- Canada

- /

- Healthcare Services

- /

- TSX:AIDX

Healwell AI Inc. (TSE:AIDX) Stock Rockets 33% As Investors Are Less Pessimistic Than Expected

Healwell AI Inc. (TSE:AIDX) shareholders have had their patience rewarded with a 33% share price jump in the last month. The annual gain comes to 116% following the latest surge, making investors sit up and take notice.

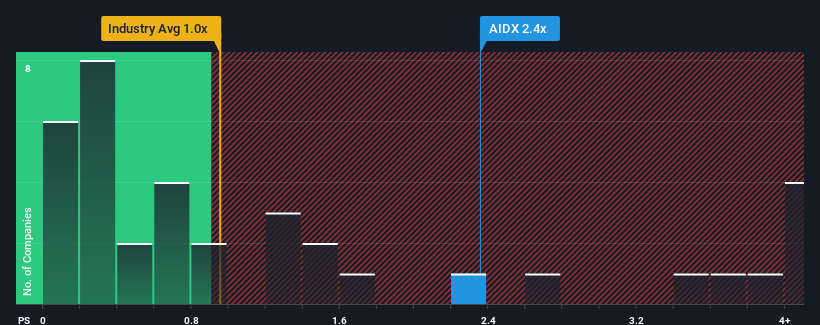

Since its price has surged higher, you could be forgiven for thinking Healwell AI is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in Canada's Healthcare industry have P/S ratios below 0.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Healwell AI

What Does Healwell AI's P/S Mean For Shareholders?

Recent times have been advantageous for Healwell AI as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Healwell AI's future stacks up against the industry? In that case, our free report is a great place to start.How Is Healwell AI's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Healwell AI's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 114%. The strong recent performance means it was also able to grow revenue by 31% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 59% during the coming year according to the three analysts following the company. Meanwhile, the broader industry is forecast to expand by 13%, which paints a poor picture.

With this in mind, we find it intriguing that Healwell AI's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Healwell AI's P/S

The large bounce in Healwell AI's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Healwell AI currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

Having said that, be aware Healwell AI is showing 4 warning signs in our investment analysis, and 2 of those don't sit too well with us.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Healwell AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:AIDX

Healwell AI

A healthcare technology company, focuses on AI and data science for preventative care.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives