Debt Exchange and Share Buyback Could Be a Game Changer for Fairfax Financial Holdings (TSX:FFH)

Reviewed by Sasha Jovanovic

- Fairfax Financial Holdings recently completed a corporate debt exchange and announced a share repurchase program of up to 2,187,316 Subordinate Voting Shares, with the bid valid until September 2026.

- AM Best upgraded the credit ratings of Fairfax’s subsidiary, Northbridge Financial, citing its balance sheet strength and robust financial support from Fairfax.

- With the improved subsidiary rating highlighting Fairfax’s strong financial position, we’ll examine how this impacts the company’s investment narrative going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Fairfax Financial Holdings Investment Narrative Recap

To be a Fairfax Financial Holdings shareholder, you need conviction in its ability to sustain elevated investment income and profitable underwriting, even as market cycles shift. The recent debt exchange and share buyback program signal ongoing capital management, but do not materially change the near-term catalyst, whether robust investment returns can hold if interest rates weaken, or the biggest risk, which is a reversal in these income streams. For now, these actions appear neutral regarding short-term drivers and threats.

Of the latest announcements, AM Best’s credit rating upgrade for Northbridge Financial stands out. This reaffirmation of subsidiary strength links directly to Fairfax’s perceived financial resilience and reinforces its capacity to support continued insurance expansion. With capital adequacy now more visibly supported, the focus remains on how persistent Fairfax’s investment income tailwinds will be in shaping future returns.

However, while the financial position looks stronger, investors should not overlook the growing risk of a downturn in net investment income if interest rates shift, as ...

Read the full narrative on Fairfax Financial Holdings (it's free!)

Fairfax Financial Holdings' outlook anticipates $41.8 billion in revenue and $2.9 billion in earnings by 2028. This relies on a 3.4% annual revenue growth rate and a $1.7 billion decrease in earnings from the current $4.6 billion.

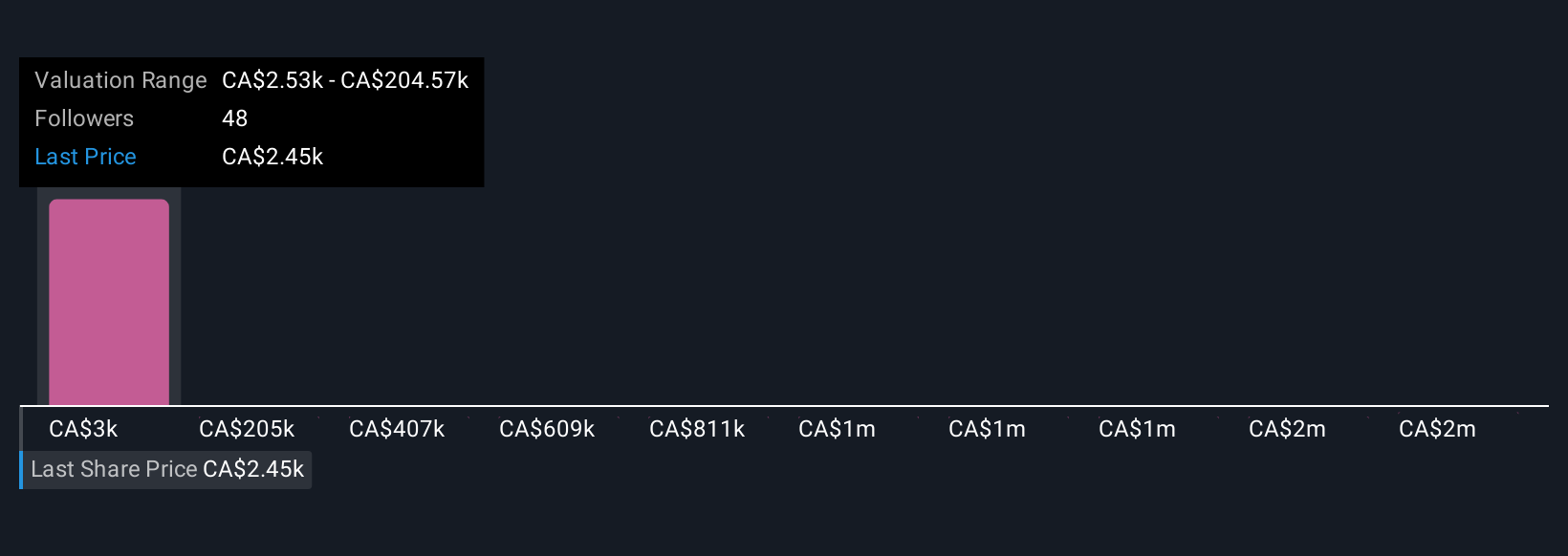

Uncover how Fairfax Financial Holdings' forecasts yield a CA$2634 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Fairfax’s fair value ranging from CA$2,528 to CA$2,022,945, reflecting six distinct outlooks. Yet with forecasts calling investment income sustainability into question, you should weigh these opinions alongside potential volatility ahead.

Explore 6 other fair value estimates on Fairfax Financial Holdings - why the stock might be a potential multi-bagger!

Build Your Own Fairfax Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fairfax Financial Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fairfax Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fairfax Financial Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FFH

Fairfax Financial Holdings

Through its subsidiaries, provides property and casualty insurance and reinsurance, and investment management services in the United States, Canada, the Middle East, Asia, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives