Getting In Cheap On Premium Brands Holdings Corporation (TSE:PBH) Might Be Difficult

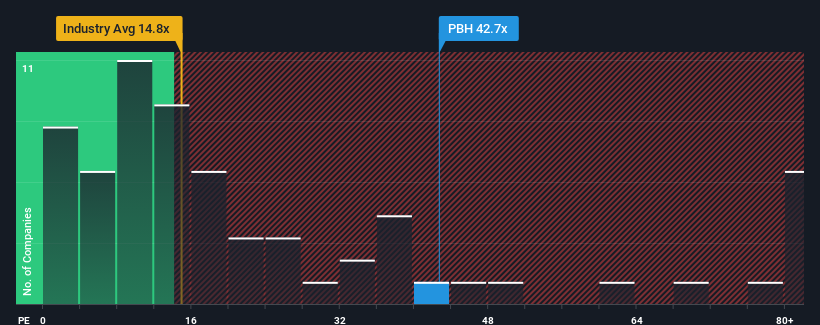

With a price-to-earnings (or "P/E") ratio of 42.7x Premium Brands Holdings Corporation (TSE:PBH) may be sending very bearish signals at the moment, given that almost half of all companies in Canada have P/E ratios under 14x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Premium Brands Holdings' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Premium Brands Holdings

How Is Premium Brands Holdings' Growth Trending?

Premium Brands Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 5.9% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 80% over the next year. That's shaping up to be materially higher than the 24% growth forecast for the broader market.

With this information, we can see why Premium Brands Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Premium Brands Holdings' P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Premium Brands Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Premium Brands Holdings (2 are significant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Premium Brands Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PBH

Premium Brands Holdings

Through its subsidiaries, manufactures and distributes food products primarily in Canada and the United States.

Undervalued with reasonable growth potential.