- Canada

- /

- Healthcare Services

- /

- TSXV:NEWU

Companies Like Newtopia (CVE:NEWU) Are In A Position To Invest In Growth

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Newtopia (CVE:NEWU) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Newtopia

How Long Is Newtopia's Cash Runway?

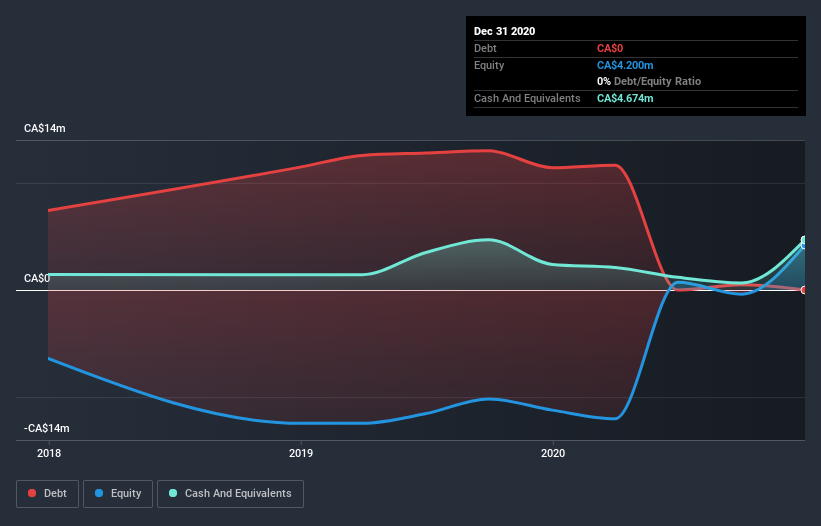

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2020, Newtopia had cash of CA$4.7m and no debt. In the last year, its cash burn was CA$4.9m. So it had a cash runway of approximately 11 months from December 2020. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. You can see how its cash balance has changed over time in the image below.

How Well Is Newtopia Growing?

On balance, we think it's mildly positive that Newtopia trimmed its cash burn by 14% over the last twelve months. Having said that, the revenue growth of 87% was considerably more inspiring. We think it is growing rather well, upon reflection. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Newtopia To Raise More Cash For Growth?

Newtopia seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of CA$57m, Newtopia's CA$4.9m in cash burn equates to about 8.5% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Newtopia's Cash Burn Situation?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Newtopia's revenue growth was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Taking a deeper dive, we've spotted 3 warning signs for Newtopia you should be aware of, and 1 of them doesn't sit too well with us.

Of course Newtopia may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Newtopia, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Newtopia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:NEWU

Newtopia

Operates as a tech-enabled whole health platform primarily in the United States.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives