Stock Analysis

Exploring Power Corporation Of Canada And Two Other TSX Dividend Stocks

Reviewed by Simply Wall St

The Canadian market has shown resilience, remaining stable in the past week and achieving a 12% increase over the last year, with earnings expected to grow by 14% annually. In this environment, dividend stocks like Power Corporation of Canada can be particularly appealing for investors seeking steady income and potential growth.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.53% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.10% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.56% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.59% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.59% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.64% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.39% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.06% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.84% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.69% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

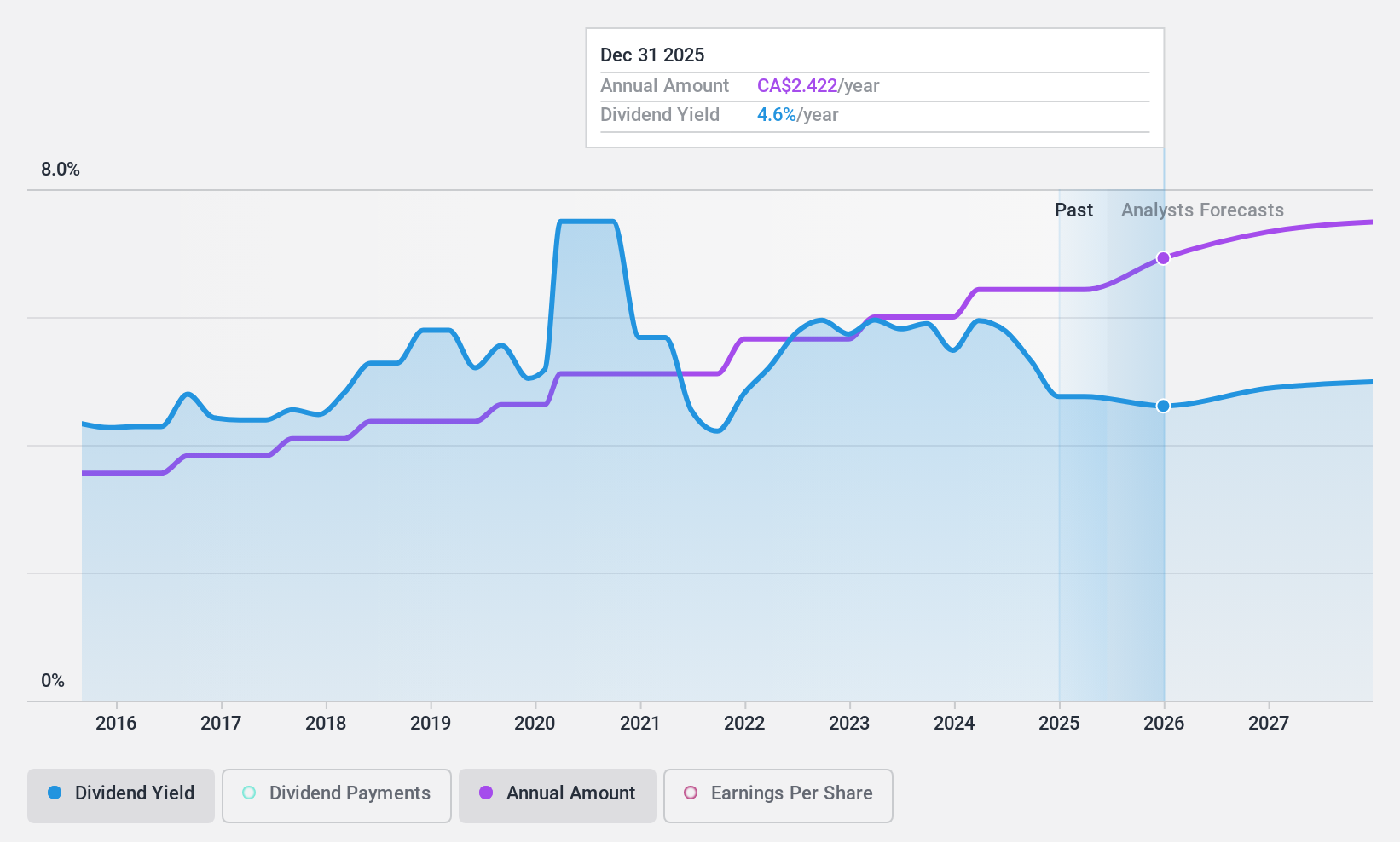

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company, operates in the financial services sector across North America, Europe, and Asia with a market capitalization of CA$25.96 billion.

Operations: Power Corporation of Canada generates its revenue primarily through Lifeco at CA$23.51 billion, Power Financial - IGM at CA$3.67 billion, and Alternative Asset Investment Platforms at CA$1.59 billion.

Dividend Yield: 5.6%

Power Corporation of Canada (POW) maintains a stable dividend profile with a 5.59% yield, supported by a payout ratio of 49.9% and a cash payout ratio of 28.4%, indicating that dividends are well-covered by both earnings and cash flow. Despite trading at 37.2% below its estimated fair value, POW's dividend yield is lower than the top quartile in the Canadian market, which stands at 6.46%. Recent financials show significant growth with net income rising to CAD 722 million in Q1 2024 from CAD 326 million year-over-year, reflecting strong operational performance.

- Click here to discover the nuances of Power Corporation of Canada with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Power Corporation of Canada shares in the market.

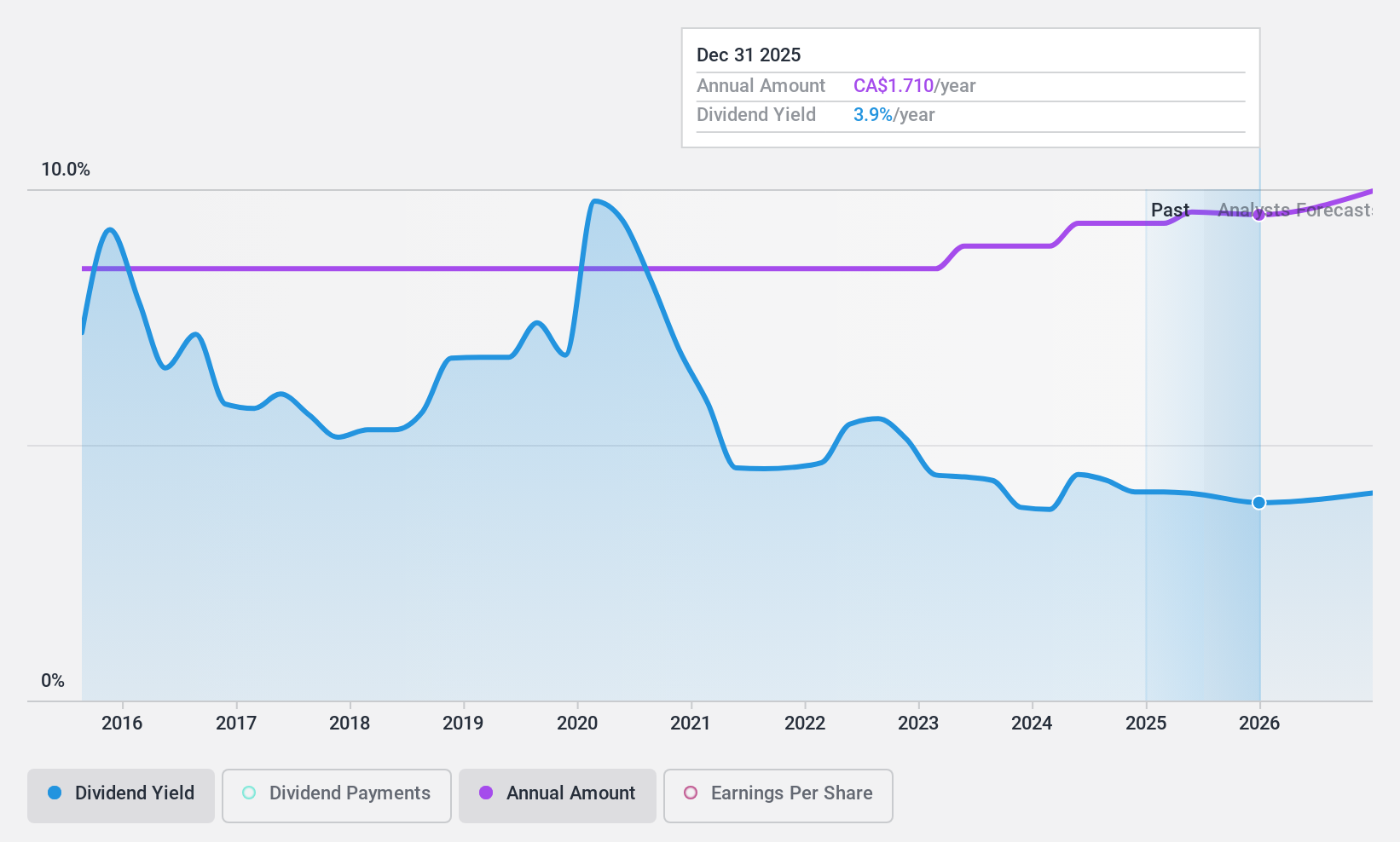

Russel Metals (TSX:RUS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a Canada-based company specializing in metal distribution and processing across Canada and the United States, with a market capitalization of approximately CA$2.31 billion.

Operations: Russel Metals Inc. generates its revenue primarily through three segments: Metals Service Centers at CA$2.95 billion, Energy Field Stores at CA$982.20 million, and Steel Distributors at CA$429 million.

Dividend Yield: 4.4%

Russel Metals Inc. has recently increased its quarterly dividend to CA$0.42 per share, despite a decline in Q1 2024 sales to CA$1.06 billion and net income to CA$49.7 million from the previous year. The company's dividends are well-supported by a payout ratio of 40.3% and a cash payout ratio of 32.1%, ensuring sustainability even with lower earnings figures this quarter. Additionally, Russel Metals completed a share buyback program, repurchasing shares worth CA$52.3 million and redeemed all its outstanding senior notes using available cash reserves, indicating strong liquidity management.

- Delve into the full analysis dividend report here for a deeper understanding of Russel Metals.

- The analysis detailed in our Russel Metals valuation report hints at an deflated share price compared to its estimated value.

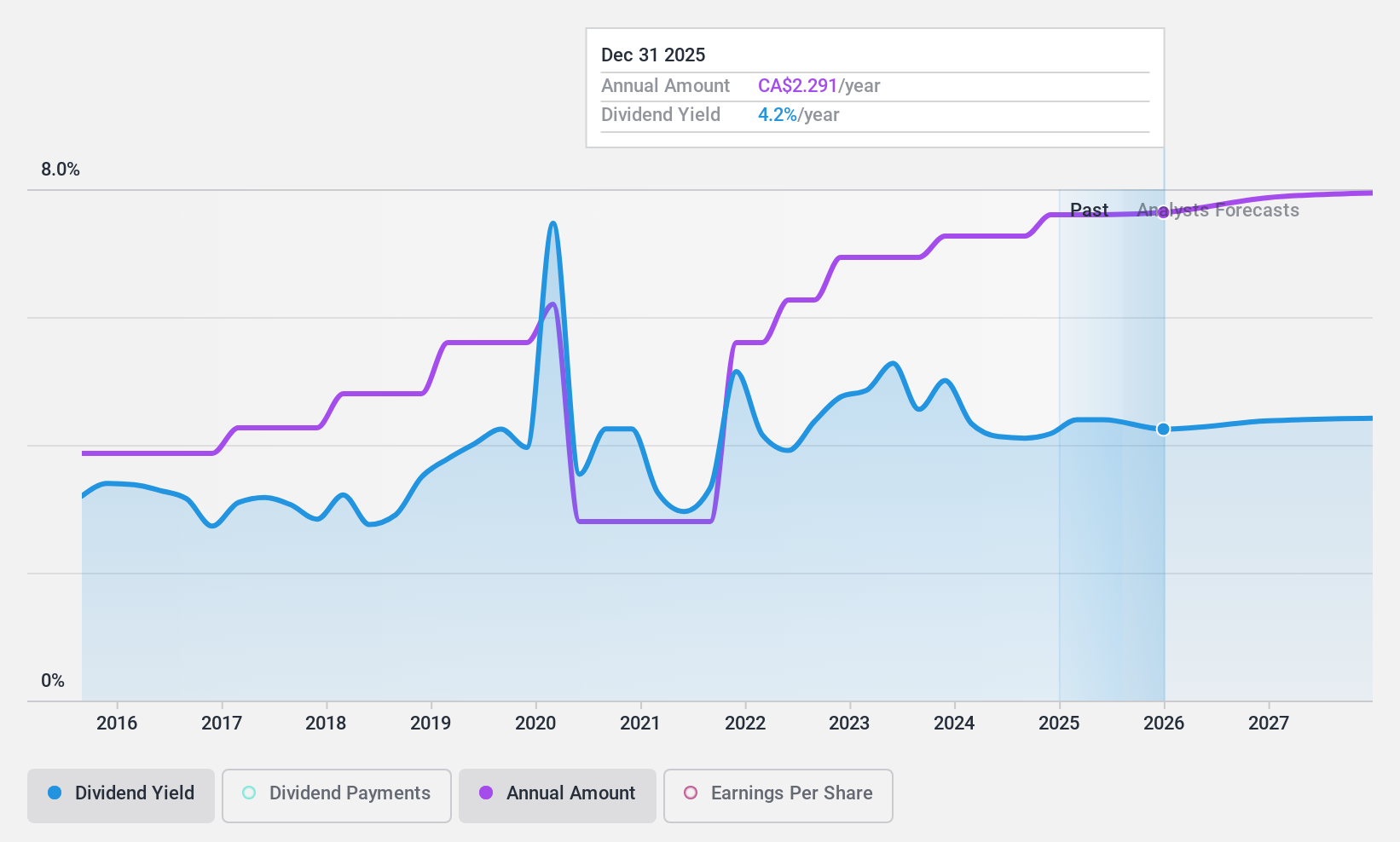

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market capitalization of CA$71.27 billion.

Operations: Suncor Energy's revenue is generated through three primary segments: Oil Sands, which brought in CA$23.76 billion, Refining and Marketing at CA$31.51 billion, and Exploration and Production contributing CA$2.17 billion.

Dividend Yield: 4%

Suncor Energy recently declared a stable quarterly dividend of CA$0.545 per share, demonstrating commitment despite a volatile history in dividend consistency over the past decade. The company's dividends are well-supported by both earnings and cash flows, with payout ratios around 35.2%. However, it trades below its estimated fair value and faces an expected average earnings decline of 7.6% annually over the next three years. Recent shareholder votes rejected proposals for enhanced climate disclosures, reflecting ongoing governance dynamics that could influence future operations and investor sentiment.

- Get an in-depth perspective on Suncor Energy's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Suncor Energy is trading behind its estimated value.

Seize The Opportunity

- Take a closer look at our Top TSX Dividend Stocks list of 31 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Power Corporation of Canada is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, offers financial services in North America, Europe, and Asia.

Undervalued with solid track record and pays a dividend.