As we approach the end of 2025, Canadian markets have shown robust performance with the TSX delivering a solid 27% gain in local currency terms, amid expectations that the Bank of Canada will maintain its current interest rate stance. With these market dynamics in mind, dividend stocks can be appealing for investors looking to balance their portfolios with stable income-generating assets, especially as we anticipate potential shifts in economic conditions and central bank policies.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Wajax (TSX:WJX) | 5.09% | ★★★★★☆ |

| Toronto-Dominion Bank (TSX:TD) | 3.54% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 14.51% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.47% | ★★★★★☆ |

| Pizza Pizza Royalty (TSX:PZA) | 6.04% | ★★★★☆☆ |

| Olympia Financial Group (TSX:OLY) | 6.39% | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | 7.55% | ★★★★☆☆ |

| Great-West Lifeco (TSX:GWO) | 3.83% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.42% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.72% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal provides diversified financial services primarily in North America, with a market cap of CA$126.98 billion.

Operations: Bank of Montreal's revenue segments include Capital Markets (CA$7.25 billion), Wealth Management (CA$5.29 billion), U.S. Personal and Commercial Banking (U.S. P&C) (CA$10.44 billion), and Canadian Personal and Commercial Banking (Canadian P&C) (CA$9.90 billion).

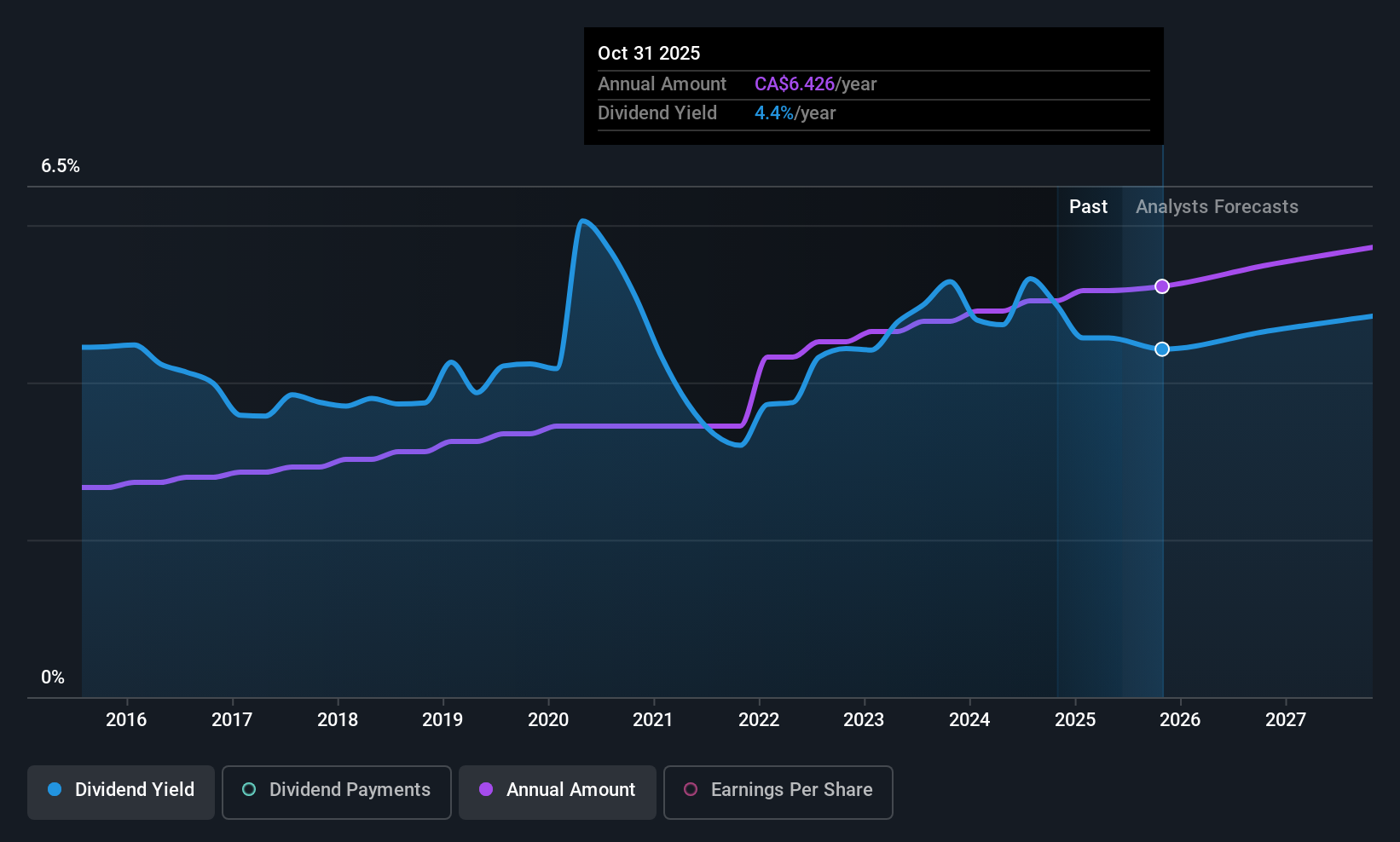

Dividend Yield: 3.7%

Bank of Montreal's dividend stock profile is marked by a stable and reliable history, with dividends growing over the past decade. The bank maintains a reasonable payout ratio of 56.2%, ensuring dividends are covered by earnings and forecasted to improve to 44.2% in three years. Despite trading below estimated fair value, its dividend yield of 3.72% lags behind Canada's top tier payers. Recent strategic moves include fixed-income offerings and a collaboration with Walmart Canada, underscoring BMO's focus on growth and client engagement initiatives.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Montreal.

- In light of our recent valuation report, it seems possible that Bank of Montreal is trading beyond its estimated value.

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally, with a market cap of approximately CA$1 billion.

Operations: Evertz Technologies Limited generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$502.13 million.

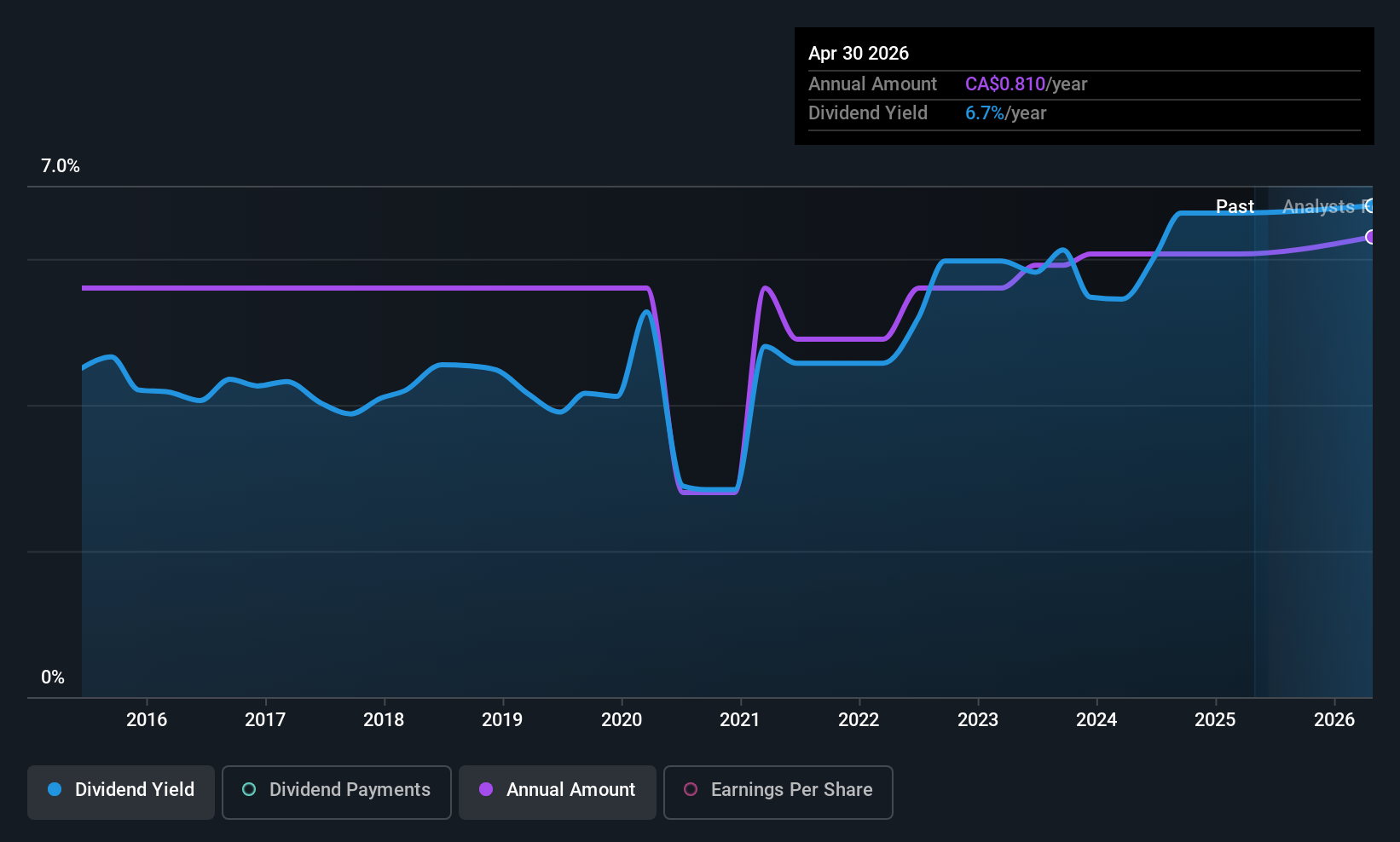

Dividend Yield: 6.1%

Evertz Technologies' dividend yield of 6.06% ranks among Canada's top payers, but sustainability is questionable due to a high payout ratio of 98.6%, not fully covered by earnings. Despite recent dividend increases and a reasonable cash payout ratio of 58.3%, historical volatility and unreliability persist. The company trades at a discount to estimated fair value and has repurchased shares worth C$5.8 million recently, while seeking acquisitions aligned with its strategic growth plan for shareholder value enhancement.

- Dive into the specifics of Evertz Technologies here with our thorough dividend report.

- The analysis detailed in our Evertz Technologies valuation report hints at an deflated share price compared to its estimated value.

Great-West Lifeco (TSX:GWO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Great-West Lifeco Inc. operates in life and health insurance, retirement savings, wealth and asset management, and reinsurance across Canada, the United States, and Europe with a market cap of CA$57.93 billion.

Operations: Great-West Lifeco's revenue is derived from its operations in Canada (CA$17.88 billion), Europe (CA$8.23 billion), the United States (CA$6.41 billion), and Capital and Risk Solutions (CA$5.31 billion).

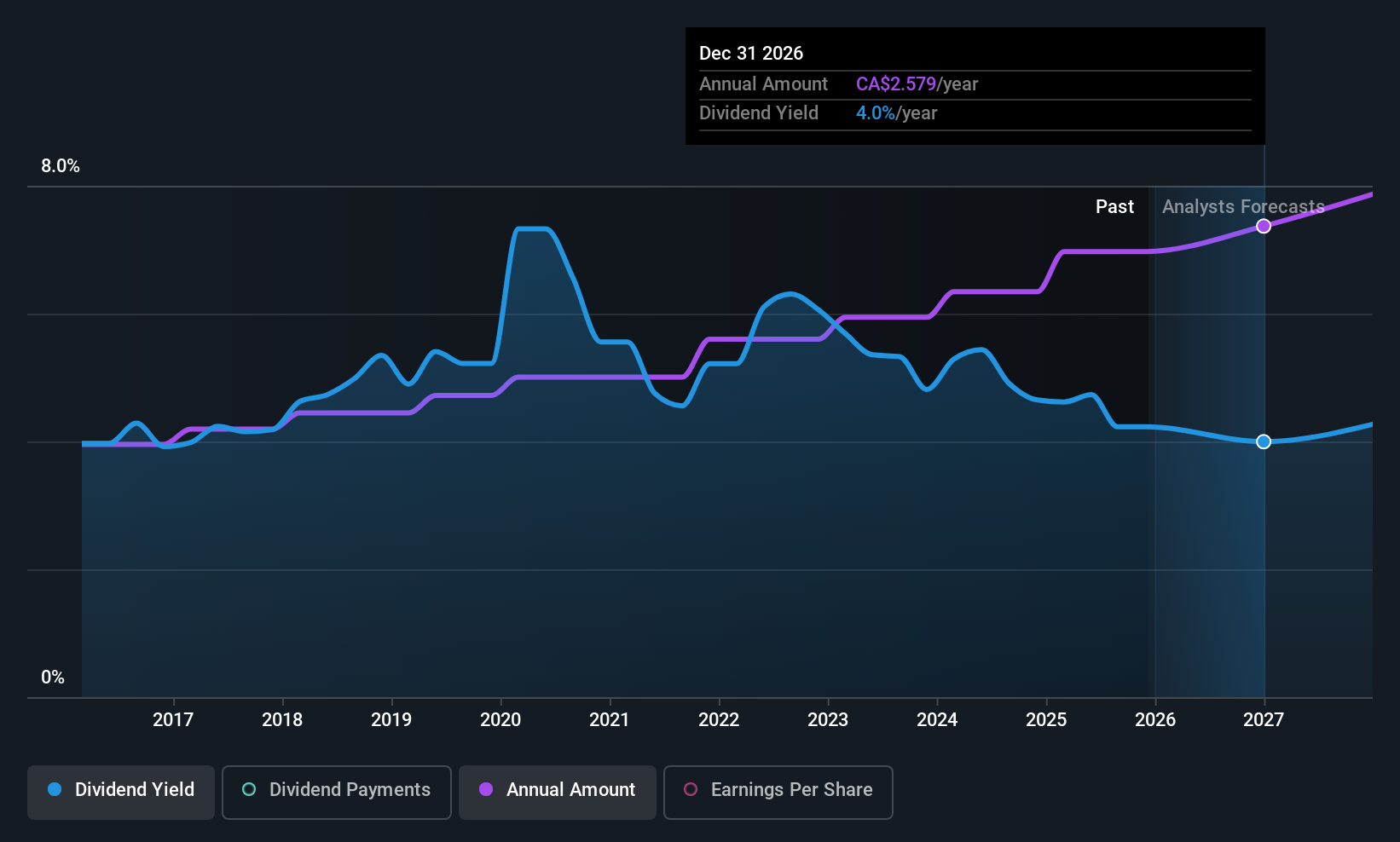

Dividend Yield: 3.8%

Great-West Lifeco's dividend yield of 3.83% is reliable, supported by a payout ratio of 55% and a cash payout ratio of 44.4%, ensuring sustainability. While the yield is below the top tier in Canada, dividends have been stable over the past decade and continue to grow. Recent earnings growth, with net income reaching C$1.2 billion for Q3 2025, further supports its dividend capacity. The company has also engaged in share buybacks worth C$995 million this year, enhancing shareholder value.

- Get an in-depth perspective on Great-West Lifeco's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Great-West Lifeco's current price could be quite moderate.

Turning Ideas Into Actions

- Take a closer look at our Top TSX Dividend Stocks list of 17 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Montreal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BMO

Bank of Montreal

Engages in the provision of diversified financial services primarily in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026