- Canada

- /

- Healthcare Services

- /

- TSX:CSH.UN

This Is The Reason Why We Think Chartwell Retirement Residences' (TSE:CSH.UN) CEO Deserves A Bump Up To Their Compensation

Key Insights

- Chartwell Retirement Residences will host its Annual General Meeting on 7th of May

- Total pay for CEO Vlad Volodarski includes CA$776.0k salary

- The overall pay is 64% below the industry average

- Over the past three years, Chartwell Retirement Residences' EPS grew by 46% and over the past three years, the total shareholder return was 72%

The solid performance at Chartwell Retirement Residences (TSE:CSH.UN) has been impressive and shareholders will probably be pleased to know that CEO Vlad Volodarski has delivered. At the upcoming AGM on 7th of May, they will get a chance to hear the board review the company results, discuss future strategy and cast their vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

Check out our latest analysis for Chartwell Retirement Residences

Comparing Chartwell Retirement Residences' CEO Compensation With The Industry

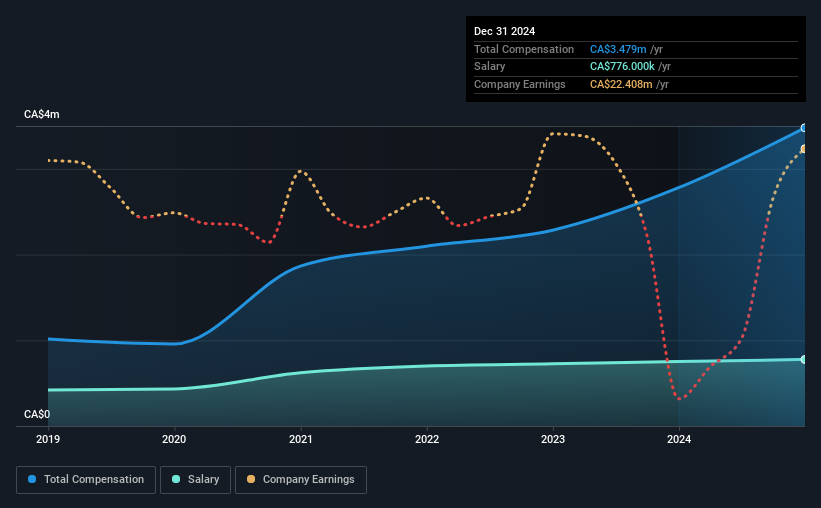

Our data indicates that Chartwell Retirement Residences has a market capitalization of CA$4.8b, and total annual CEO compensation was reported as CA$3.5m for the year to December 2024. We note that's an increase of 25% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$776k.

On examining similar-sized companies in the Canadian Healthcare industry with market capitalizations between CA$2.8b and CA$8.9b, we discovered that the median CEO total compensation of that group was CA$9.8m. That is to say, Vlad Volodarski is paid under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CA$776k | CA$752k | 22% |

| Other | CA$2.7m | CA$2.0m | 78% |

| Total Compensation | CA$3.5m | CA$2.8m | 100% |

Speaking on an industry level, nearly 33% of total compensation represents salary, while the remainder of 67% is other remuneration. In Chartwell Retirement Residences' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Chartwell Retirement Residences' Growth

Chartwell Retirement Residences's earnings per share (EPS) grew 46% per year over the last three years. Its revenue is up 17% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Chartwell Retirement Residences Been A Good Investment?

Boasting a total shareholder return of 72% over three years, Chartwell Retirement Residences has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 3 warning signs (and 1 which is significant) in Chartwell Retirement Residences we think you should know about.

Switching gears from Chartwell Retirement Residences, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CSH.UN

Chartwell Retirement Residences

Chartwell is in the business of serving and caring for Canada's seniors, committed to its vision of Making People's Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents.

Reasonable growth potential with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success