- Canada

- /

- Healthcare Services

- /

- TSX:QIPT

TSX Penny Stocks Spotlight Delota And Two Others

Reviewed by Simply Wall St

As the Canadian market experiences a period of stabilized yields and moderated inflation, investors are keeping a close eye on potential opportunities within the TSX. Penny stocks, often associated with smaller or newer companies, continue to intrigue investors due to their mix of affordability and growth potential when backed by solid financials. In this context, we'll explore several standout penny stocks that exhibit strong financial foundations and could offer promising prospects for those seeking under-the-radar investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.78 | CA$175.48M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$453.58M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$641.48M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$3.89 | CA$3.2B | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.92 | CA$192.45M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.04 | CA$210.81M | ★★★★☆☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Delota (CNSX:NIC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Delota Corp. operates in Canada, focusing on the retail of various cannabis products, with a market cap of CA$2.77 million.

Operations: The company generates CA$40.08 million in revenue from its specialty retail segment.

Market Cap: CA$2.77M

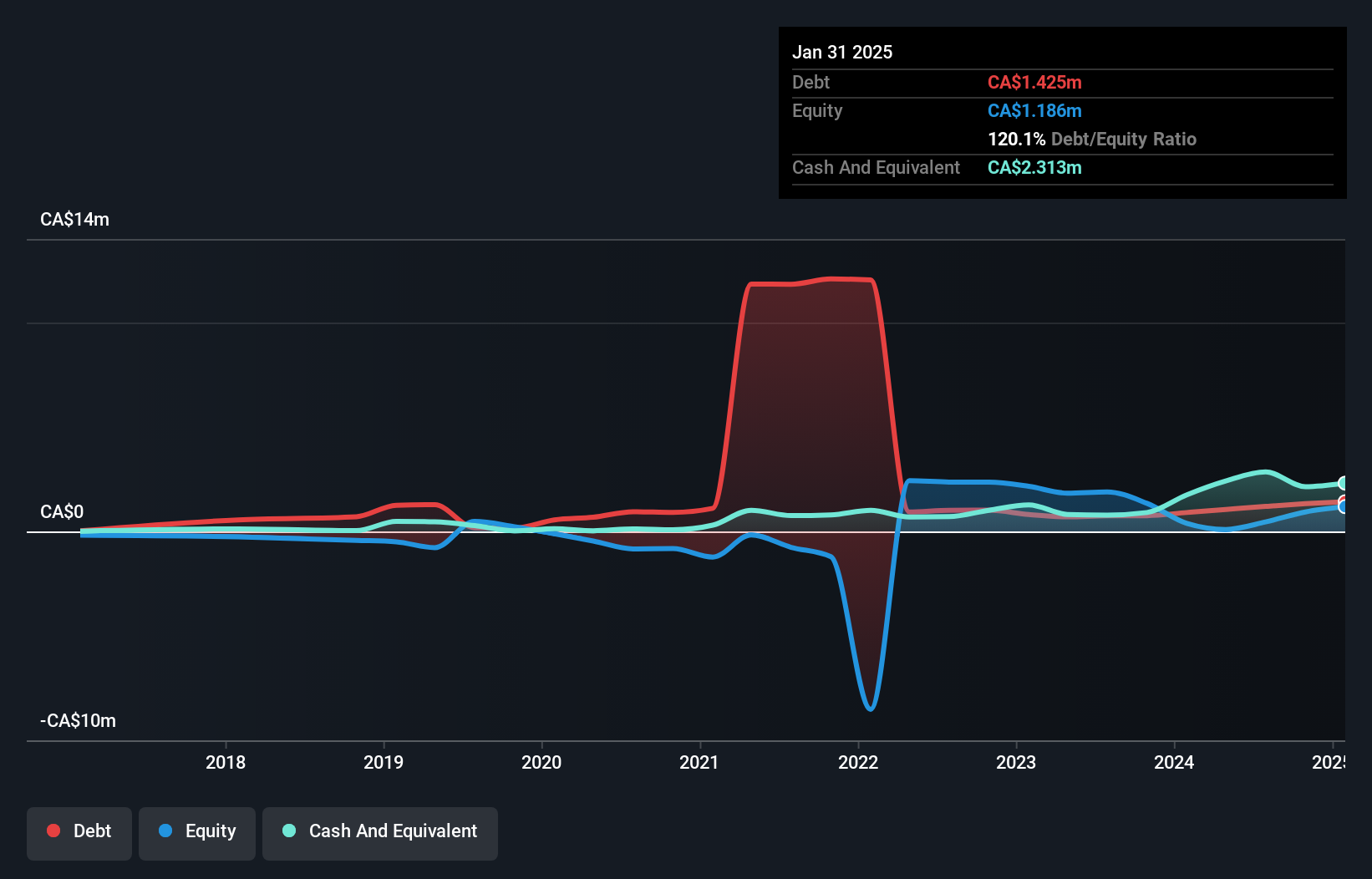

Delota Corp. has expanded its retail footprint to 32 locations in Ontario, with plans for further growth into Western Canada. Despite a volatile share price and increased debt-to-equity ratio, Delota reported CA$10.29 million in third-quarter sales, up from the previous year, and achieved a net income of CA$0.47 million compared to a loss previously. The company benefits from an experienced board and management team, with sufficient cash runway for over three years due to positive free cash flow growth. However, short-term liabilities exceed assets, posing potential liquidity challenges amidst its expansion efforts.

- Take a closer look at Delota's potential here in our financial health report.

- Gain insights into Delota's past trends and performance with our report on the company's historical track record.

Quipt Home Medical (TSX:QIPT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quipt Home Medical Corp. operates in the United States through its subsidiaries, providing durable and home medical equipment and supplies, with a market cap of CA$161.59 million.

Operations: The company generates revenue of $244.72 million from its provision of durable and home medical equipment and supplies in the United States.

Market Cap: CA$161.59M

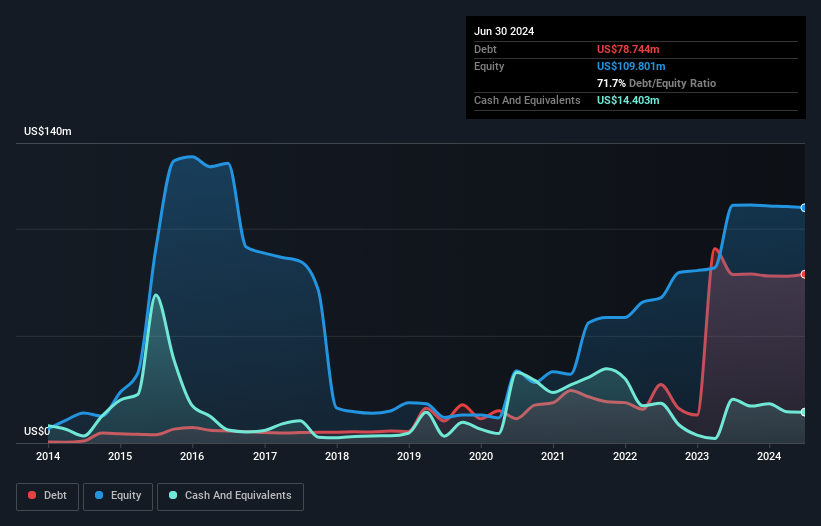

Quipt Home Medical Corp., with a market cap of CA$161.59 million, reported first-quarter revenue of US$61.38 million, slightly down from the previous year, while reducing its net loss to US$1.08 million. Despite being unprofitable, Quipt maintains positive free cash flow and has a cash runway exceeding three years if current trends continue. The company's short-term assets surpass its short-term liabilities; however, long-term liabilities remain uncovered by these assets. While shareholder dilution was minimal last year and management is experienced with an average tenure of seven years, the high net debt-to-equity ratio remains a concern for potential investors amidst ongoing investor activism challenges.

- Click to explore a detailed breakdown of our findings in Quipt Home Medical's financial health report.

- Understand Quipt Home Medical's earnings outlook by examining our growth report.

Fresh Factory B.C (TSXV:FRSH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Fresh Factory B.C. Ltd. formulates, develops, manufactures, distributes, and sells fresh and plant-based food and beverages in the United States with a market cap of CA$54.77 million.

Operations: The company generates revenue primarily from its food processing segment, which amounts to $30.42 million.

Market Cap: CA$54.77M

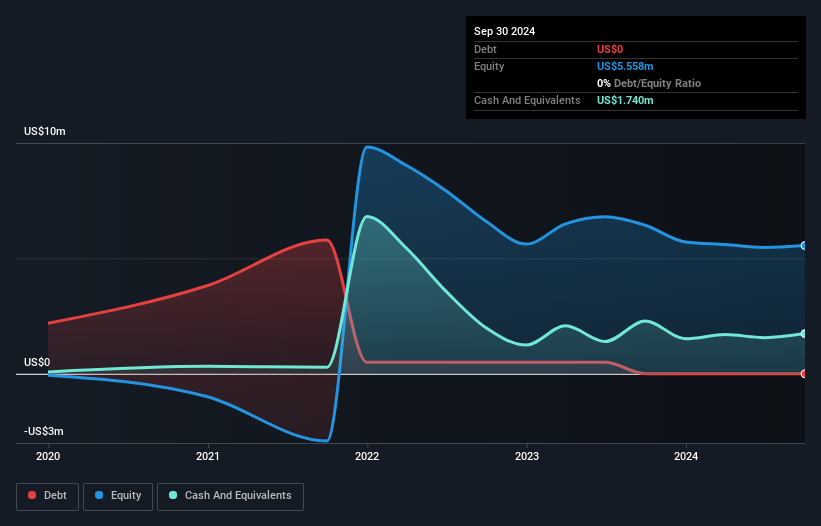

Fresh Factory B.C. Ltd., with a market cap of CA$54.77 million, primarily generates revenue from its food processing segment, amounting to US$30.42 million annually. Despite being unprofitable, the company has reduced losses by 5.1% per year over the past five years and maintains a positive free cash flow with a cash runway exceeding three years if growth continues. Recent developments include a non-brokered private placement aiming to raise approximately US$3 million and strategic board changes with Tim Doelman joining as a director, bringing extensive industry experience that could support future operational scaling and innovation efforts.

- Dive into the specifics of Fresh Factory B.C here with our thorough balance sheet health report.

- Learn about Fresh Factory B.C's historical performance here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 940 companies within our TSX Penny Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quipt Home Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QIPT

Quipt Home Medical

Through its subsidiaries, engages in the provision of durable and home medical equipment and supplies in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives