- Canada

- /

- Electrical

- /

- TSX:HPS.A

Exploring Medical Facilities And 2 Other Canadian Small Caps With Strong Potential

Reviewed by Simply Wall St

In the wake of a decisive U.S. election outcome, markets have experienced a significant rally, with investors now focusing on potential policy changes and their implications for economic growth. As the Canadian market navigates these shifts, small-cap stocks present intriguing opportunities for those looking to capitalize on strong fundamentals and promising growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Maxim Power | 25.01% | 13.56% | 17.14% | ★★★★★☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Corby Spirit and Wine | 75.89% | 5.97% | -5.75% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Medical Facilities (TSX:DR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Medical Facilities Corporation, with a market cap of CA$352.17 million, owns and operates specialty hospitals and ambulatory surgery centers in the United States through its subsidiaries.

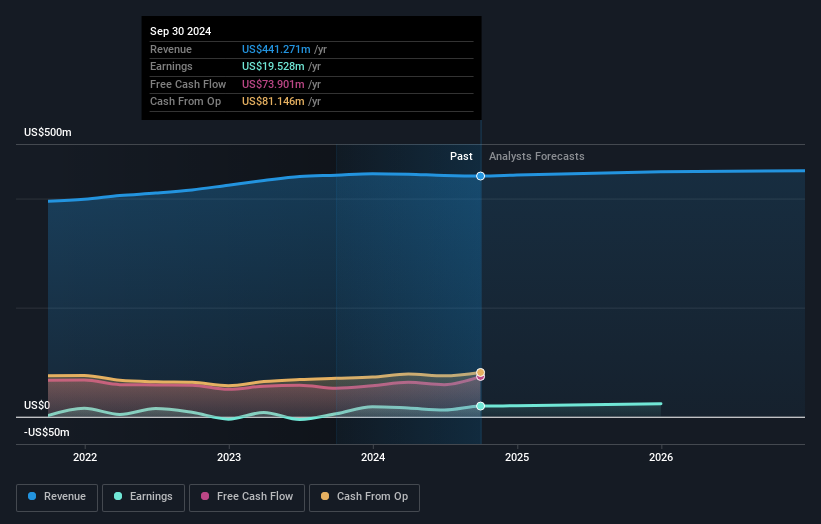

Operations: The company generates revenue primarily from its healthcare facilities and services, amounting to $441.27 million.

Medical Facilities has demonstrated impressive earnings growth of 265.2% over the past year, significantly outpacing the healthcare industry's 11.8%. Trading at a remarkable 90.7% below its estimated fair value, it presents an attractive proposition for investors seeking undervalued opportunities. The company's debt to equity ratio has improved from 105.7% to 48.9% over five years, indicating prudent financial management. Recent earnings reports show a turnaround with net income reaching US$7.25 million in Q3 compared to a loss last year, while also completing share buybacks worth US$12.08 million since November 2023, enhancing shareholder value.

- Delve into the full analysis health report here for a deeper understanding of Medical Facilities.

Assess Medical Facilities' past performance with our detailed historical performance reports.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Hammond Power Solutions Inc. designs, manufactures, and sells transformers across Canada, the United States, Mexico, and India with a market capitalization of CA$1.47 billion.

Operations: Hammond Power Solutions generates revenue primarily from the manufacture and sale of transformers, totaling CA$766.82 million.

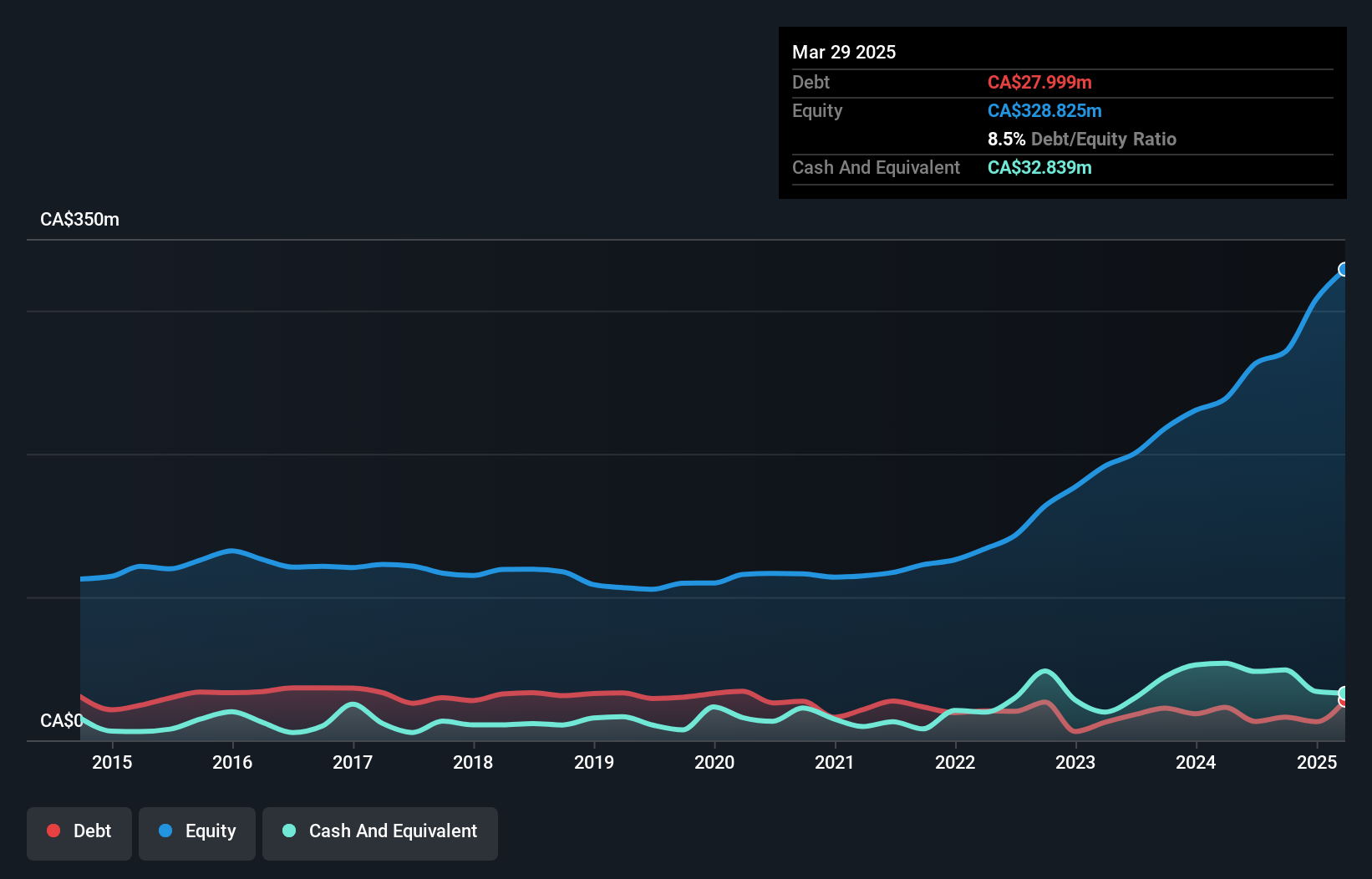

Hammond Power Solutions, a promising player in Canada's market, has seen its debt to equity ratio drop from 27% to just 6% over the past five years. The company boasts high-quality earnings and is trading at a significant discount of 45% below its estimated fair value. Recent earnings for Q3 show a solid performance with sales reaching C$191.97 million and net income at C$16.31 million, both up from the previous year. Despite some insider selling recently, Hammond's EBIT covers interest payments by an impressive 80 times, indicating strong financial health and potential for future growth.

- Dive into the specifics of Hammond Power Solutions here with our thorough health report.

Learn about Hammond Power Solutions' historical performance.

TWC Enterprises (TSX:TWC)

Simply Wall St Value Rating: ★★★★★★

Overview: TWC Enterprises Limited owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States with a market cap of CA$438.88 million.

Operations: TWC Enterprises generates revenue primarily from its Canadian Golf Club Operations at CA$153.38 million and US Golf Club Operations at CA$23.76 million.

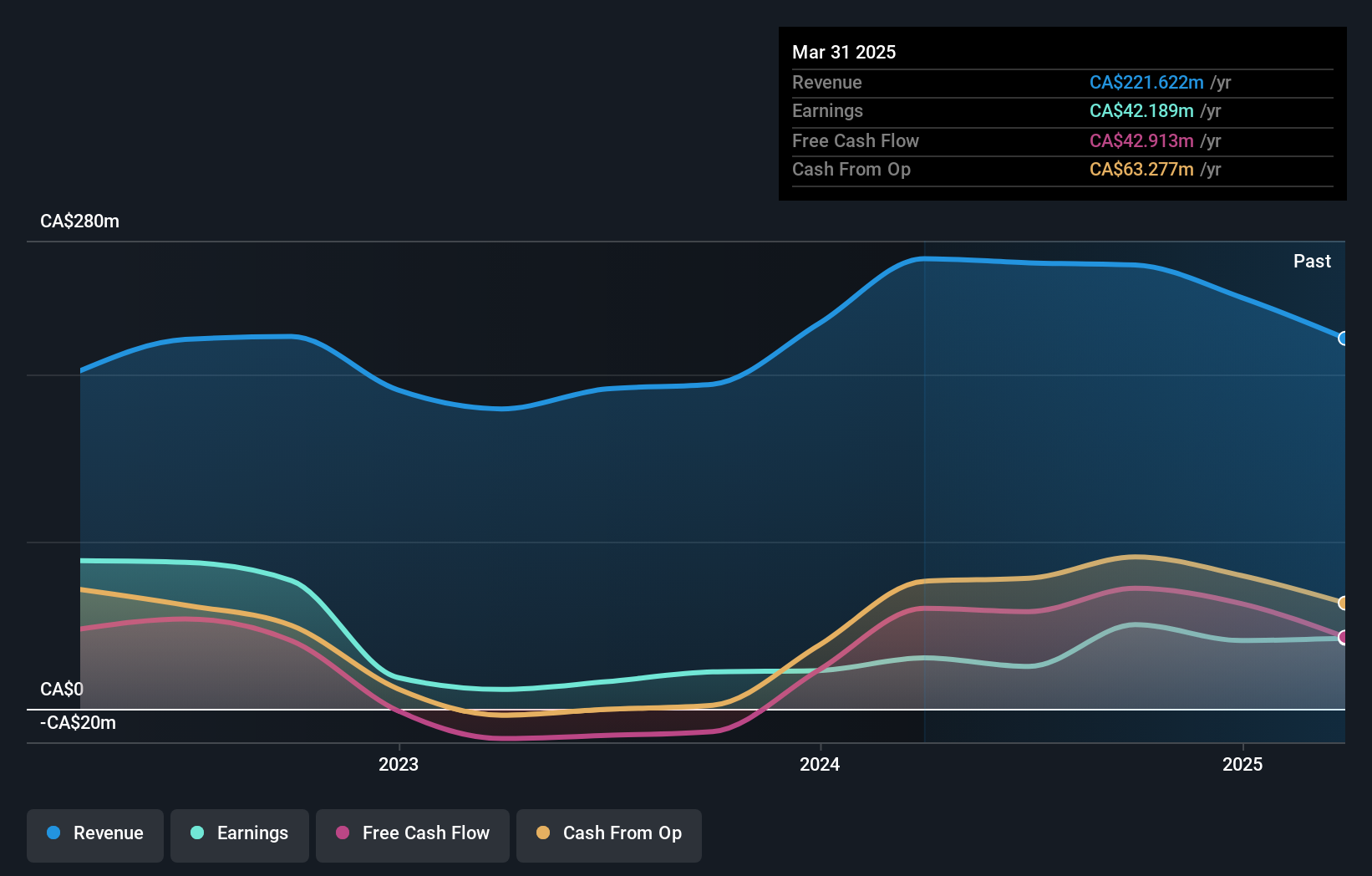

TWC Enterprises, a notable player in Canada's hospitality sector, has demonstrated impressive financial dynamics. Over the past year, earnings surged by 128%, significantly outpacing the industry's 20% growth rate. This performance was bolstered by a substantial one-off gain of CA$33.9 million within the last twelve months ending September 2024. The company's debt management is commendable, with its debt-to-equity ratio dropping from 31.5% to just 6.2% over five years and maintaining more cash than total debt obligations. Trading at a value notably below estimated fair value enhances its appeal as an investment opportunity amidst ongoing share repurchase initiatives and steady dividends.

- Click to explore a detailed breakdown of our findings in TWC Enterprises' health report.

Examine TWC Enterprises' past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Reveal the 42 hidden gems among our TSX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammond Power Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet with proven track record.