Fairfax Financial (TSX:FFH): Evaluating Valuation After Exchange Offer and Major Buyback Announcement

Reviewed by Kshitija Bhandaru

Fairfax Financial Holdings (TSX:FFH) just announced a fixed-income exchange offer featuring new senior unsecured notes and confirmed a major share repurchase program. These moves appear aimed at reshaping its capital structure and attracting fresh attention from investors.

See our latest analysis for Fairfax Financial Holdings.

Fairfax Financial’s recent buyback initiative and fixed-income exchange offer have added a spark to the narrative, especially as investors consider its steady 1-year total shareholder return of 41.8%. Momentum appears to be building for those looking beyond day-to-day share price moves. This points to renewed optimism and the possibility of a longer-term value story taking shape.

If Fairfax’s capital moves have you thinking about what makes a stock stand out, now’s the perfect time to discover fast growing stocks with high insider ownership

With Fairfax shares rising sharply over the last year, investors now face a key question: is the stock still undervalued after its recent run, or is all the future growth already priced in?

Most Popular Narrative: 7% Undervalued

Fairfax Financial Holdings' most popular narrative sees its fair value notably above the last close. This drives ongoing debate on whether market optimism is running ahead of fundamentals or if the story still has room to run.

The market may be overestimating the sustainability of Fairfax's elevated net investment income. Current results are heavily boosted by high interest rates and strong gains on fixed income portfolios. If global rates moderate or decline, this tailwind could reverse and materially lower net earnings.

What bets are analysts really making? The whole valuation rests on a fundamental shift in future profit margins and a forward-looking multiple that exceeds the industry average. Consider underlying business changes, controversial assumptions and bold moves in insurance and investment income. Are you ready to spot what could send the price flying or falling? The numbers behind this call might surprise you.

Result: Fair Value of $2,634 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Fairfax's rising investment income and successful global expansion persist, these strengths could counter any earnings pressure and reshape the valuation outlook.

Find out about the key risks to this Fairfax Financial Holdings narrative.

Another View: Is the Valuation Gap Real?

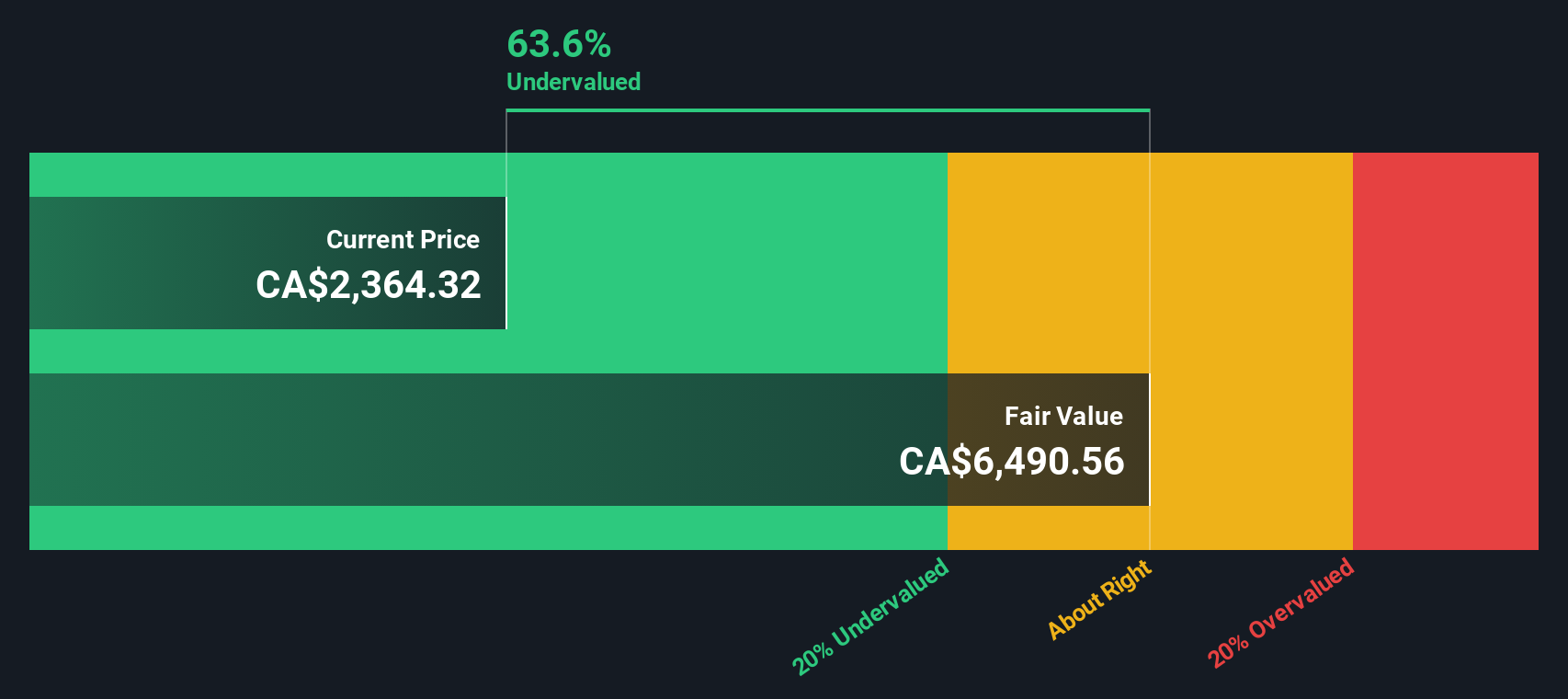

While the fair value estimate points to upside, a look at our DCF model tells a different story. The SWS DCF model suggests Fairfax is trading at a striking 63% below its estimated fair value, which is significantly undervalued compared to the current market price. Can a gap this wide persist, or is a re-rating on the cards?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fairfax Financial Holdings Narrative

If you see the numbers another way or want to follow your own line of research, it takes just a few minutes to craft your own thesis. Do it your way

A great starting point for your Fairfax Financial Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself the edge by checking out these handpicked opportunities before the crowd catches on. See where smart money might be heading next and never miss the chance for breakthrough returns.

- Uncover top-paying companies and boost your income by scanning these 19 dividend stocks with yields > 3% with reliable yields above 3%.

- Ride the momentum of innovation by tracking these 24 AI penny stocks that are making headlines in artificial intelligence breakthroughs.

- Seize value opportunities others overlook by identifying these 906 undervalued stocks based on cash flows that score well on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FFH

Fairfax Financial Holdings

Through its subsidiaries, provides property and casualty insurance and reinsurance, and investment management services in the United States, Canada, the Middle East, Asia, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives