- Canada

- /

- Healthcare Services

- /

- TSX:WELL

Investors ignore increasing losses at WELL Health Technologies (TSE:WELL) as stock jumps 7.6% this past week

WELL Health Technologies Corp. (TSE:WELL) shareholders might be concerned after seeing the share price drop 13% in the last month. But that doesn't change the fact that the returns over the last half decade have been spectacular. In fact, during that period, the share price climbed 962%. Impressive! So we don't think the recent decline in the share price means its story is a sad one. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. Anyone who held for that rewarding ride would probably be keen to talk about it.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for WELL Health Technologies

SWOT Analysis for WELL Health Technologies

- Debt is well covered by cash flow.

- Interest payments on debt are not well covered.

- Shareholders have been diluted in the past year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- No apparent threats visible for WELL.

Given that WELL Health Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years WELL Health Technologies saw its revenue grow at 64% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 60% per year in that time. It's never too late to start following a top notch stock like WELL Health Technologies, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

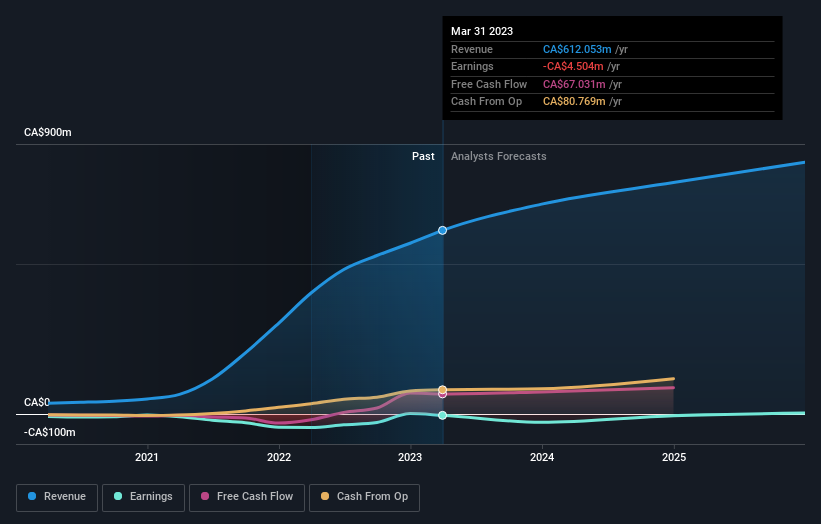

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

WELL Health Technologies is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think WELL Health Technologies will earn in the future (free analyst consensus estimates)

A Different Perspective

It's good to see that WELL Health Technologies has rewarded shareholders with a total shareholder return of 24% in the last twelve months. However, the TSR over five years, coming in at 60% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that WELL Health Technologies is showing 1 warning sign in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if WELL Health Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WELL

WELL Health Technologies

Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives