- Canada

- /

- Healthtech

- /

- TSXV:RHT

Investors push Reliq Health Technologies (CVE:RHT) 12% lower this week, company's increasing losses might be to blame

The last three months have been tough on Reliq Health Technologies Inc. (CVE:RHT) shareholders, who have seen the share price decline a rather worrying 32%. But that does not change the realty that the stock's performance has been terrific, over five years. Indeed, the share price is up a whopping 469% in that time. So we don't think the recent decline in the share price means its story is a sad one. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price.

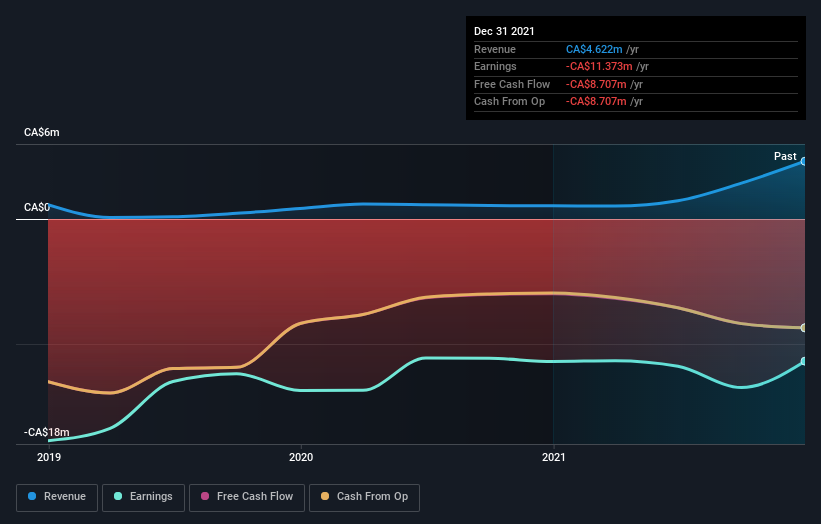

Although Reliq Health Technologies has shed CA$19m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Reliq Health Technologies

Reliq Health Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Reliq Health Technologies can boast revenue growth at a rate of 29% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 42%(per year) over the same period. It's never too late to start following a top notch stock like Reliq Health Technologies, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Reliq Health Technologies provided a TSR of 17% over the year. That's fairly close to the broader market return. It has to be noted that the recent return falls short of the 42% shareholders have gained each year, over half a decade. Although the share price growth has slowed, the longer term story points to a business well worth watching. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Reliq Health Technologies (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:RHT

Reliq Health Technologies

A healthcare technology company, develops secure telemedicine and virtual care solutions for the healthcare market.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026