- Canada

- /

- Medical Equipment

- /

- TSX:PRN

Profound Medical (TSE:PRN) soars 14% this week, taking one-year gains to 18%

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. Of course, the aim of the game is to pick stocks that do better than an index fund. Profound Medical Corp. (TSE:PRN) has done well over the last year, with the stock price up 18% beating the market return of 16% (not including dividends). In contrast, the longer term returns are negative, since the share price is 13% lower than it was three years ago.

The past week has proven to be lucrative for Profound Medical investors, so let's see if fundamentals drove the company's one-year performance.

View our latest analysis for Profound Medical

Profound Medical wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Profound Medical saw its revenue grow by 39%. We respect that sort of growth, no doubt. While the share price performed well, gaining 18% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

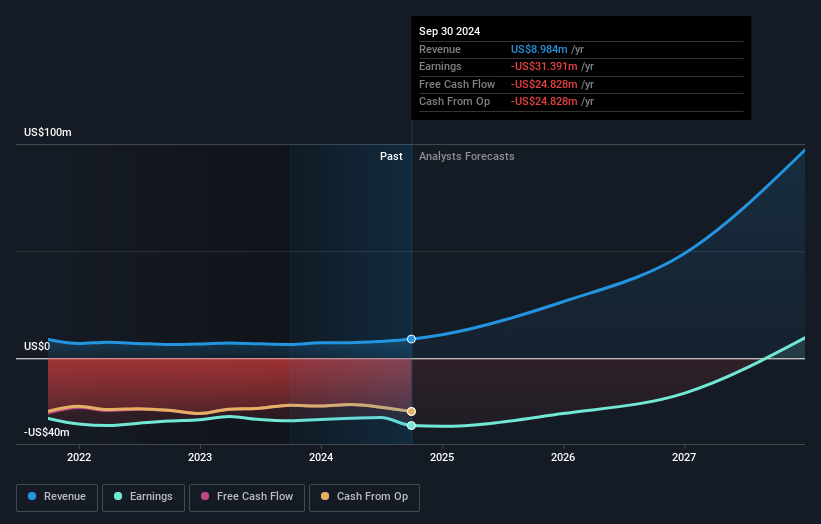

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Profound Medical in this interactive graph of future profit estimates.

A Different Perspective

Profound Medical provided a TSR of 18% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 2% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Profound Medical better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Profound Medical , and understanding them should be part of your investment process.

Profound Medical is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PRN

Profound Medical

Operates as a commercial-stage medical device company that develops and markets incision-free therapeutic systems for the image guided ablation of diseased tissue in Canada, Germany, the United States, and Finland.

Flawless balance sheet with high growth potential.