With EPS Growth And More, iA Financial (TSE:IAG) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like iA Financial (TSE:IAG), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide iA Financial with the means to add long-term value to shareholders.

View our latest analysis for iA Financial

How Quickly Is iA Financial Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. iA Financial managed to grow EPS by 11% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

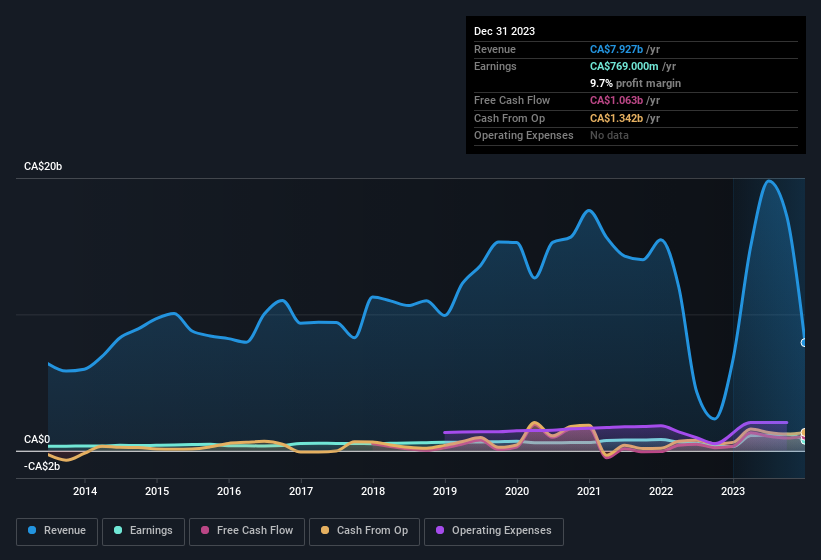

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of iA Financial's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The music to the ears of iA Financial shareholders is that EBIT margins have grown from 6.1% to 13% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for iA Financial's future profits.

Are iA Financial Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth CA$292k) this was overshadowed by a mountain of buying, totalling CA$1.4m in just one year. We find this encouraging because it suggests they are optimistic about iA Financial'sfuture. We also note that it was the company insider, Martin Gagnon, who made the biggest single acquisition, paying CA$864k for shares at about CA$86.44 each.

Should You Add iA Financial To Your Watchlist?

As previously touched on, iA Financial is a growing business, which is encouraging. It's not easy for business to grow EPS, but iA Financial has shown the strengths to do just that. The real kicker is that insiders have been accumulating, suggesting that those who understand the company best see some potential. Of course, just because iA Financial is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of iA Financial, you'll probably love this curated collection of companies in CA that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IAG

iA Financial

Provides insurance and wealth management services in Canada and the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives