- Canada

- /

- Medical Equipment

- /

- TSXV:ZEN

TSX Penny Stocks Spotlight: Amerigo Resources Plus Two More Hidden Opportunities

Reviewed by Simply Wall St

The Canadian TSX has shown resilience, rising over 2% recently despite global market volatility driven by tariff uncertainties and economic policy shifts. In such a fluctuating landscape, identifying stocks with solid fundamentals becomes crucial, especially when exploring the niche area of penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still offer unique growth opportunities for investors willing to look beyond larger-cap options.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.61 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.69 | CA$69.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.31 | CA$685.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.70 | CA$198.39M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$282.4M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.57 | CA$521.69M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.66 | CA$70.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.18M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.21 | CA$43.57M | ✅ 2 ⚠️ 4 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.26 | CA$98.46M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., with a market cap of CA$282.40 million, operates through its subsidiary Minera Valle Central S.A. to produce copper and molybdenum concentrates in Chile.

Operations: The company generates revenue of $192.77 million from producing copper concentrates under a tolling agreement with DET.

Market Cap: CA$282.4M

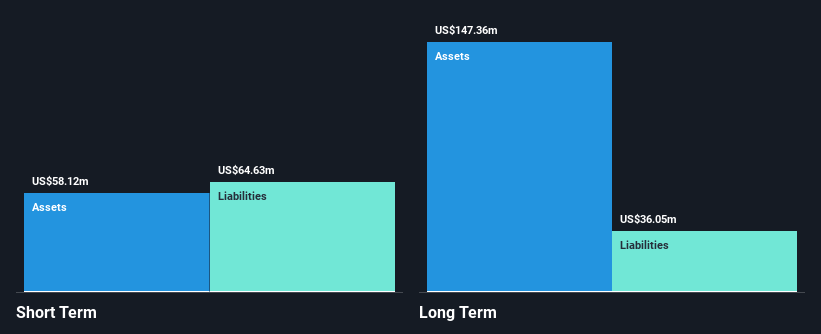

Amerigo Resources Ltd. has shown strong financial performance, with earnings growth of 468.9% over the past year and net income rising to US$19.24 million for 2024. The company benefits from a stable management team and board, both seasoned with significant tenure. Its debt is well-covered by operating cash flow, and it holds more cash than total debt, reflecting prudent financial management. However, short-term liabilities exceed short-term assets slightly at US$64.6 million versus US$58.1 million respectively, which may require attention despite the company's robust profitability and strategic share buybacks enhancing shareholder value.

- Get an in-depth perspective on Amerigo Resources' performance by reading our balance sheet health report here.

- Explore Amerigo Resources' analyst forecasts in our growth report.

Sintana Energy (TSXV:SEI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sintana Energy Inc. is involved in crude oil and natural gas exploration and development in Colombia, with a market cap of CA$182.91 million.

Operations: Sintana Energy Inc. currently does not report any revenue segments.

Market Cap: CA$182.91M

Sintana Energy Inc., with a market cap of CA$182.91 million, is pre-revenue and involved in oil and gas exploration in Colombia and Namibia. Recent updates highlight its indirect 49% interest in Custos, participating in promising drilling activities within Namibia's Orange Basin. Despite the absence of revenue, Sintana maintains a solid cash runway exceeding one year without debt, although it faces high share price volatility and significant insider selling recently. The seasoned management team provides stability amidst ongoing efforts to secure partners for exploration funding, following Woodside Energy's decision not to farm-in on PEL 87 projects.

- Navigate through the intricacies of Sintana Energy with our comprehensive balance sheet health report here.

- Assess Sintana Energy's previous results with our detailed historical performance reports.

Zentek (TSXV:ZEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zentek Ltd., with a market cap of CA$158.55 million, is involved in the research and development of graphene and related nanomaterials in Canada.

Operations: The company's revenue is derived from its Metals & Mining - Miscellaneous segment, amounting to CA$0.06 million.

Market Cap: CA$158.55M

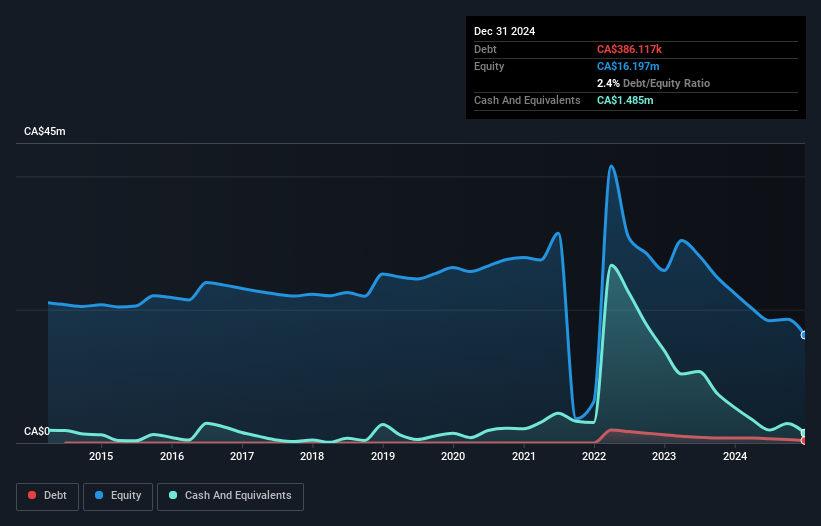

Zentek Ltd., with a market cap of CA$158.55 million, is pre-revenue and engaged in the development of graphene-based technologies. Recent collaborations, including one with Jazeera Paints for corrosion protection products and another with Filtration Solutions Industrial Co. for ZenGUARD™ Enhanced Air Filters, highlight its strategic expansion into the Gulf Cooperation Council region. The company has raised additional capital through a private placement to support its operations but remains unprofitable with limited cash runway despite having more cash than debt. Zentek's management and board are experienced, providing some stability amid its financial challenges.

- Unlock comprehensive insights into our analysis of Zentek stock in this financial health report.

- Gain insights into Zentek's historical outcomes by reviewing our past performance report.

Make It Happen

- Click through to start exploring the rest of the 927 TSX Penny Stocks now.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zentek, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zentek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZEN

Zentek

Engages in the research and development of graphene and related nanomaterials in Canada.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives