The Canadian market has remained flat over the past week, yet it boasts a 23% increase over the past year with earnings expected to grow by 16% annually. In this context, penny stocks—though an outdated term—remain relevant as they often represent smaller or newer companies that can present unique growth opportunities. By focusing on those with robust financials and clear growth potential, investors can discover promising candidates among these under-the-radar stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$176.58M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.34 | CA$390.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$109.91M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$547.51M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$224.43M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.19 | CA$29.28M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.52 | CA$968.15M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 924 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

NamSys (TSXV:CTZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NamSys Inc. offers software solutions for currency management and processing tailored to the banking and merchant industries, with a market cap of CA$29.28 million.

Operations: The company generates revenue from Software Related Sales and Services amounting to CA$6.54 million.

Market Cap: CA$29.28M

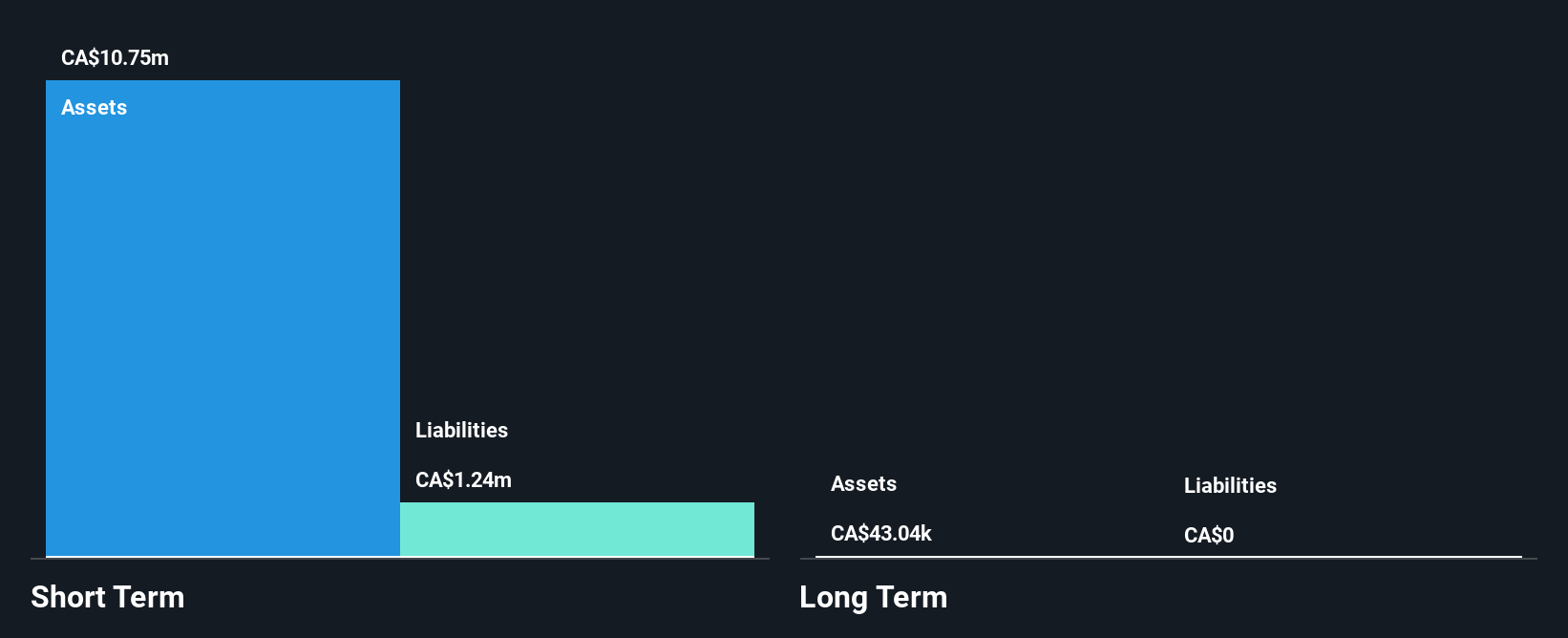

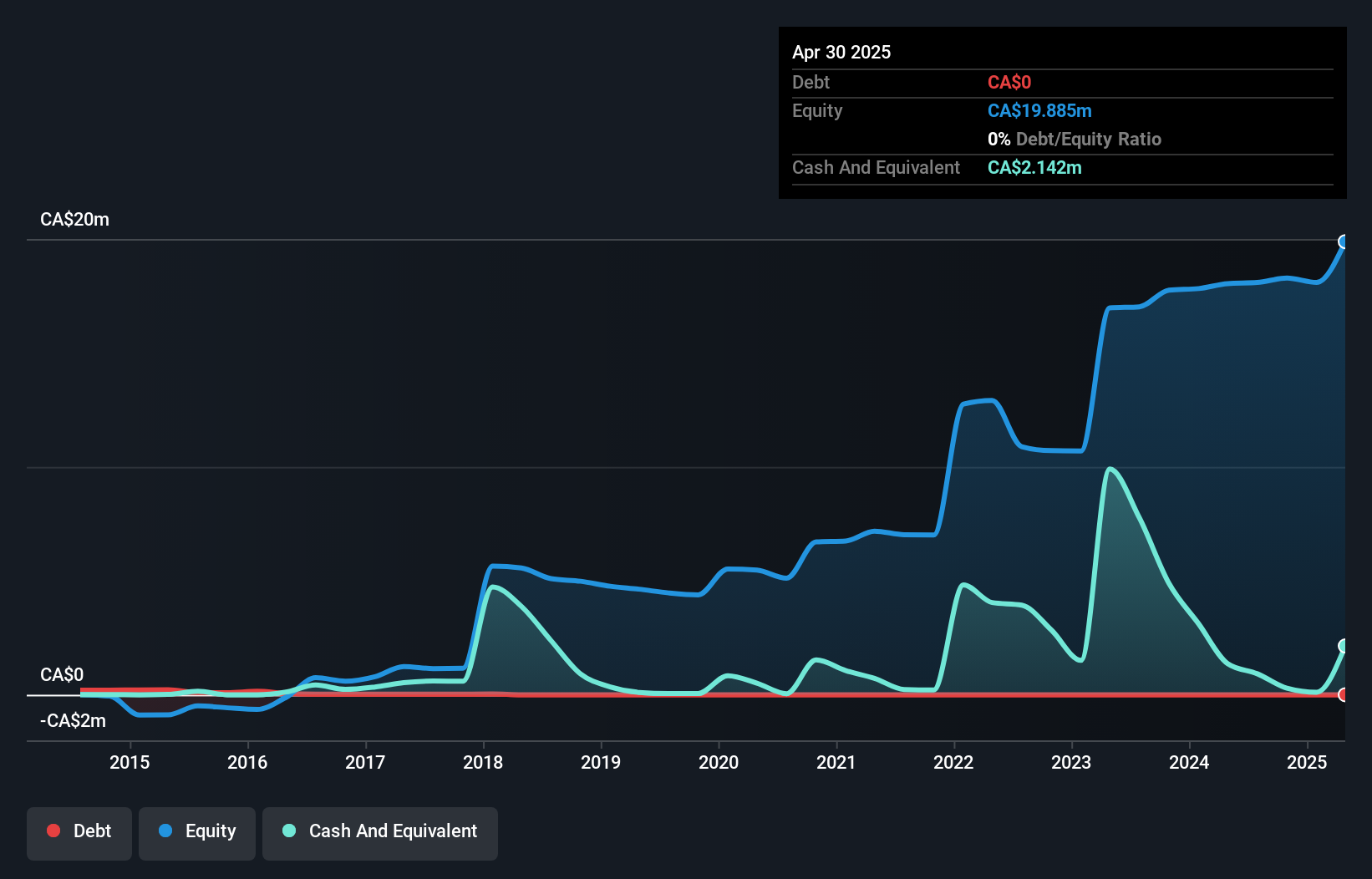

NamSys Inc., with a market cap of CA$29.28 million, has demonstrated stable financial health and growth potential in the penny stock arena. The company reported CA$1.74 million in sales for Q3 2024, an increase from the previous year, alongside improved net income and earnings per share. NamSys is debt-free, with short-term assets exceeding liabilities significantly. Its return on equity stands high at 25.9%, indicating efficient profit generation relative to shareholder equity. Recent board changes include the retirement of long-serving Chairman K. Barry Sparks and new appointments like Michael Robb, enhancing governance stability amidst ongoing growth initiatives such as share buybacks.

- Click to explore a detailed breakdown of our findings in NamSys' financial health report.

- Gain insights into NamSys' past trends and performance with our report on the company's historical track record.

Imagine Lithium (TSXV:ILI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Imagine Lithium Inc. is a junior mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in North America, with a market cap of CA$5.54 million.

Operations: The company does not report any revenue segments.

Market Cap: CA$5.54M

Imagine Lithium Inc., with a market cap of CA$5.54 million, remains pre-revenue but has recently achieved profitability, marking a significant milestone for this junior exploration firm. Despite having no debt and sufficient short-term assets to cover liabilities, the stock exhibits high volatility compared to most Canadian stocks. The company's low return on equity at 6.8% suggests room for improvement in profit generation efficiency. Recent participation in industry conferences highlights its active engagement with stakeholders and potential investors as it continues to explore mineral properties across North America without significant revenue streams yet established.

- Jump into the full analysis health report here for a deeper understanding of Imagine Lithium.

- Examine Imagine Lithium's past performance report to understand how it has performed in prior years.

Nova Leap Health (TSXV:NLH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nova Leap Health Corp. offers home and home health care services in the United States and Canada, with a market cap of CA$21.55 million.

Operations: The company generates revenue from its operations in Canada ($3.78 million) and the United States ($21.94 million), with additional contributions from its Group Head Office ($0.01 million).

Market Cap: CA$21.55M

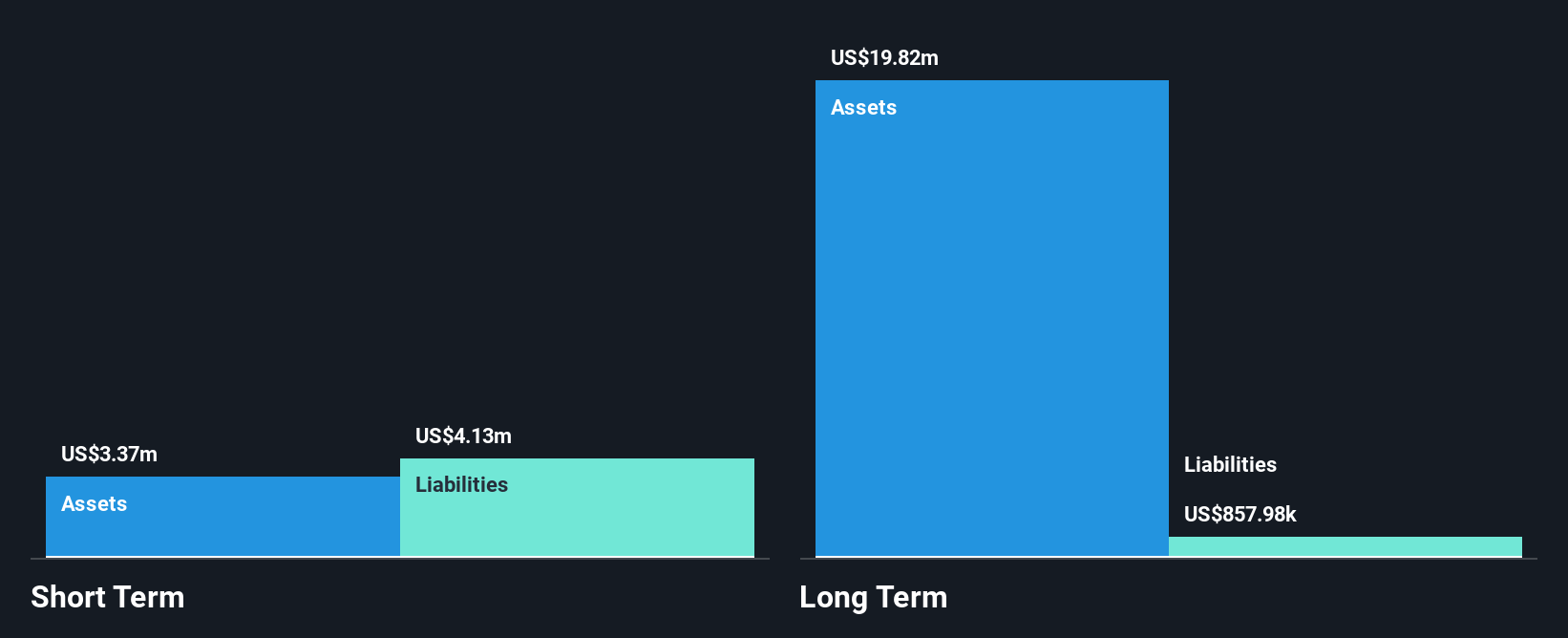

Nova Leap Health Corp., with a market cap of CA$21.55 million, navigates the penny stock landscape by leveraging its home health care services in Canada and the U.S., generating revenues of $3.78 million and $21.94 million respectively. Despite being unprofitable, it maintains a solid financial position with short-term assets exceeding liabilities and more cash than debt. Recent amendments to its credit agreement with BMO Bank of Montreal provide an additional $7 million for acquisitions, supporting growth initiatives like those in Nova Scotia and Florida. The company's cash runway extends over three years due to positive free cash flow trends despite declining earnings.

- Unlock comprehensive insights into our analysis of Nova Leap Health stock in this financial health report.

- Review our historical performance report to gain insights into Nova Leap Health's track record.

Summing It All Up

- Explore the 924 names from our TSX Penny Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NamSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CTZ

NamSys

Provides software solutions for currency management and processing for the banking and merchant industries.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives