- Canada

- /

- Metals and Mining

- /

- TSXV:RBX

TSX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the Canadian market navigates a period of economic resilience amidst moderating growth and geopolitical uncertainties, investors are keenly observing how these factors influence the performance of various sectors. In this environment, growth companies with high insider ownership on the TSX can offer unique insights into potential stability and confidence, as insiders often have intimate knowledge of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Tenaz Energy (TSX:TNZ) | 10.3% | 151.2% |

| Stingray Group (TSX:RAY.A) | 24.2% | 30.8% |

| Robex Resources (TSXV:RBX) | 24.4% | 90.3% |

| Propel Holdings (TSX:PRL) | 23.5% | 33% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Enterprise Group (TSX:E) | 32.2% | 24.8% |

| Discovery Silver (TSX:DSV) | 17.5% | 39.4% |

| Burcon NutraScience (TSX:BU) | 15.1% | 152.2% |

| Aritzia (TSX:ATZ) | 17.4% | 24.7% |

| Almonty Industries (TSX:AII) | 11.9% | 55.2% |

Underneath we present a selection of stocks filtered out by our screen.

Kits Eyecare (TSX:KITS)

Simply Wall St Growth Rating: ★★★★☆☆

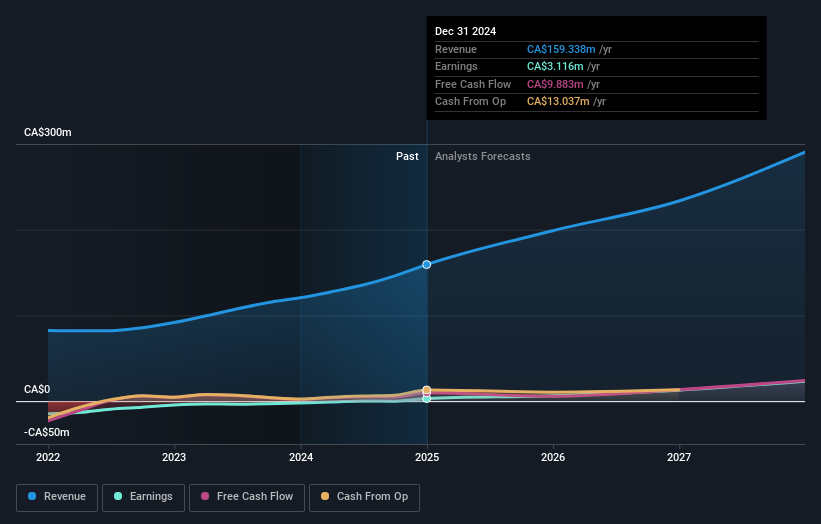

Overview: Kits Eyecare Ltd. operates a digital eyecare platform in the United States and Canada, with a market cap of CA$439.13 million.

Operations: Kits Eyecare generates revenue primarily from the sale of eyewear products, amounting to CA$171.15 million.

Insider Ownership: 22.6%

Revenue Growth Forecast: 19.5% p.a.

Kits Eyecare demonstrates characteristics of a growth company with high insider ownership, underscored by substantial insider buying over the past three months. The company's earnings are forecast to grow significantly at 54.1% annually, outpacing the Canadian market's average. Recent initiatives include a share repurchase program aimed at enhancing shareholder value and strategic partnerships expanding access to vision care in Canada and the U.S., supporting its revenue growth trajectory despite it being slightly below 20% per year.

- Dive into the specifics of Kits Eyecare here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Kits Eyecare's current price could be quite moderate.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

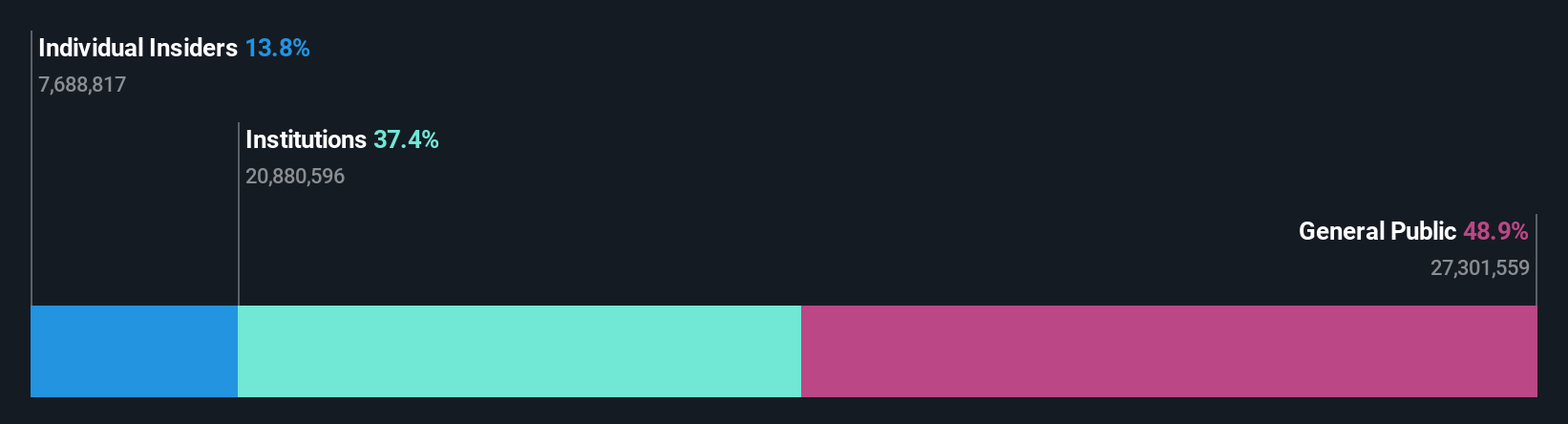

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$616.82 million.

Operations: The company generates revenue from its healthcare software segment, amounting to CA$75.01 million.

Insider Ownership: 13.8%

Revenue Growth Forecast: 16% p.a.

Vitalhub showcases strong growth potential with high insider ownership, highlighted by substantial insider buying recently. The company's earnings are projected to grow significantly at 56.1% annually, surpassing the Canadian market's average. Despite a decline in profit margins from last year, Vitalhub trades below its estimated fair value and revenue is expected to rise faster than the market at 16% per year. A CAD 250 million shelf registration filing indicates strategic financial planning for future expansion.

- Delve into the full analysis future growth report here for a deeper understanding of Vitalhub.

- Our valuation report here indicates Vitalhub may be undervalued.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

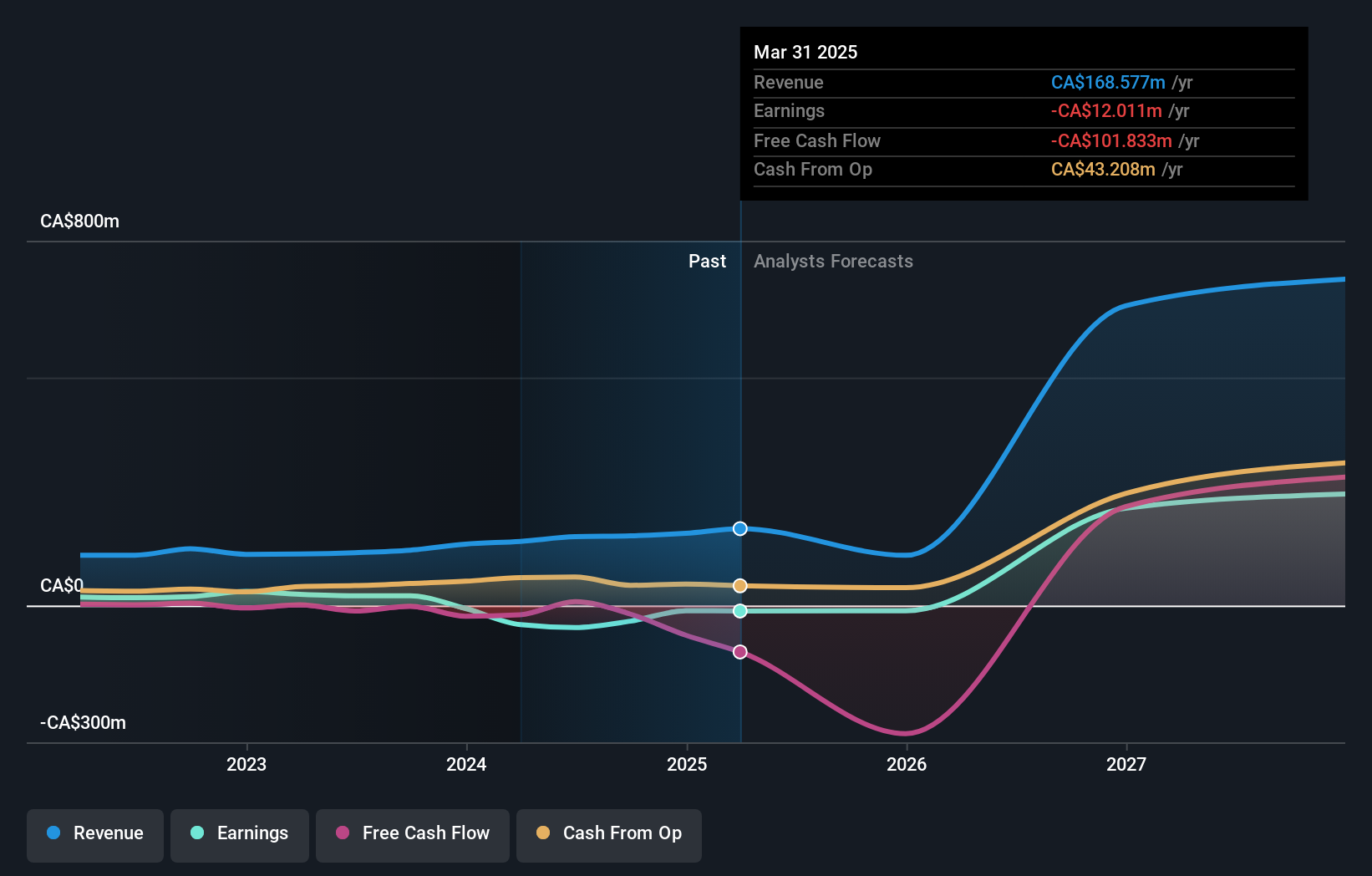

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa with a market cap of CA$735.24 million.

Operations: The company's revenue is primarily generated from its mining operations at the Nampala gold mine, amounting to CA$168.58 million.

Insider Ownership: 24.4%

Revenue Growth Forecast: 58.2% p.a.

Robex Resources demonstrates growth potential with significant insider ownership and recent insider buying. The company is on track to achieve profitability within three years, with revenue projected to grow significantly faster than the Canadian market at 58.2% annually. Despite recent shareholder dilution and ongoing net losses, Robex trades well below its estimated fair value. Construction progress at Kiniero Gold Project supports future production targets, positioning Robex strategically for upcoming gold output expansion in 2026.

- Take a closer look at Robex Resources' potential here in our earnings growth report.

- Our expertly prepared valuation report Robex Resources implies its share price may be lower than expected.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 43 Fast Growing TSX Companies With High Insider Ownership now.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RBX

Robex Resources

Engages in the exploration, development, and production of gold in West Africa.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives