- Canada

- /

- Healthcare Services

- /

- TSXV:PHA

Further Upside For Premier Health of America Inc. (CVE:PHA) Shares Could Introduce Price Risks After 26% Bounce

Premier Health of America Inc. (CVE:PHA) shareholders have had their patience rewarded with a 26% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

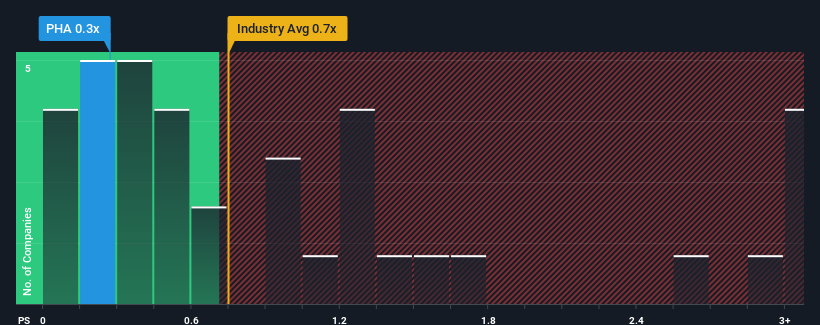

Although its price has surged higher, it's still not a stretch to say that Premier Health of America's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Healthcare industry in Canada, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Premier Health of America

How Premier Health of America Has Been Performing

Recent times haven't been great for Premier Health of America as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Premier Health of America will help you uncover what's on the horizon.How Is Premier Health of America's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Premier Health of America's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 79% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

In light of this, it's curious that Premier Health of America's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Premier Health of America's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Premier Health of America's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Premier Health of America (2 can't be ignored!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Premier Health of America, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:PHA

Premier Health of America

Engages in the provision of staffing and outsourced service solutions for healthcare needs in Canada.

Undervalued with mediocre balance sheet.