Does Team Canada Protein Partnership Redefine Maple Leaf Foods' Brand-Led Growth Story (TSX:MFI)?

Reviewed by Sasha Jovanovic

- Earlier this month, the Canadian Olympic Committee and Maple Leaf Foods Inc. announced a multi-year partnership naming Maple Leaf Foods the Official Protein Partner of Team Canada from the 2026 Milano-Cortina Olympics through the 2028 Los Angeles Games, alongside a national "Victory. But First, Protein" campaign launching in January.

- This collaboration aligns Maple Leaf’s core protein brands with high-profile Canadian athletes and Olympic storytelling, potentially deepening consumer engagement with health-focused, higher-value protein products across its portfolio.

- Next, we’ll explore how becoming Team Canada’s Official Protein Partner could influence Maple Leaf Foods’ investment narrative, especially its brand-led growth ambitions.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Maple Leaf Foods Investment Narrative Recap

To own Maple Leaf Foods, you need to believe in its ability to turn strong demand for protein and premium, health-focused products into durable margins while managing input cost volatility and higher SG&A. The new Team Canada partnership looks more like a brand-building opportunity than a direct short term earnings catalyst, and it does not materially change near term risks around margin consistency, pork markets, or execution on the Canada Packers spin off.

The recent launch of Maple Leaf Mighty Protein chicken sticks ties directly into the Olympic sponsorship, giving the company a clear hero product to spotlight in its "Victory. But First, Protein" campaign. For investors watching revenue momentum and marketing-driven SG&A, this combination of new product and high-profile endorsement will be important in assessing whether heavier brand investment can support premium pricing without eroding the margin gains Maple Leaf has worked to rebuild.

However, investors should also be aware that, despite these brand wins, the upcoming Canada Packers spin off could still...

Read the full narrative on Maple Leaf Foods (it's free!)

Maple Leaf Foods' narrative projects CA$5.6 billion revenue and CA$467.3 million earnings by 2028.

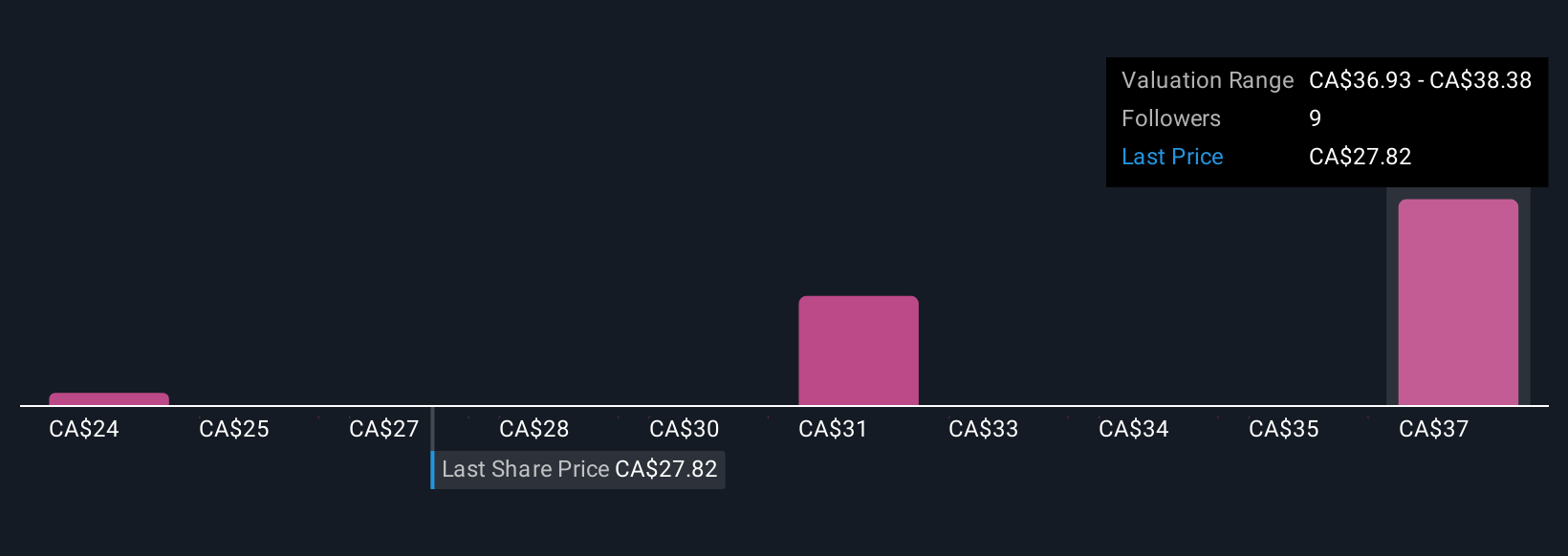

Uncover how Maple Leaf Foods' forecasts yield a CA$36.81 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently place Maple Leaf Foods’ fair value between C$23.92 and C$43.77, underscoring how far opinions can diverge. Before you pick a side, remember that recent earnings included one off and timing related boosts, which could influence how sustainable any perceived value gap really is.

Explore 3 other fair value estimates on Maple Leaf Foods - why the stock might be worth 5% less than the current price!

Build Your Own Maple Leaf Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maple Leaf Foods research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Maple Leaf Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maple Leaf Foods' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFI

Maple Leaf Foods

Produces food products in Canada, the United States, Japan, China, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026