Why We're Not Concerned Yet About Yerbaé Brands Corp.'s (CVE:YERB.U) 25% Share Price Plunge

Unfortunately for some shareholders, the Yerbaé Brands Corp. (CVE:YERB.U) share price has dived 25% in the last thirty days, prolonging recent pain. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

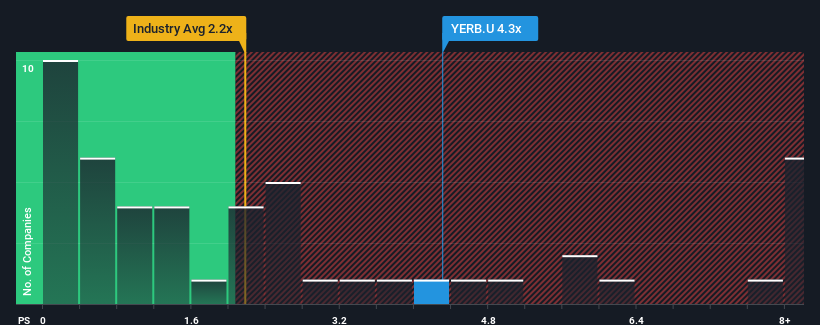

Even after such a large drop in price, given around half the companies in Canada's Beverage industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Yerbaé Brands as a stock to avoid entirely with its 4.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Yerbaé Brands

What Does Yerbaé Brands' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Yerbaé Brands has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Yerbaé Brands' future stacks up against the industry? In that case, our free report is a great place to start.How Is Yerbaé Brands' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Yerbaé Brands' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 88% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 17% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 61% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 5.2% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Yerbaé Brands' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Yerbaé Brands' P/S

Even after such a strong price drop, Yerbaé Brands' P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Yerbaé Brands shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 3 warning signs for Yerbaé Brands that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:YERB.U

Yerbaé Brands

Engages in the development, marketing, sale, and distribution of plant-based energy beverages in the United States.

Medium-low and slightly overvalued.