billion.

Operations: Power Corporation of Canada's revenue segments include CA$3.56 billion from IGM, CA$31.02 billion from Lifeco, and CA$2.39 billion from Alternative Asset Investment Platforms.

Dividend Yield: 4.5%

Power Corporation of Canada offers a stable dividend, currently at CAD 0.6125 per share, with a reliable history over the past decade. The company's payout ratio of 53.4% ensures dividends are covered by earnings, while a cash payout ratio of 35.2% confirms coverage by cash flows. Although its yield is below the top Canadian payers, it trades at a significant discount to fair value and has recently completed a CAD 68 million share buyback program, reflecting strong capital management practices.

- Click to explore a detailed breakdown of our findings in Power Corporation of Canada's dividend report.

- According our valuation report, there's an indication that Power Corporation of Canada's share price might be on the cheaper side.

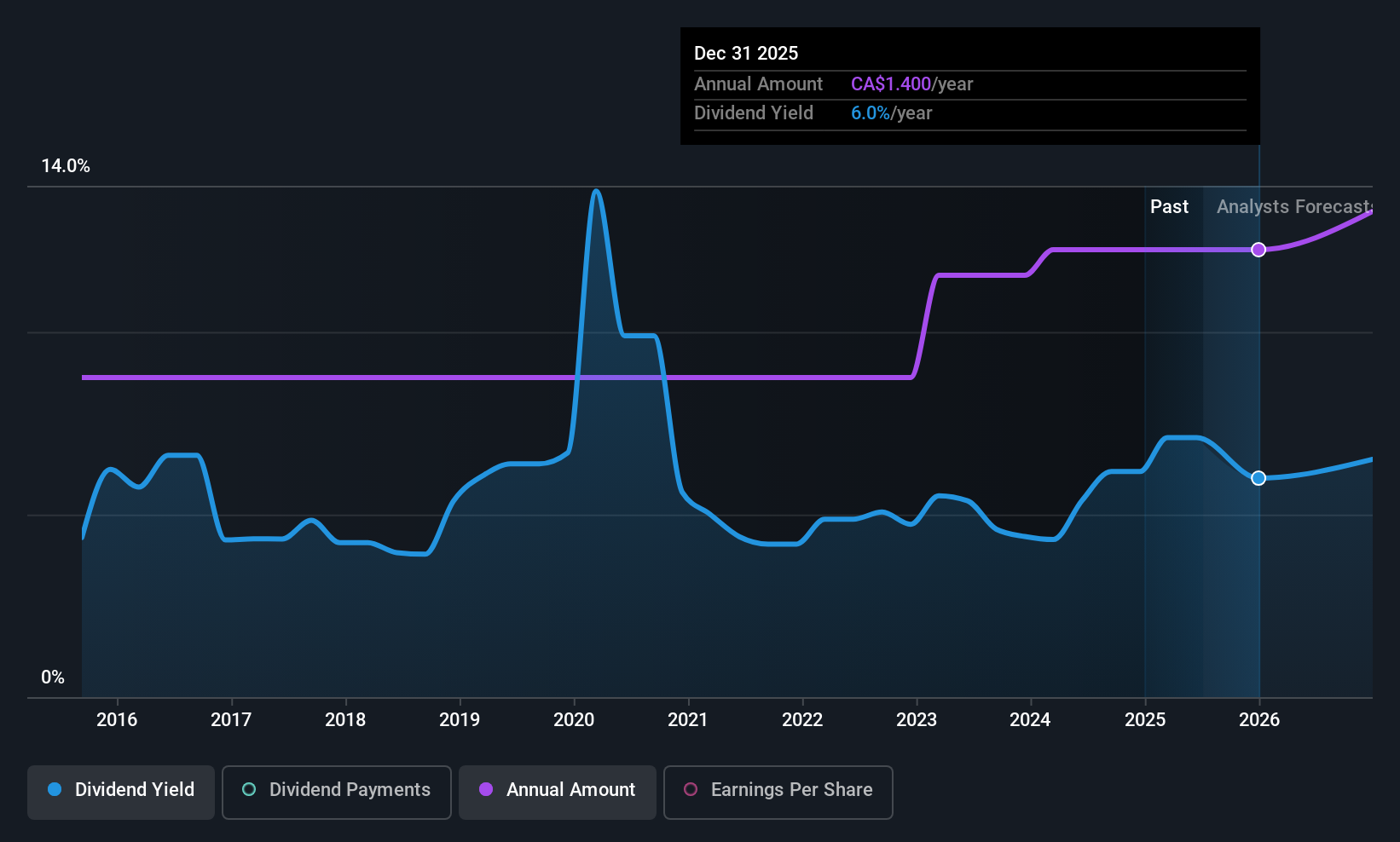

Wajax (TSX:WJX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wajax Corporation offers industrial products and services across Canada, with a market cap of approximately CA$493.70 million.

Operations: Wajax Corporation generates revenue primarily through its Wholesale - Machinery & Industrial Equipment segment, which accounts for CA$2.17 billion.

Dividend Yield: 6.3%

Wajax's dividend, recently declared at CAD 0.35 per share, is well-covered by cash flows with a low cash payout ratio of 30.9%, though its history shows volatility and a declining trend over the past decade. The payout ratio stands at 73.9%, indicating coverage by earnings despite fluctuating profits and reduced net margins this year. While trading below estimated fair value, interest payments are not well covered by earnings, posing potential concerns for financial stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Wajax.

- Upon reviewing our latest valuation report, Wajax's share price might be too pessimistic.

Make It Happen

- Gain an insight into the universe of 27 Top TSX Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wajax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WJX

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives