Over the last 7 days, the Canadian market has risen 2.0% and is up 13% over the last 12 months, with earnings expected to grow by 15% per annum over the next few years. In this favorable environment, identifying top dividend stocks that offer consistent returns and growth potential can be a strategic move for investors looking to capitalize on these trends.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.38% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.50% | ★★★★★☆ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.52% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.40% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.74% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.52% | ★★★★★☆ |

| iA Financial (TSX:IAG) | 3.11% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.51% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.26% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.37% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

iA Financial (TSX:IAG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: iA Financial Corporation Inc. provides insurance and wealth management services in Canada and the United States, with a market cap of CA$9.82 billion.

Operations: iA Financial Corporation Inc. generates revenue from various segments, including CA$3.95 billion from Insurance in Canada, CA$2.42 billion from Wealth Management, CA$1.62 billion from US Operations, and CA$517 million from Investments.

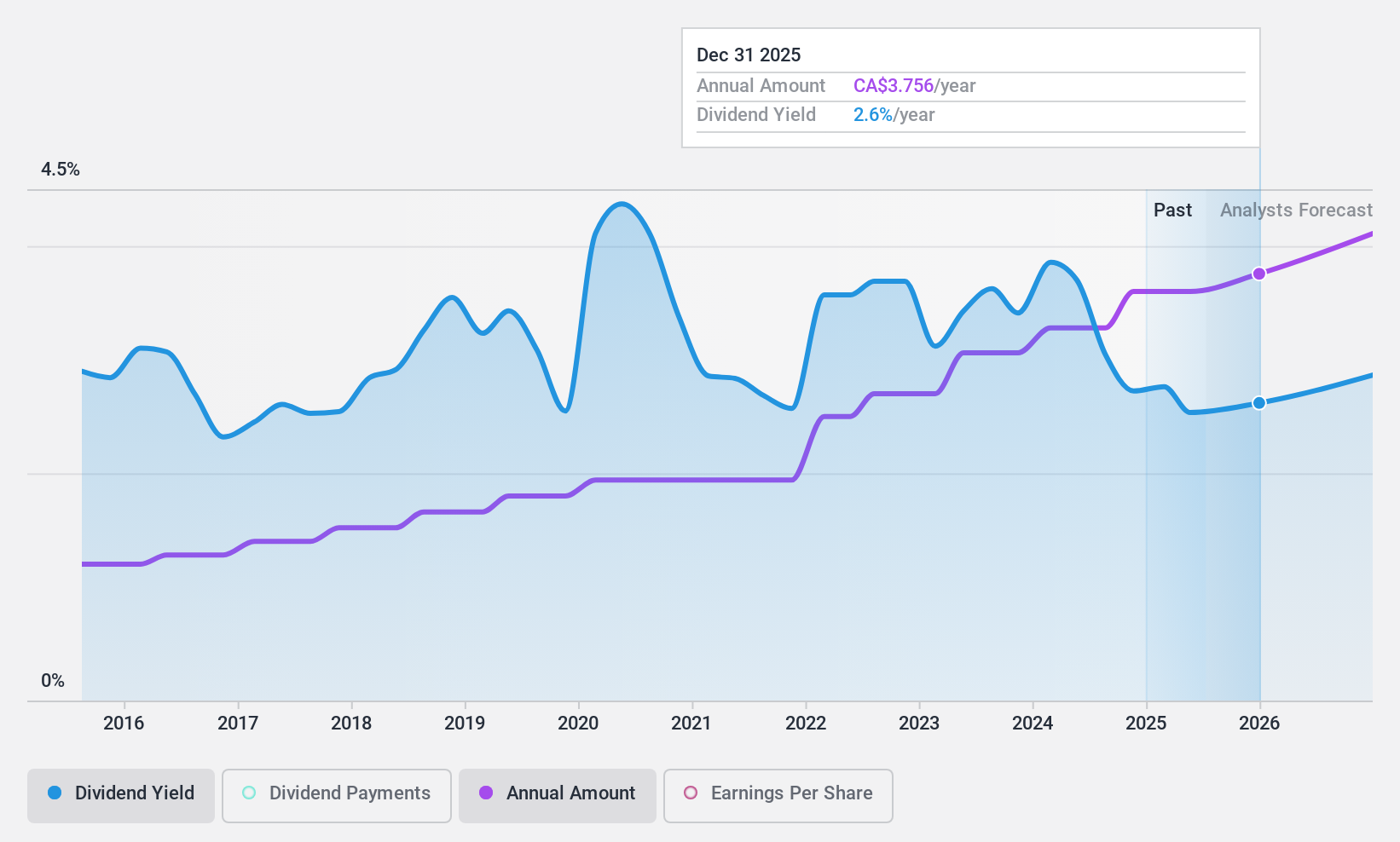

Dividend Yield: 3.1%

iA Financial's dividend payments have been stable and increasing over the past decade, supported by a low payout ratio of 43% and a cash payout ratio of 16.9%. The company’s recent strategic partnership with IG Wealth Management enhances its market position. Despite a lower-than-top-tier dividend yield of 3.11%, iA remains attractive due to its reliable and well-covered dividends, trading significantly below estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of iA Financial.

- According our valuation report, there's an indication that iA Financial's share price might be on the cheaper side.

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers financial services to individuals, businesses, institutional clients, and governments both domestically and internationally, with a market cap of CA$43.51 billion.

Operations: National Bank of Canada's revenue segments include Wealth Management (CA$2.70 billion), Personal and Commercial (CA$4.41 billion), Financial Markets excluding USSF&I (CA$2.96 billion), and U.S. Specialty Finance and International (USSF&I) (CA$1.21 billion).

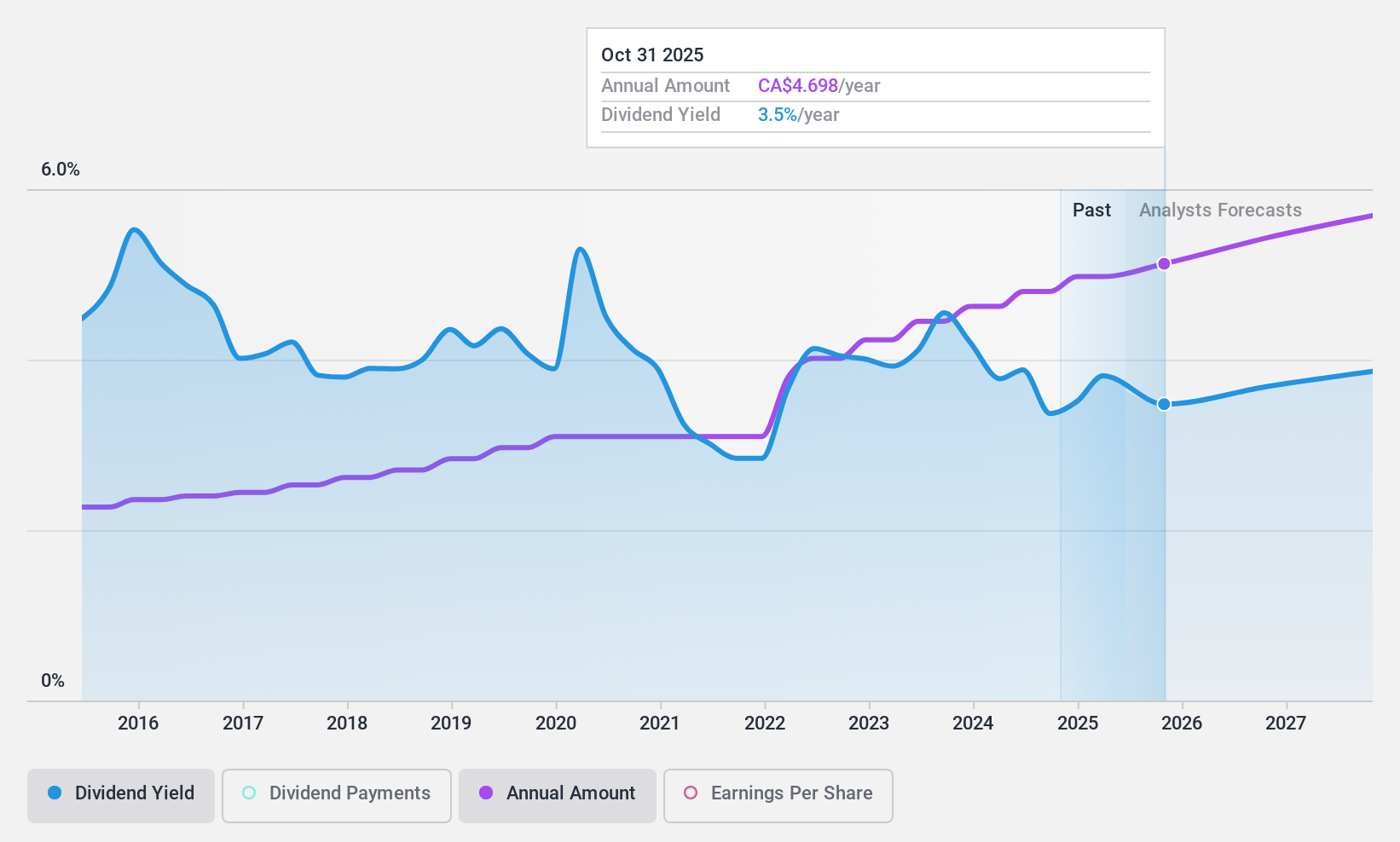

Dividend Yield: 3.4%

National Bank of Canada offers a reliable dividend yield of 3.44%, supported by a low payout ratio of 41%. Recent earnings growth and stable dividend payments over the past decade underscore its commitment to shareholders. The company declared quarterly dividends on various preferred shares and $1.10 per common share, payable in November 2024. Additionally, a CAD 5 billion shelf registration filing indicates potential future capital raises, enhancing its financial flexibility for sustaining dividends.

- Click here to discover the nuances of National Bank of Canada with our detailed analytical dividend report.

- Our valuation report unveils the possibility National Bank of Canada's shares may be trading at a discount.

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada (TSX:POW) is an international management and holding company that provides financial services across North America, Europe, and Asia, with a market cap of CA$26.66 billion.

Operations: Power Corporation of Canada's revenue segments include Lifeco (CA$26.23 billion), Power Financial - IGM (CA$3.65 billion), Holding Company (CA$83 million), and Alternative Asset Investment Platforms and Other (CA$1.69 billion).

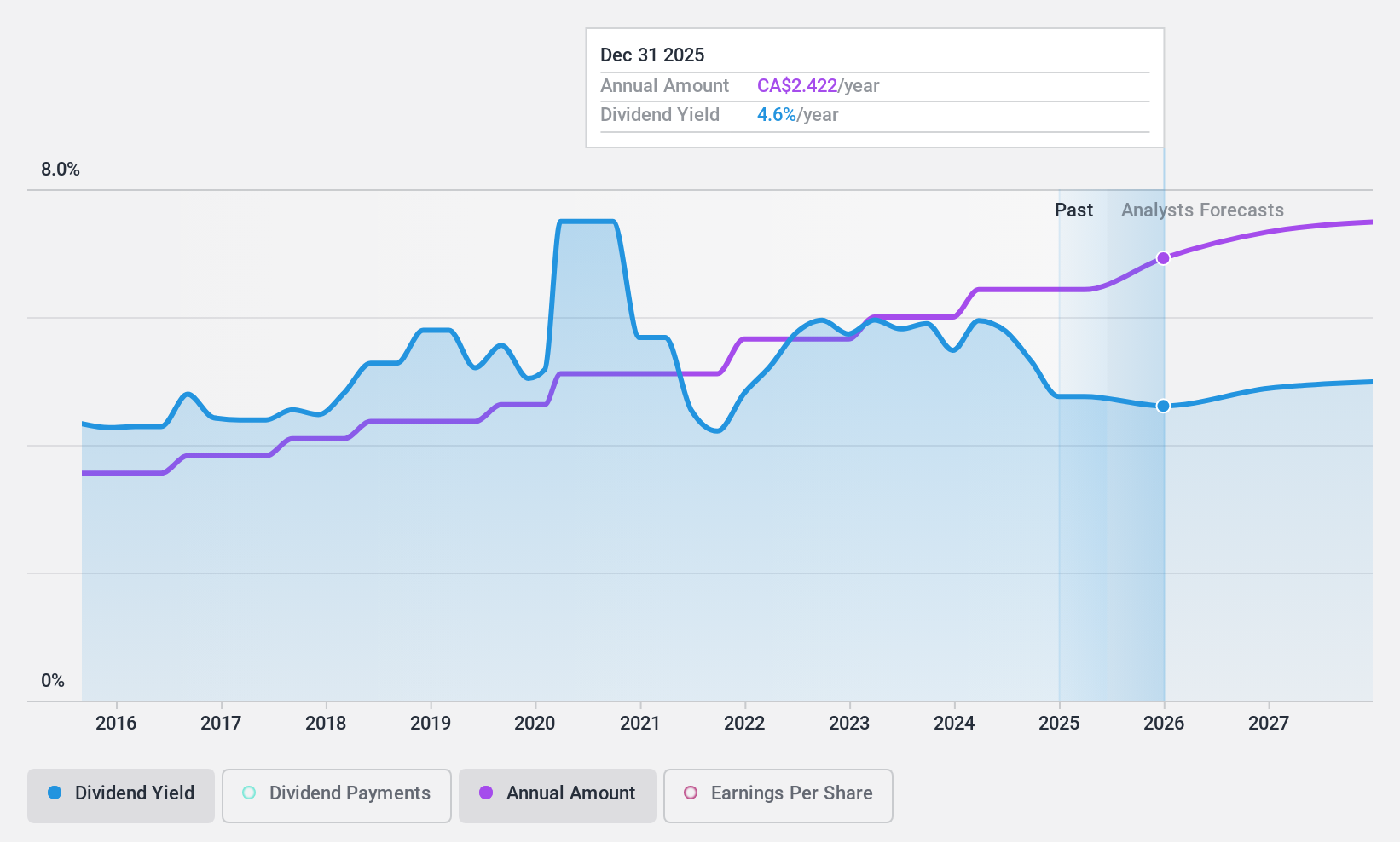

Dividend Yield: 5.4%

Power Corporation of Canada provides a stable dividend yield of 5.36%, supported by low payout ratios (earnings: 47.8%, cash flow: 33.4%). The company has consistently increased dividends over the past decade and reported significant earnings growth, with net income reaching CAD 1.47 billion for the first half of 2024. Recent buybacks and quarterly dividends on various preferred shares further highlight its commitment to returning value to shareholders while maintaining financial health.

- Dive into the specifics of Power Corporation of Canada here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Power Corporation of Canada is priced lower than what may be justified by its financials.

Summing It All Up

- Unlock more gems! Our Top TSX Dividend Stocks screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Top TSX Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IAG

iA Financial

Provides insurance and wealth management services for individual and group basis in Canada and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives