Undiscovered Gems in Canada Top Stocks to Explore October 2024

Reviewed by Simply Wall St

The Canadian market has shown impressive momentum, with a 1.2% increase over the last week and a remarkable 28% rise over the past year, while earnings are expected to grow by 16% annually. In this thriving environment, identifying stocks that combine strong fundamentals with growth potential can uncover hidden opportunities for investors seeking to capitalize on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Santacruz Silver Mining | 14.30% | 49.04% | 63.44% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Firan Technology Group | 15.52% | 6.50% | 32.07% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

| Dundee | 5.93% | -38.65% | 39.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Lassonde Industries (TSX:LAS.A)

Simply Wall St Value Rating: ★★★★★★

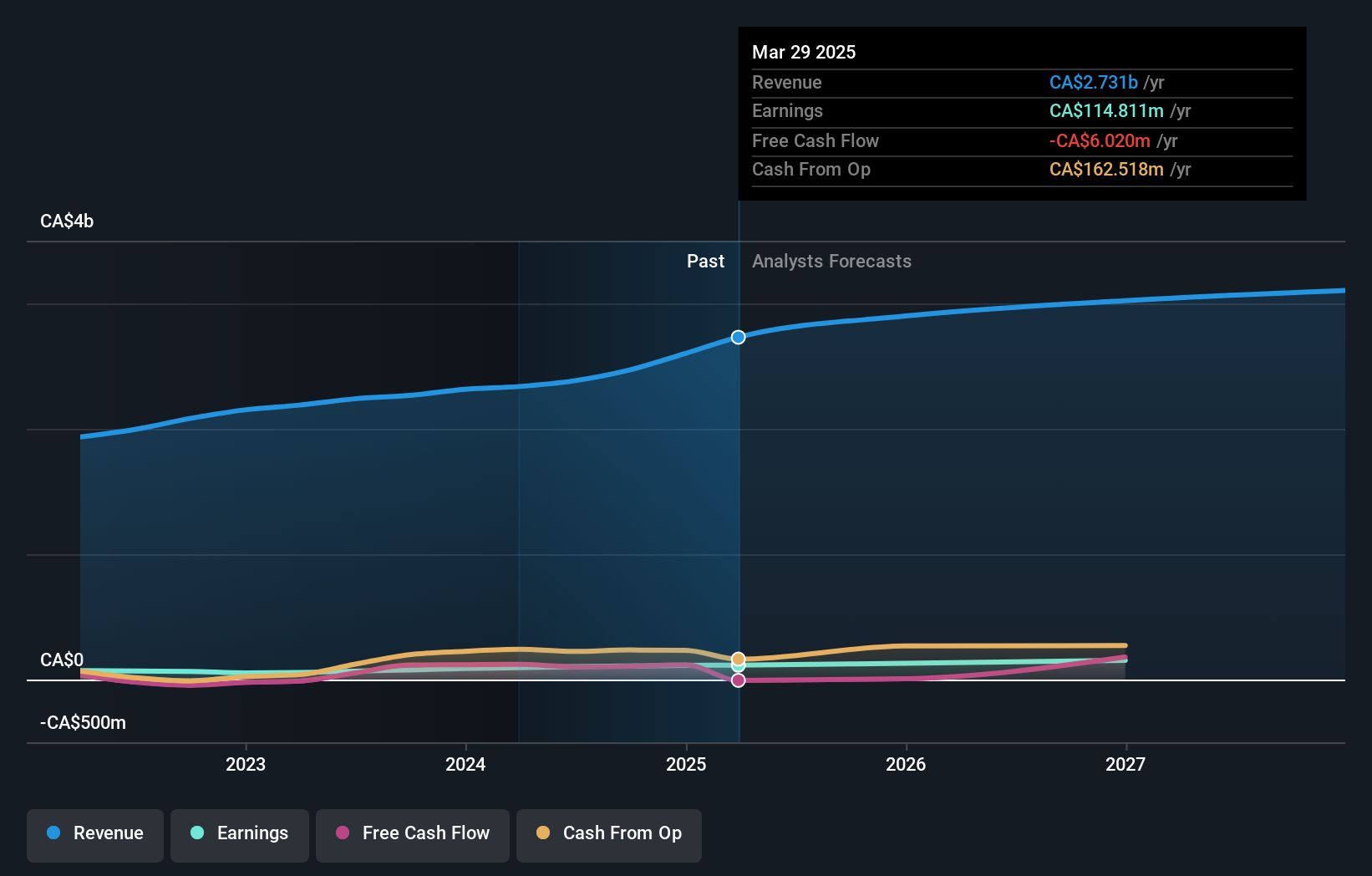

Overview: Lassonde Industries Inc. is a company that, along with its subsidiaries, focuses on the development, manufacturing, and marketing of ready-to-drink beverages, fruit-based snacks, and frozen juice concentrates across Canada, the United States, and internationally; it has a market cap of approximately CA$1.18 billion.

Operations: Lassonde generates revenue primarily from its non-alcoholic beverages segment, totaling CA$2.38 billion.

Lassonde Industries, a dynamic player in Canada's food sector, showcases impressive growth with earnings surging 53% over the past year, outpacing the industry's 7.3%. The company's net debt to equity ratio stands at a satisfactory 14.4%, reflecting strong financial health. Trading significantly below its estimated fair value by 70%, Lassonde appears undervalued in the market. Recent expansions include a USD 200 million investment for a new U.S. facility aimed at boosting efficiency and competitiveness, alongside strategic leadership transitions that position it well for future growth and operational enhancements across key markets.

PHX Energy Services (TSX:PHX)

Simply Wall St Value Rating: ★★★★★★

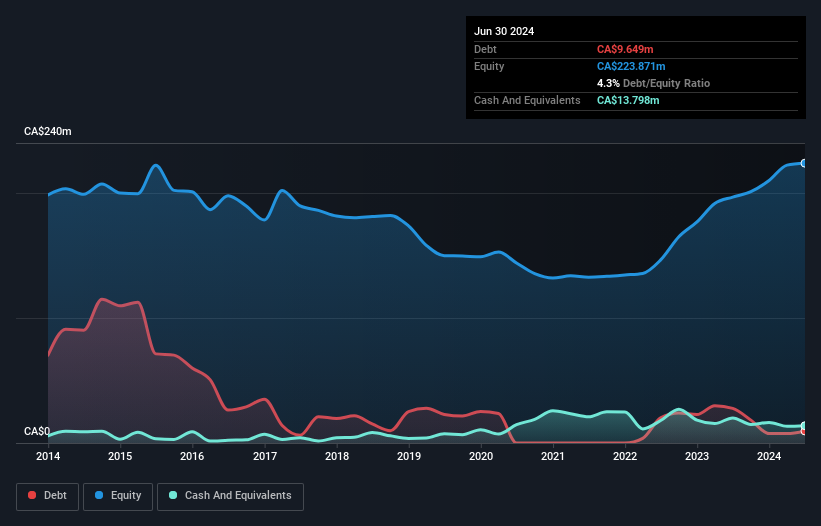

Overview: PHX Energy Services Corp. specializes in providing horizontal and directional drilling services, renting performance drilling motors, and selling motor equipment and parts to oil and natural gas companies across Canada, the United States, Albania, the Middle East regions, and internationally with a market cap of CA$446.20 million.

Operations: PHX Energy generates revenue primarily from horizontal and directional drilling services, with reported sales of CA$655.05 million. The company's financial performance can be analyzed through its gross profit margin, which reflects the efficiency of its core operations in generating profits relative to its revenue.

PHX Energy Services, a nimble player in the energy services sector, showcases robust financial health with its debt to equity ratio dropping from 15.3% to 4.3% over five years and interest payments well-covered by EBIT at 16.7x. Despite a slight dip in sales to C$154.23 million for Q2 2024 compared to the previous year, PHX's earnings growth of 19% outpaces industry standards significantly lagging at -6.7%. The company repurchased approximately 2.39 million shares for C$21.4 million recently, highlighting its commitment to enhancing shareholder value while trading at around 65% below estimated fair value.

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Value Rating: ★★★★★★

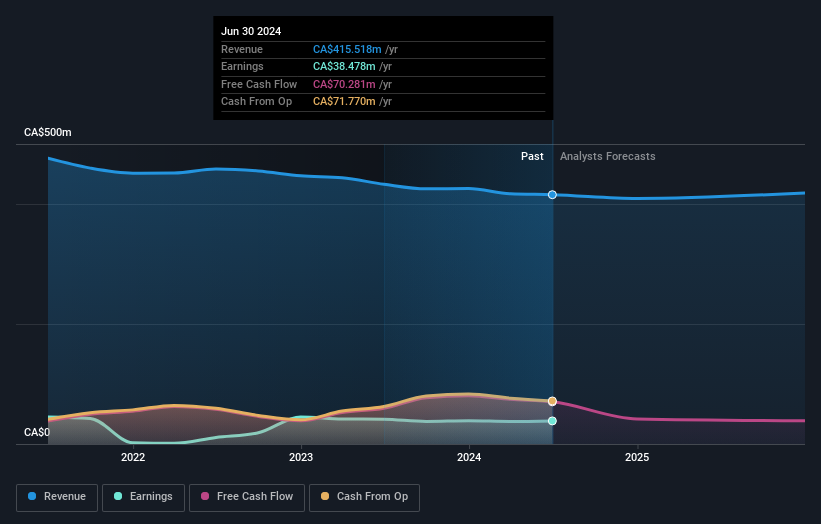

Overview: Richards Packaging Income Fund, with a market cap of CA$345.63 million, operates in North America by designing, manufacturing, and distributing packaging containers and healthcare supplies and products.

Operations: Richards Packaging Income Fund generates revenue primarily from its wholesale segment, which reported CA$415.52 million. The company's financial performance can be assessed through its gross profit margin, which is a key indicator of profitability.

Richards Packaging Income Fund, a small player in the packaging sector, shows a mixed financial picture. Its net debt to equity ratio stands at a satisfactory 8.1%, down from 53.8% over five years, indicating effective debt management. Despite trading at 52.1% below estimated fair value and having high-quality earnings, the company saw negative earnings growth of -6.7% compared to the industry's 2.3%. Interest payments are well covered by EBIT with a coverage of 20.6 times, suggesting strong profitability despite challenges in sales and income consistency over recent quarters (e.g., CAD 107 million sales vs CAD 108 million prior year).

Seize The Opportunity

- Embark on your investment journey to our 53 TSX Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Richards Packaging Income Fund, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RPI.UN

Richards Packaging Income Fund

Designs, manufactures, and distributes packaging containers and healthcare supplies and products in North America.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives