- Canada

- /

- Metals and Mining

- /

- TSXV:NIM

TSX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has remained flat, but it is up 27% over the past year with earnings expected to grow by 16% annually in the coming years. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer surprising value when backed by strong financials. In this article, we explore three penny stocks that demonstrate financial strength and potential for long-term growth.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.59M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.145 | CA$4.56M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.33 | CA$313.02M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.75M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.76 | CA$291.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.14 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.24 | CA$137.16M | ★★★★☆☆ |

Click here to see the full list of 952 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Aurora Spine (TSXV:ASG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aurora Spine Corporation, operating through its subsidiary Aurora Spine, Inc., focuses on developing and distributing minimally invasive interspinous fusion systems and devices in Canada, with a market cap of CA$36.00 million.

Operations: The company generates revenue from its Medical Products segment, totaling $16.90 million.

Market Cap: CA$36M

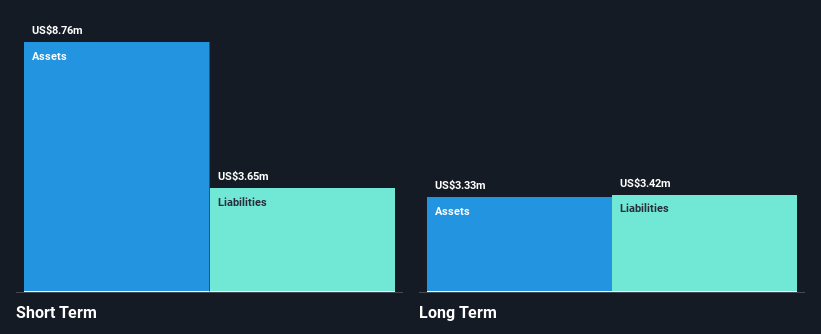

Aurora Spine Corporation, with a market cap of CA$36 million, has shown revenue growth, reporting US$4.77 million in Q3 2024 compared to US$3.95 million the previous year. Despite this, the company remains unprofitable with a negative return on equity and increasing losses over five years at an 8% annual rate. The seasoned management team and board bring stability; however, Aurora faces financial challenges with less than a year of cash runway if free cash flow trends continue. Its recent product launch could enhance its market position but does not immediately resolve profitability concerns.

- Click to explore a detailed breakdown of our findings in Aurora Spine's financial health report.

- Learn about Aurora Spine's historical performance here.

Nicola Mining (TSXV:NIM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nicola Mining Inc. is a junior exploration and custom milling company focused on identifying, acquiring, and exploring mineral property interests in Canada, with a market cap of CA$52.55 million.

Operations: There are no specific revenue segments reported for the company.

Market Cap: CA$52.55M

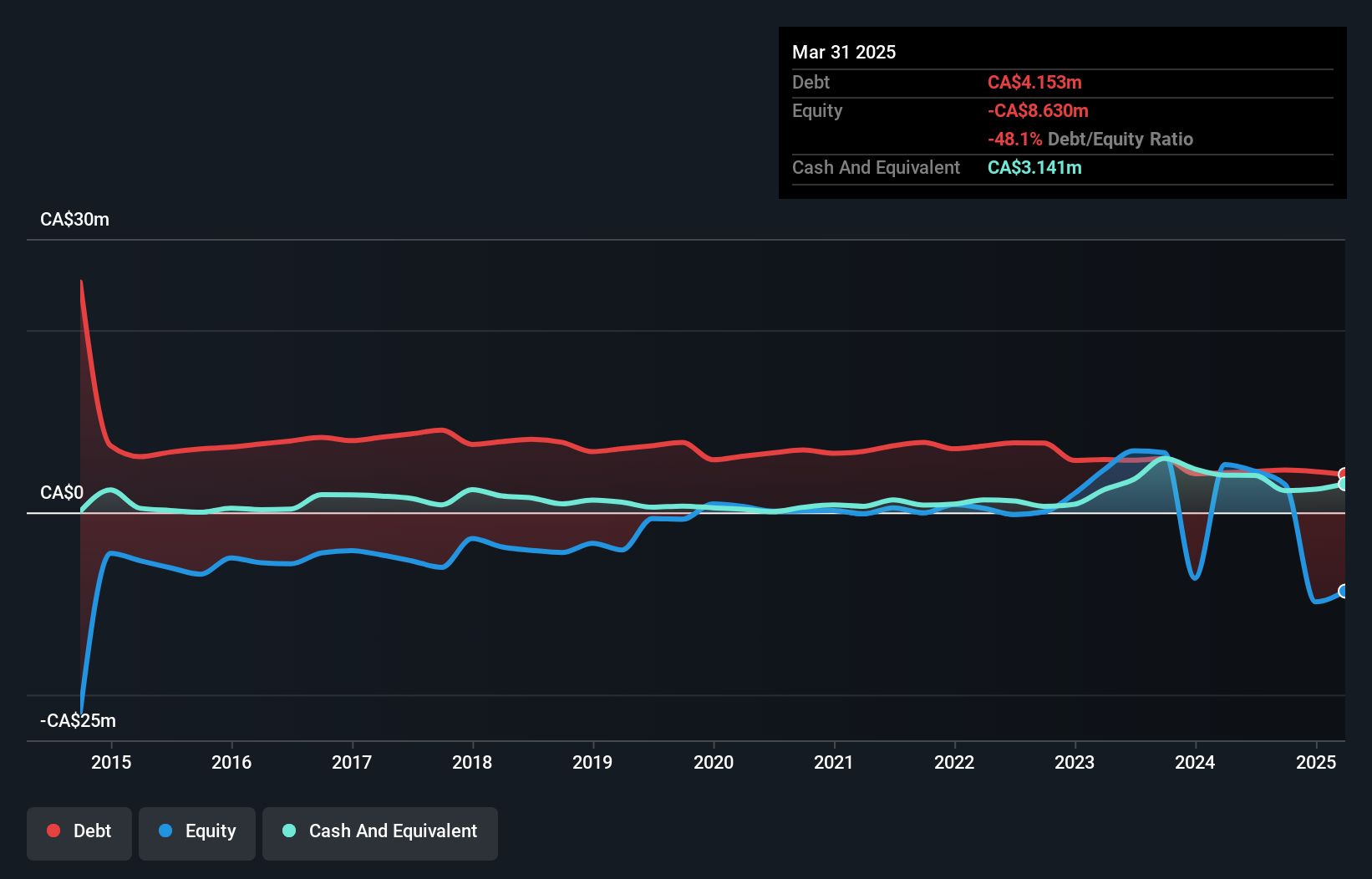

Nicola Mining Inc., with a market cap of CA$52.55 million, remains pre-revenue despite exploration progress at its New Craigmont Copper Project and Treasure Mountain Mine. The company recently reported a net loss of CA$2.52 million for Q2 2024, reflecting ongoing challenges in achieving profitability. However, Nicola's sufficient cash runway for over three years and positive free cash flow provide financial stability amidst its unprofitability. The management team is relatively new with an average tenure of 0.7 years, while the board has more experience at 8.4 years on average. Shareholders faced dilution with outstanding shares increasing by 4.1%.

- Dive into the specifics of Nicola Mining here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Nicola Mining's track record.

Radisson Mining Resources (TSXV:RDS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Radisson Mining Resources Inc. is a gold exploration company focused on acquiring, exploring, and developing mining properties in Canada, with a market cap of CA$89.94 million.

Operations: Radisson Mining Resources Inc. does not report any revenue segments.

Market Cap: CA$89.94M

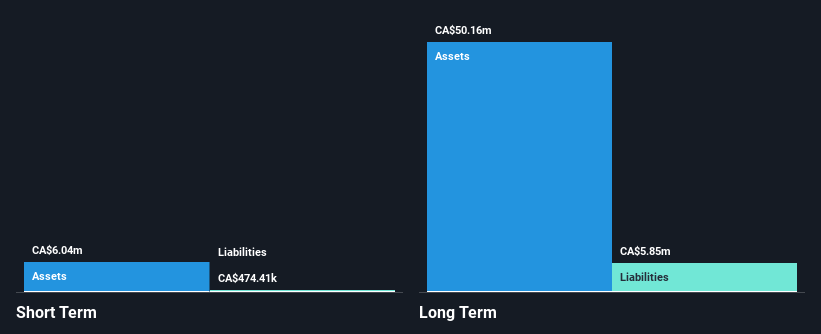

Radisson Mining Resources Inc., with a market cap of CA$89.94 million, is pre-revenue and focused on its O'Brien Gold Project in Québec. Recent drilling results show high-grade mineralization, enhancing the project's potential but not yet translating into revenue. The company's addition to the S&P/TSX Venture Composite Index highlights its growing visibility among investors. Despite a volatile share price and recent shareholder dilution, Radisson remains debt-free with sufficient cash runway for over a year. A memorandum with IAMGOLD Corporation could potentially advance project development if processing collaboration proves viable, though no guarantees exist at this stage.

- Jump into the full analysis health report here for a deeper understanding of Radisson Mining Resources.

- Gain insights into Radisson Mining Resources' historical outcomes by reviewing our past performance report.

Taking Advantage

- Explore the 952 names from our TSX Penny Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nicola Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NIM

Nicola Mining

A junior exploration and custom milling company, engages in the identification, acquisition, and exploration of mineral property interests in Canada.

Adequate balance sheet low.

Market Insights

Community Narratives