- Canada

- /

- Healthtech

- /

- TSXV:NURS

The Market Lifts Hydreight Technologies Inc. (CVE:NURS) Shares 67% But It Can Do More

Despite an already strong run, Hydreight Technologies Inc. (CVE:NURS) shares have been powering on, with a gain of 67% in the last thirty days. The last 30 days were the cherry on top of the stock's 629% gain in the last year, which is nothing short of spectacular.

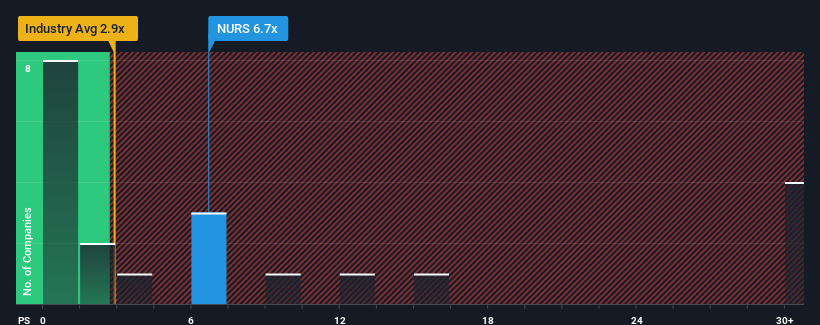

Although its price has surged higher, Hydreight Technologies may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 6.7x, since almost half of all companies in the Healthcare Services industry in Canada have P/S ratios greater than 11.4x and even P/S higher than 34x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Hydreight Technologies

How Has Hydreight Technologies Performed Recently?

Hydreight Technologies certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Hydreight Technologies will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hydreight Technologies' earnings, revenue and cash flow.How Is Hydreight Technologies' Revenue Growth Trending?

Hydreight Technologies' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 56% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 9.5% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Hydreight Technologies' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Hydreight Technologies' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Hydreight Technologies currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 4 warning signs for Hydreight Technologies (3 are potentially serious!) that you need to take into consideration.

If you're unsure about the strength of Hydreight Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hydreight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NURS

Hydreight Technologies

Provides mobile health and wellness services primarily in the United States.

Moderate and overvalued.

Market Insights

Community Narratives