Yerbaé Brands Corp.'s (CVE:YERB.U) 27% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, Yerbaé Brands Corp. (CVE:YERB.U) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

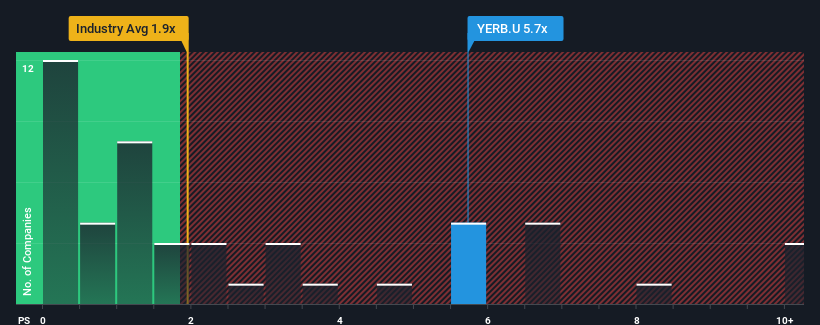

In spite of the heavy fall in price, you could still be forgiven for thinking Yerbaé Brands is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.7x, considering almost half the companies in Canada's Beverage industry have P/S ratios below 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Yerbaé Brands

What Does Yerbaé Brands' P/S Mean For Shareholders?

Recent times have been advantageous for Yerbaé Brands as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Yerbaé Brands' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Yerbaé Brands' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 88%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 17% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 75% during the coming year according to the three analysts following the company. With the rest of the industry predicted to shrink by 4.1%, that would be a fantastic result.

With this information, we can see why Yerbaé Brands is trading at such a high P/S compared to the industry. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

The Bottom Line On Yerbaé Brands' P/S

Even after such a strong price drop, Yerbaé Brands' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we anticipated, our review of Yerbaé Brands' analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Yerbaé Brands (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:YERB.U

Yerbaé Brands

Engages in the development, marketing, sale, and distribution of plant-based energy beverages in the United States.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives