Over the last 7 days, the Canadian market has remained flat, yet it boasts a remarkable 27% increase over the past year with earnings forecasted to grow by 16% annually. In such a dynamic environment, identifying stocks with strong growth potential and unique value propositions can be key to uncovering undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Santacruz Silver Mining | 14.30% | 49.04% | 63.44% | ★★★★★★ |

| Lithium Chile | NA | nan | 30.02% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

| Dundee | 5.93% | -38.65% | 39.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Aris Mining (TSX:ARIS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aris Mining Corporation is involved in acquiring, exploring, developing, and operating gold properties across Canada, Colombia, and Guyana with a market cap of CA$1.15 billion.

Operations: Aris Mining generates revenue primarily from its Segovia Operations and Marmato Project, with the Segovia Operations contributing $415.17 million and the Marmato Project $51.09 million.

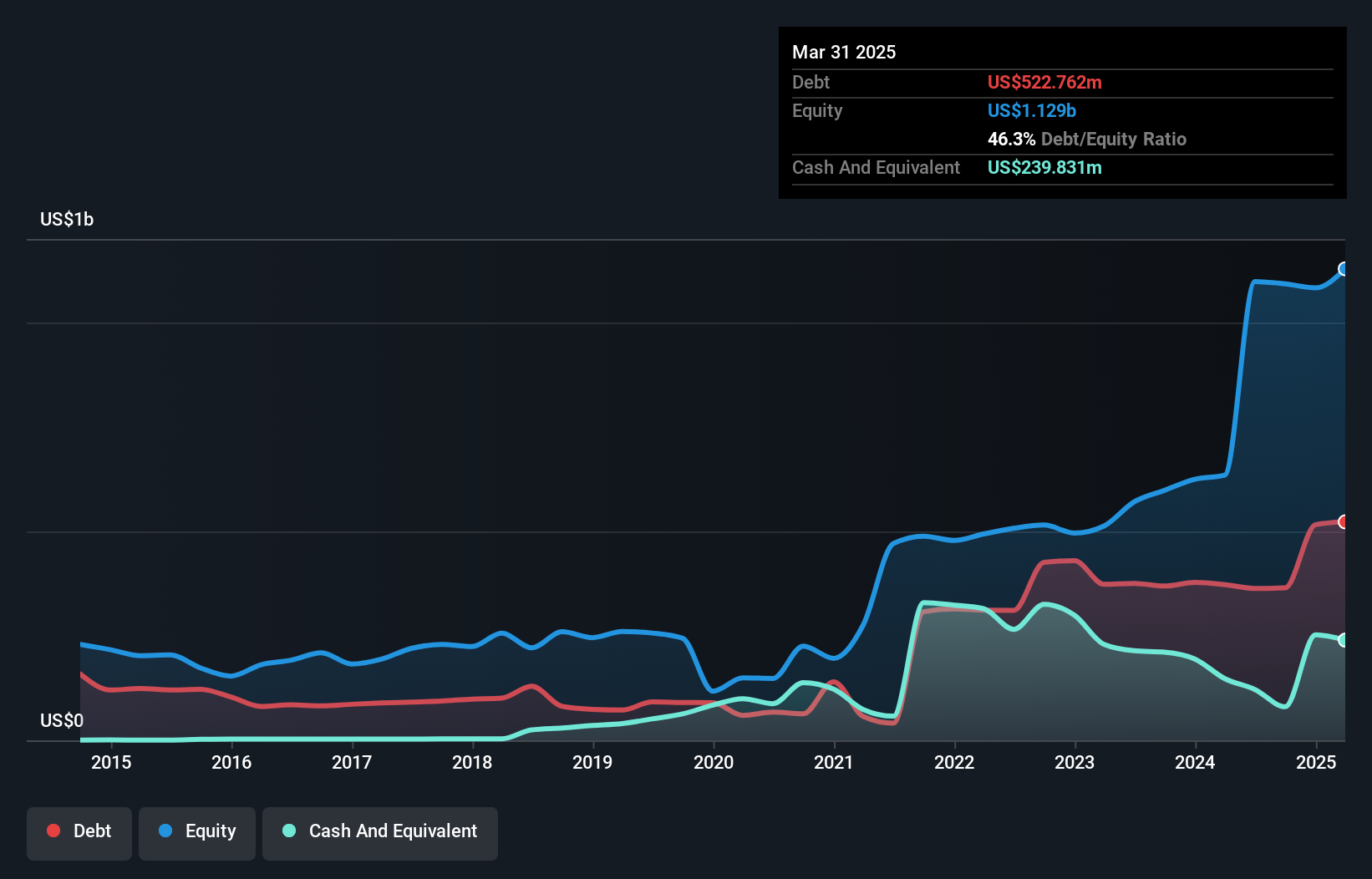

Aris Mining, a smaller player in the metals and mining sector, has been making strides with its financials and operations. The company's debt to equity ratio improved from 35.8% to 33.1% over five years, while interest payments are well-covered at 6.2 times EBIT. Despite significant insider selling recently, Aris remains profitable with high-quality earnings and a satisfactory net debt to equity ratio of 22%. Recent gold production increased by 9% in Q3 2024 compared to the previous quarter, reaching 53,608 ounces. However, shareholders experienced dilution over the past year as the company navigates growth challenges.

High Liner Foods (TSX:HLF)

Simply Wall St Value Rating: ★★★★★☆

Overview: High Liner Foods Incorporated processes and markets frozen seafood products in North America, with a market cap of CA$398.16 million.

Operations: High Liner Foods generates revenue primarily through the manufacturing and marketing of prepared and packaged frozen seafood, totaling $992.12 million.

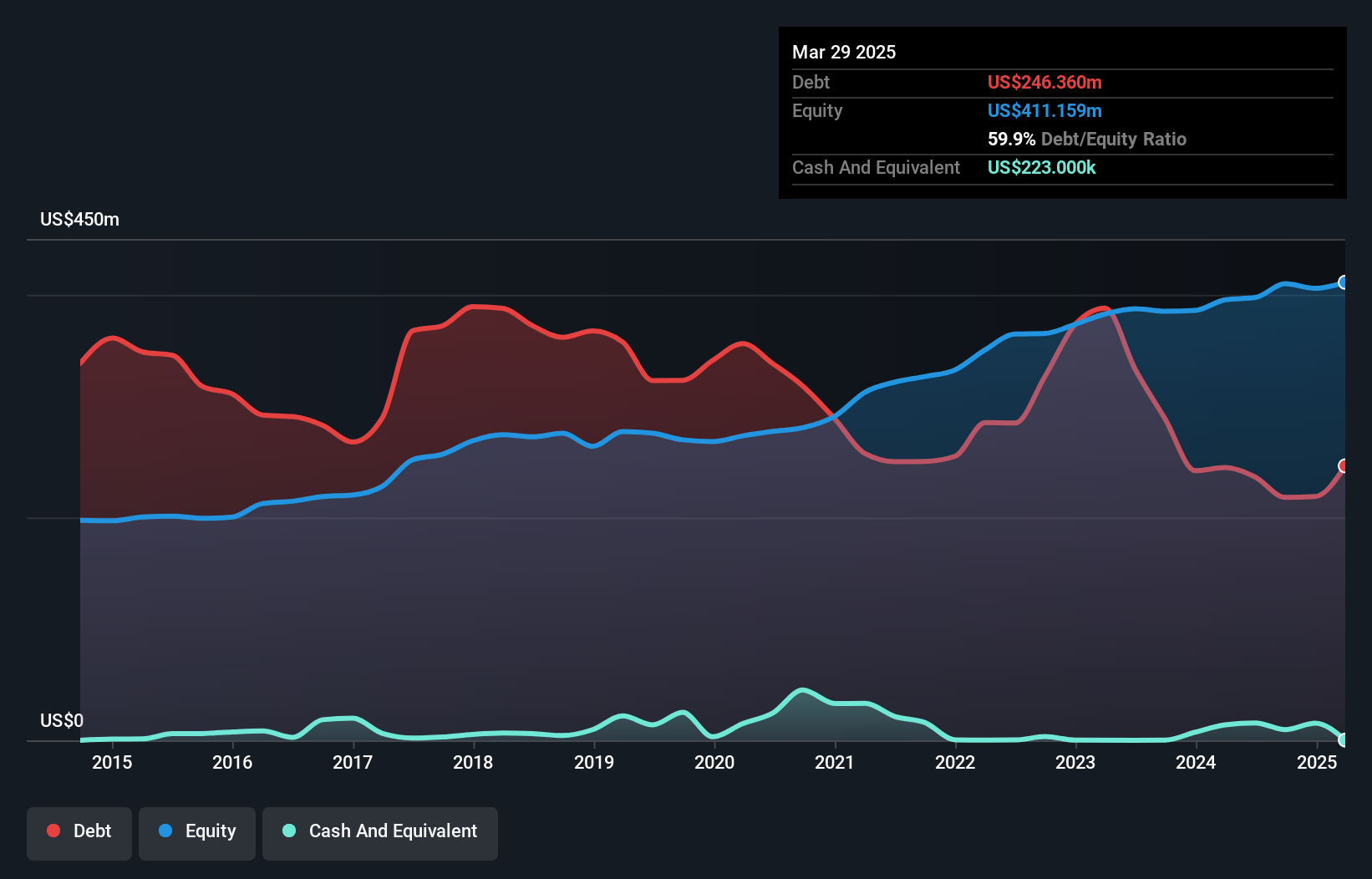

High Liner Foods, a notable player in Canada's food industry, has been making waves with its impressive financial strides. The company reported a net income of US$19.29 million for the second quarter of 2024, up from US$5.89 million the previous year, showcasing strong earnings growth. Despite sales dipping to US$218.32 million from US$254.35 million last year, their basic earnings per share rose to US$0.59 from US$0.18, indicating improved profitability and efficiency in operations. Additionally, High Liner completed a share buyback program repurchasing 659,900 shares for CAD7.7 million by mid-2024 and refinanced its term loan to reduce interest expenses significantly by approximately $1.4 million annually while extending maturity until July 2031.

- Take a closer look at High Liner Foods' potential here in our health report.

Examine High Liner Foods' past performance report to understand how it has performed in the past.

Rogers Sugar (TSX:RSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. focuses on refining, packaging, marketing, and distributing sugar and maple products across Canada, the United States, Europe, and internationally with a market cap of CA$724.01 million.

Operations: The company generates revenue primarily from sugar and maple products, with sugar contributing CA$981.45 million and maple products CA$225.32 million.

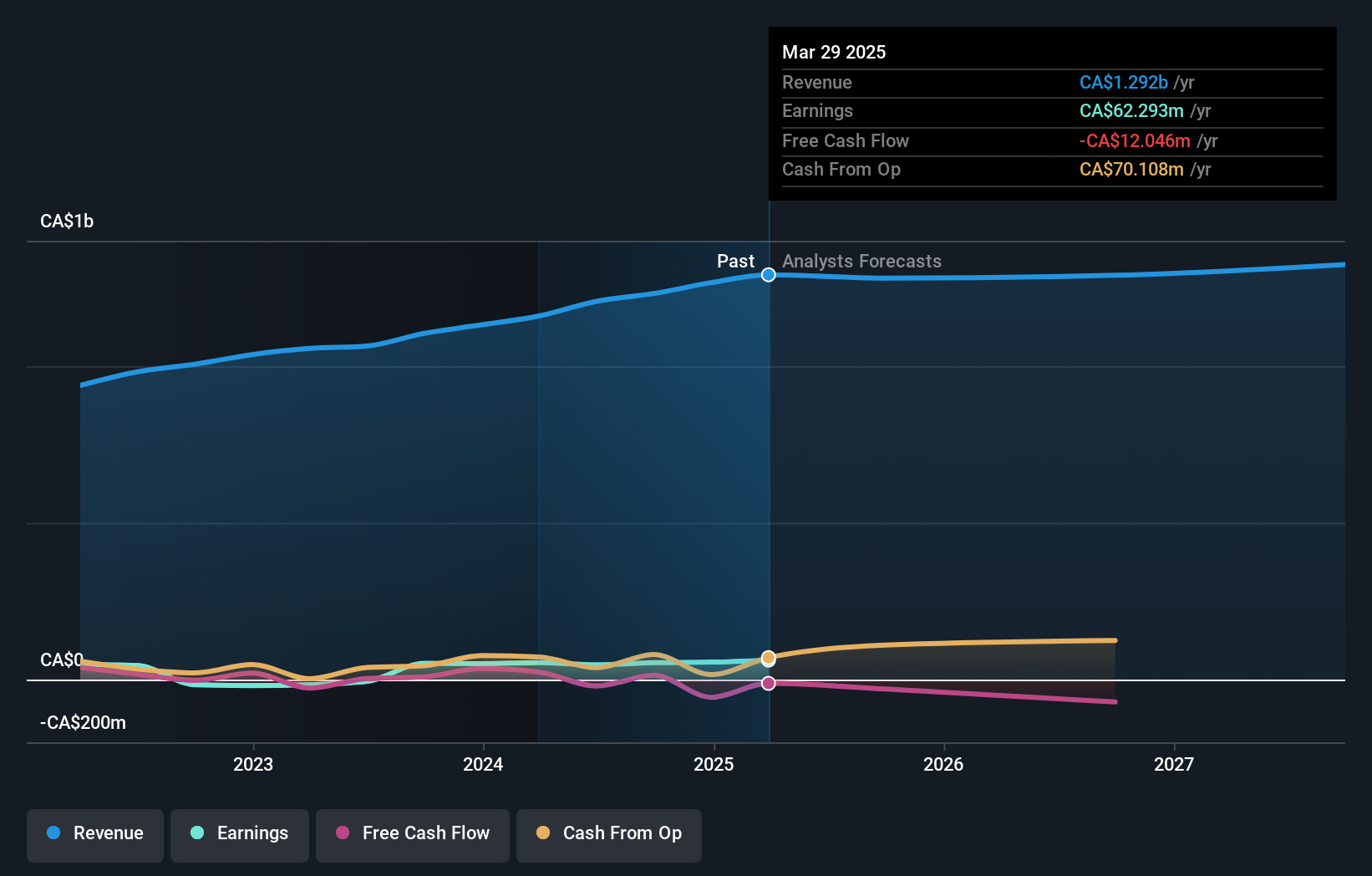

Rogers Sugar, a notable player in the Canadian market, reported sales of C$309 million for Q3 2024, up from C$262 million the previous year. Despite this increase, net income dropped to C$7.38 million from C$14.18 million, with basic earnings per share falling to C$0.06 from C$0.13. The company seems to face challenges as its debt-to-equity ratio has improved slightly over five years but remains high at 91%. Trading at a significant discount of 48% below estimated fair value suggests potential upside if operational efficiencies improve and debt is managed effectively.

- Click here to discover the nuances of Rogers Sugar with our detailed analytical health report.

Gain insights into Rogers Sugar's past trends and performance with our Past report.

Next Steps

- Gain an insight into the universe of 52 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RSI

Rogers Sugar

Engages in refining, packaging, marketing, and distribution of sugar, maple syrup, and related products in Canada, the United States, Europe, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026