- Canada

- /

- Healthcare Services

- /

- TSX:CSH.UN

Chartwell Retirement Residences' (TSE:CSH.UN) Dividend Will Be CA$0.051

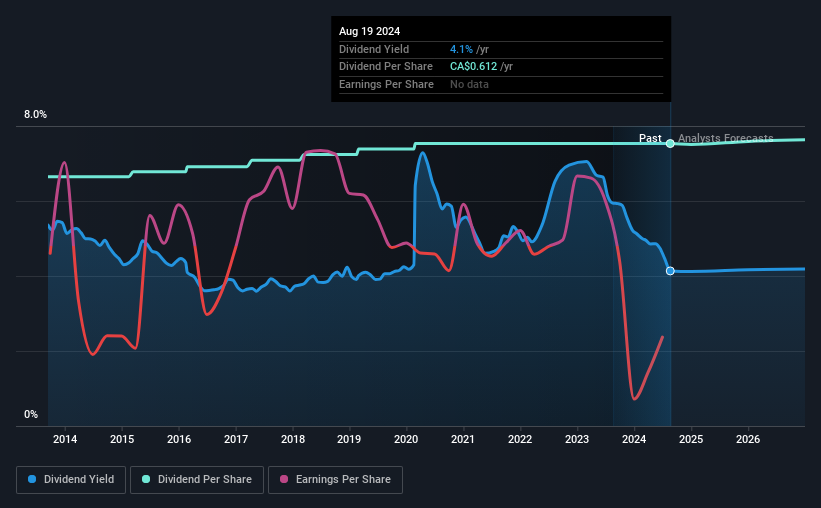

Chartwell Retirement Residences' (TSE:CSH.UN) investors are due to receive a payment of CA$0.051 per share on 16th of September. This means that the annual payment will be 4.1% of the current stock price, which is in line with the average for the industry.

Check out our latest analysis for Chartwell Retirement Residences

Chartwell Retirement Residences' Distributions May Be Difficult To Sustain

We aren't too impressed by dividend yields unless they can be sustained over time. Chartwell Retirement Residences is not generating a profit, and despite this is paying out most of its free cash flow as a dividend. Generally it is unsustainable for a company to be paying a dividend while unprofitable, and with limited reinvestment into the business growth may be slow.

Analysts expect the EPS to grow by 89.9% over the next 12 months. This is the right direction to be moving, but it is not enough to achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

Chartwell Retirement Residences Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the dividend has gone from CA$0.54 total annually to CA$0.612. This works out to be a compound annual growth rate (CAGR) of approximately 1.3% a year over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately things aren't as good as they seem. Earnings per share has been sinking by 40% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We should note that Chartwell Retirement Residences has issued stock equal to 13% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. To that end, Chartwell Retirement Residences has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about. Is Chartwell Retirement Residences not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CSH.UN

Chartwell Retirement Residences

Chartwell is in the business of serving and caring for Canada's seniors, committed to its vision of Making People's Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents.

Reasonable growth potential with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026