Definity Financial (TSX:DFY) Plans CAD 1 Billion Private Placement With Senior Unsecured Notes

Reviewed by Simply Wall St

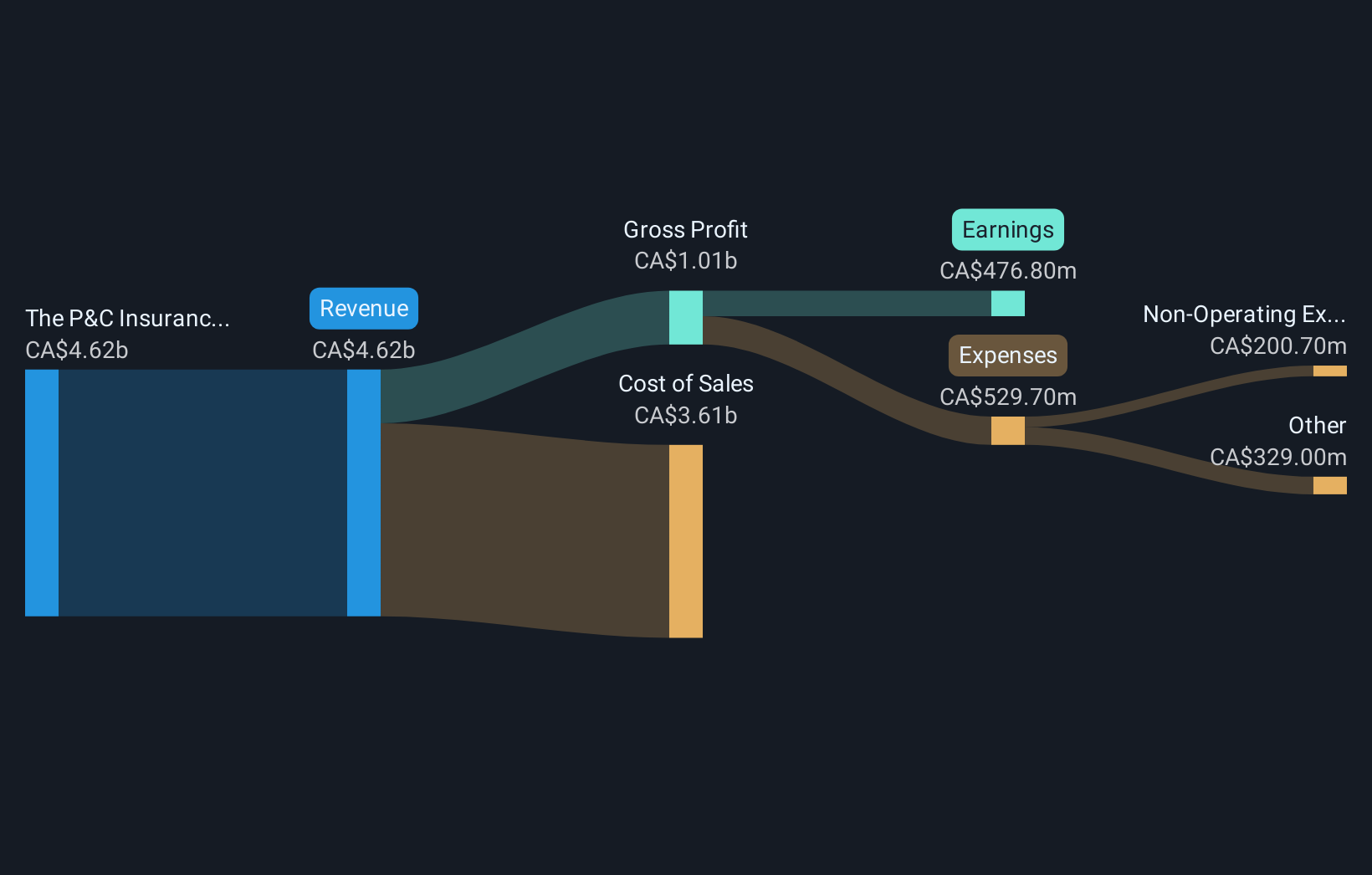

Definity Financial (TSX:DFY) recently announced a CAD 1 billion private placement aimed at bolstering funding through senior unsecured notes. This move, while significant, came against a mixed broader market backdrop where the Dow slipped 0.4%, and the Nasdaq hit new record highs. Despite such a varied environment, Definity's share price rose 3.64% over the past month. While the company's funding strategy may have offered confidence, market trends, including anticipated interest rate cuts and tech stock gains, could have played a role in buoying the stock alongside general market movements.

The announcement of Definity Financial's CAD 1 billion private placement positions the company to potentially enhance its financial strength, which aligns with its ongoing efforts to drive operational efficiencies through acquisitions and digital transformation. This funding boost could support the proposed acquisition of Travelers Canada, facilitating scale benefits and operational synergies that might bolster future profitability and revenue. The focus on digital innovations could further optimize underwriting practices, potentially resulting in improved earnings forecasts. However, integration risks and regulatory challenges remain factors that could affect these outcomes.

Over the longer term, Definity's shares have witnessed significant appreciation, recording a total shareholder return of 91.12% over the past three years. This reflects a favorable upward trajectory compared to its one-year performance, where it surpassed the Canadian insurance industry's return of 22.2%, highlighting its resilience and potential growth capacity.

With the current share price at CA$74.30, the company's movement toward the consensus price target of CA$81.11 represents a 10.8% anticipated increase. This price target, derived from future revenue and earnings projections, suggests that analysts foresee growth opportunities for Definity, albeit with caution given the relatively high price-to-earnings ratio compared to industry averages. Investors will likely keep a close eye on how these strategies translate into tangible improvements in financial metrics to justify reaching the price target.

Understand Definity Financial's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DFY

Definity Financial

Offers property and casualty insurance products in Canada.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion