- Canada

- /

- Personal Products

- /

- TSXV:LOVE

Cannara Biotech Inc.'s (CVE:LOVE) 33% Price Boost Is Out Of Tune With Earnings

Those holding Cannara Biotech Inc. (CVE:LOVE) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

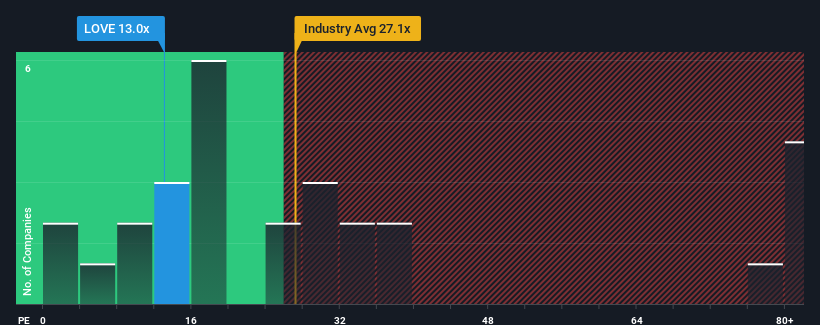

In spite of the firm bounce in price, it's still not a stretch to say that Cannara Biotech's price-to-earnings (or "P/E") ratio of 13x right now seems quite "middle-of-the-road" compared to the market in Canada, where the median P/E ratio is around 15x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

The recent earnings growth at Cannara Biotech would have to be considered satisfactory if not spectacular. It might be that many expect the respectable earnings performance to only match most other companies over the coming period, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Cannara Biotech

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Cannara Biotech's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a worthy increase of 7.3%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 30% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's curious that Cannara Biotech's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Cannara Biotech's P/E?

Cannara Biotech appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Cannara Biotech currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 3 warning signs for Cannara Biotech (1 is a bit concerning!) that we have uncovered.

Of course, you might also be able to find a better stock than Cannara Biotech. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:LOVE

Cannara Biotech

Engages in the indoor cultivation, processing, and sale of cannabis and cannabis-derivated products in Canada.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives