- Canada

- /

- Healthcare Services

- /

- TSX:QIPT

Investors Aren't Entirely Convinced By Quipt Home Medical Corp.'s (TSE:QIPT) Revenues

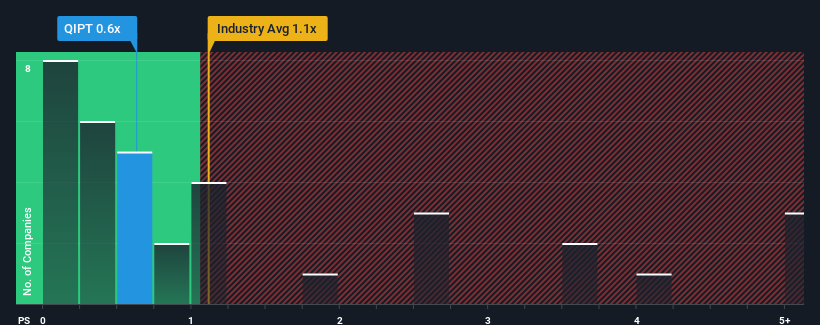

It's not a stretch to say that Quipt Home Medical Corp.'s (TSE:QIPT) price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" for companies in the Healthcare industry in Canada, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Quipt Home Medical

How Quipt Home Medical Has Been Performing

With revenue growth that's superior to most other companies of late, Quipt Home Medical has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Quipt Home Medical will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Quipt Home Medical?

In order to justify its P/S ratio, Quipt Home Medical would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 70% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 199% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 18% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 12% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Quipt Home Medical's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Quipt Home Medical's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Quipt Home Medical currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Quipt Home Medical is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Quipt Home Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:QIPT

Quipt Home Medical

Through its subsidiaries, engages in the provision of durable and home medical equipment and supplies in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives