- Canada

- /

- Communications

- /

- TSX:ET

Undiscovered Gems in Canada Highlight 3 Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

As Canada navigates the implications of new U.S. policies on energy, tariffs, and economic growth under President Trump's administration, the TSX index has shown resilience with a notable rise since Inauguration Day. Amidst this backdrop of market volatility and potential policy shifts, investors may find opportunities in small-cap stocks that demonstrate strong fundamentals and adaptability to changing economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Corby Spirit and Wine (TSX:CSW.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corby Spirit and Wine Limited, with a market cap of CA$361.37 million, operates by manufacturing, marketing, and importing spirits, wines, and ready-to-drink cocktails across Canada, the United States, the United Kingdom, and international markets.

Operations: Corby Spirit and Wine generates revenue primarily from Case Goods, accounting for CA$204.08 million, followed by Commissions at CA$27.71 million. The company also earns from Other Services amounting to CA$4.34 million.

Corby Spirit and Wine, a Canadian beverage player, has shown robust earnings growth of 18.7% over the past year, outpacing the industry average of 13.2%. Despite this positive momentum, the company's net debt to equity ratio stands at a high 59.1%, up from 0% five years ago, indicating increased leverage. On a brighter note, Corby's interest payments are well covered by EBIT at 7.1 times coverage. Recent financials reveal sales of CAD 65 million for Q1 FY2024 and net income of CAD 9.3 million compared to CAD 7.52 million last year, reflecting solid operational performance amidst financial challenges.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets globally with a market cap of approximately CA$1.02 billion.

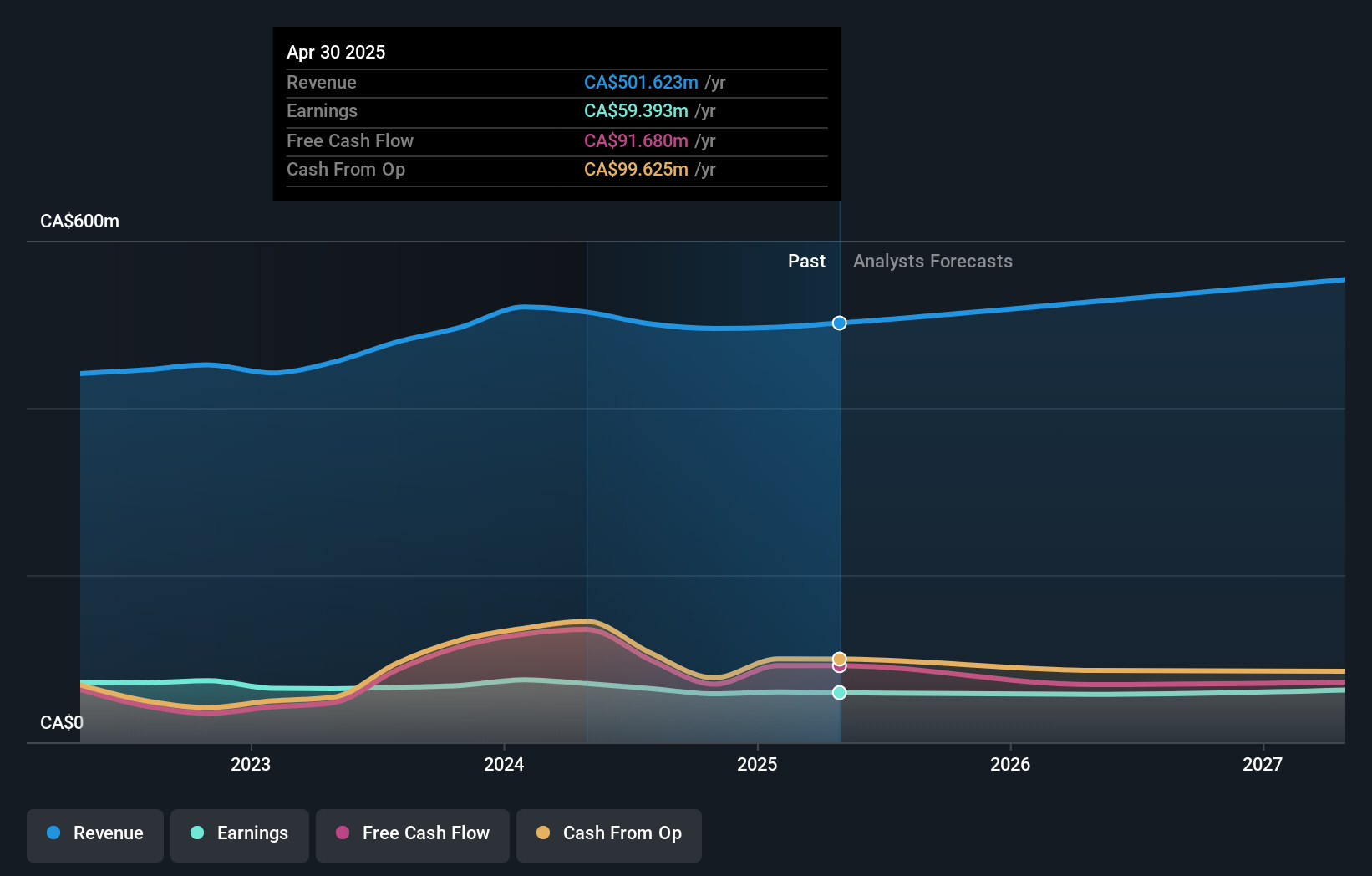

Operations: Evertz Technologies generates revenue primarily from the Television Broadcast Equipment Market, totaling CA$494.95 million.

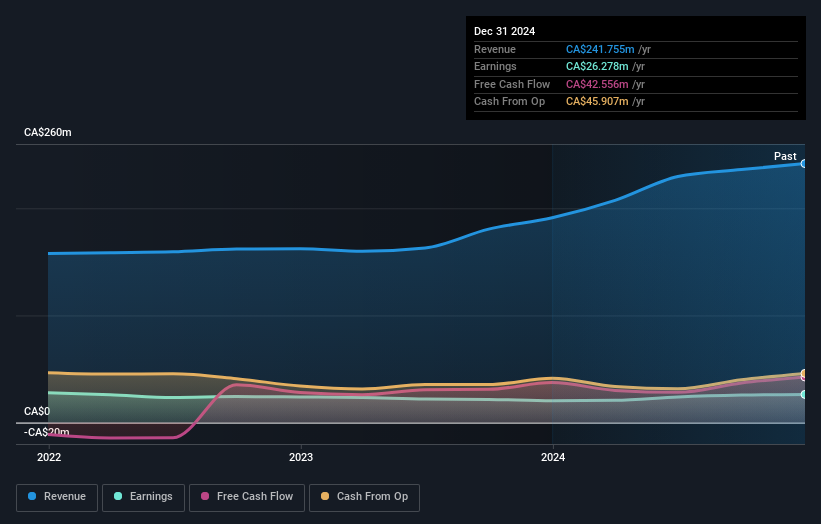

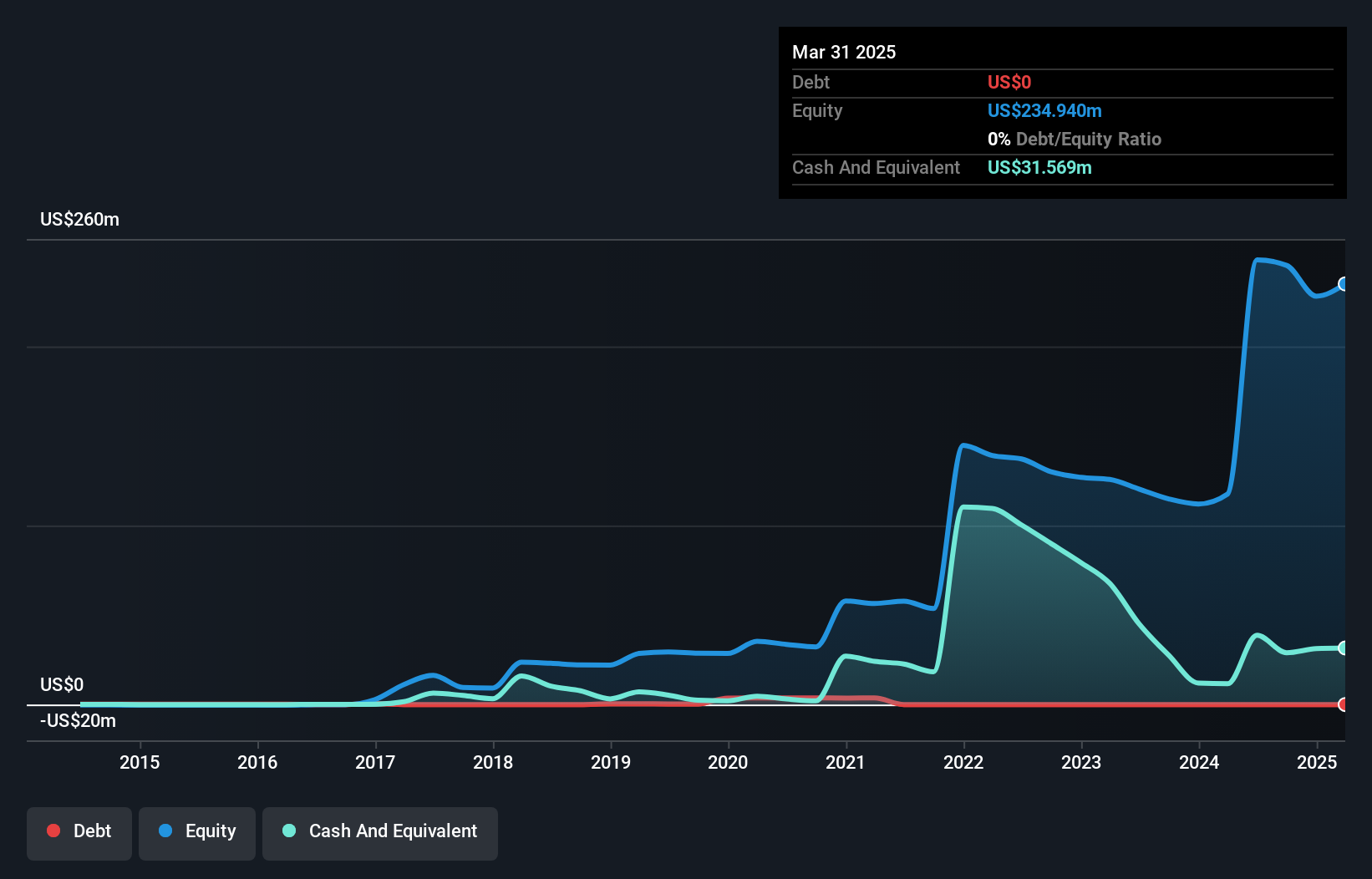

Evertz Technologies, a nimble player in the tech space, recently announced a quarterly dividend increase to CAD 0.20 per share, reflecting its commitment to returning value to shareholders. Despite reporting a drop in net income for the second quarter of 2024 at CAD 15.8 million compared to CAD 22.09 million from the previous year, Evertz remains debt-free with high-quality earnings and strong free cash flow of CAD 135.12 million as of April 2024. The company has also been active in share repurchases, buying back over 200,000 shares for approximately CAD 2.56 million recently under its buyback program.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Lithium Ltd. focuses on the exploration, development, and processing of lithium brine properties in the United States with a market cap of CA$429.13 million.

Operations: Standard Lithium Ltd. does not currently report any revenue from its operations, as indicated by the absence of revenue segments.

Standard Lithium, a small player in the lithium sector, has made significant strides by becoming profitable this year. The company boasts a low price-to-earnings ratio of 2.5x compared to the Canadian market's 15x, indicating potential value. Despite having no debt now versus a debt-to-equity ratio of 1.1% five years ago, it faces challenges with non-cash earnings and limited revenue under US$1 million. Recent developments include securing a US$225 million grant from the U.S. Department of Energy for its South West Arkansas project and advancing drilling efforts in collaboration with Equinor ASA to enhance lithium extraction capabilities.

- Click here to discover the nuances of Standard Lithium with our detailed analytical health report.

Evaluate Standard Lithium's historical performance by accessing our past performance report.

Make It Happen

- Access the full spectrum of 47 TSX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet established dividend payer.