Further Upside For Wildpack Beverage Inc. (CVE:CANS) Shares Could Introduce Price Risks After 29% Bounce

Those holding Wildpack Beverage Inc. (CVE:CANS) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 10.0% over that time.

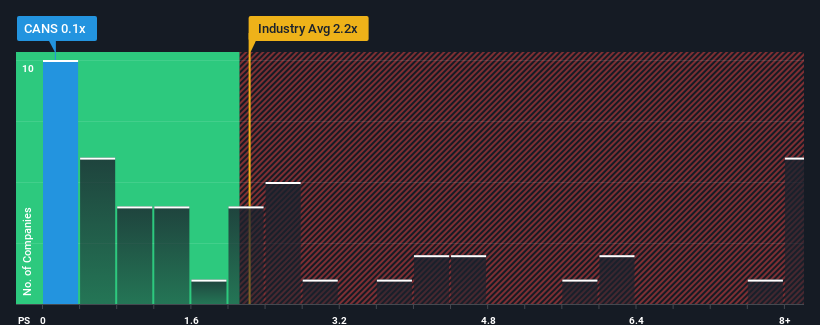

Even after such a large jump in price, Wildpack Beverage's price-to-sales (or "P/S") ratio of 0.1x might still make it look like a buy right now compared to the Beverage industry in Canada, where around half of the companies have P/S ratios above 0.9x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Wildpack Beverage

What Does Wildpack Beverage's Recent Performance Look Like?

Recent times have been advantageous for Wildpack Beverage as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Wildpack Beverage will help you uncover what's on the horizon.How Is Wildpack Beverage's Revenue Growth Trending?

Wildpack Beverage's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 62% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 87% as estimated by the only analyst watching the company. With the industry only predicted to deliver 5.2%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Wildpack Beverage's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Wildpack Beverage's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Wildpack Beverage's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Wildpack Beverage's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 4 warning signs for Wildpack Beverage (3 are potentially serious!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wildpack Beverage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CANS

Wildpack Beverage

Engages in filling, decorating, and brokering of aluminum cans in Canada and the United States.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives